Answered step by step

Verified Expert Solution

Question

1 Approved Answer

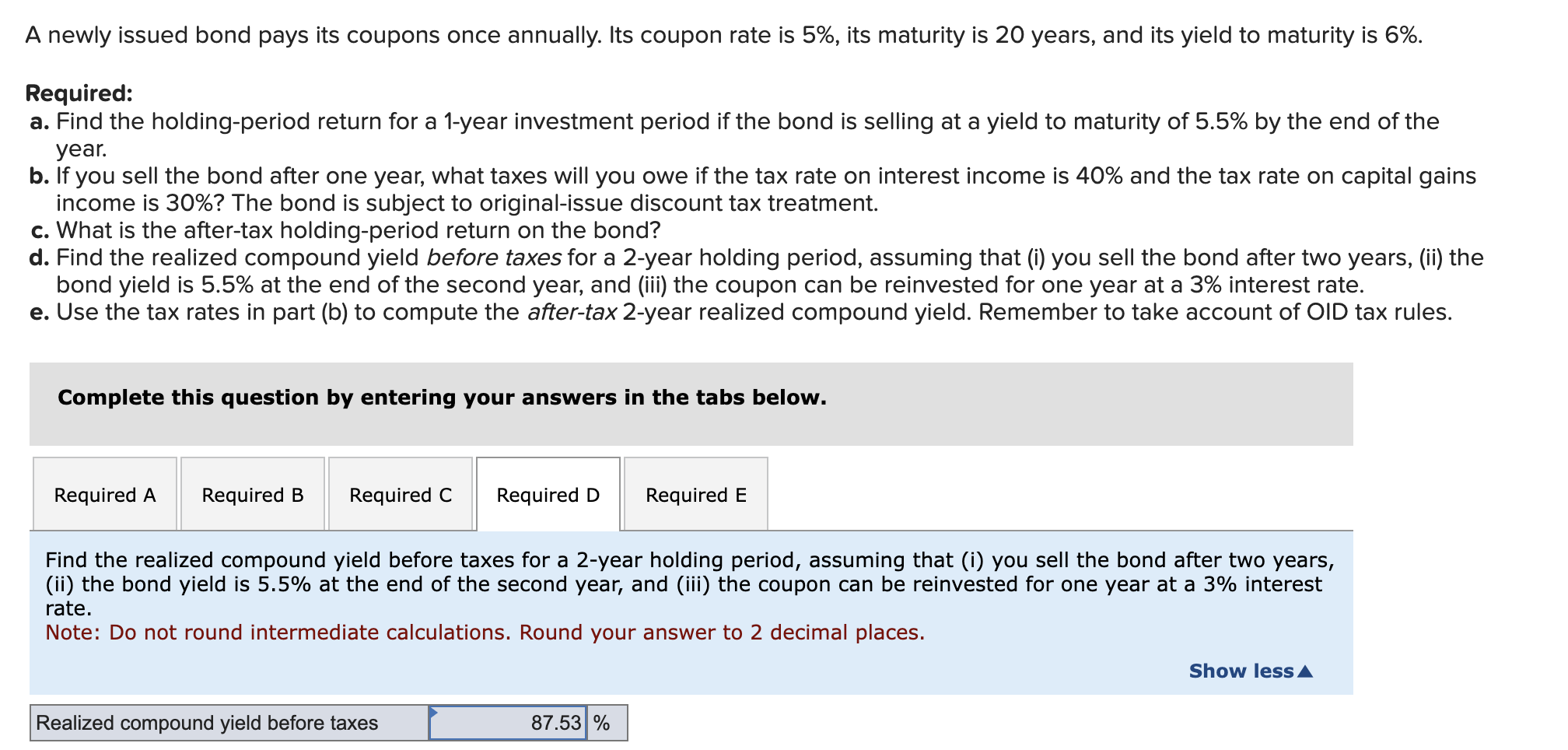

A newly issued bond pays its coupons once annually. Its coupon rate is 5 % , its maturity is 2 0 years, and its yield

A newly issued bond pays its coupons once annually. Its coupon rate is its maturity is years, and its yield to maturity is A newly issued bond pays its coupons once annually. Its coupon rate is its maturity is years, and its yield to maturity is

Required:

a Find the holdingperiod return for a year investment period if the bond is selling at a yield to maturity of by the end of the

year.

b If you sell the bond after one year, what taxes will you owe if the tax rate on interest income is and the tax rate on capital gains

income is The bond is subject to originalissue discount tax treatment.

c What is the aftertax holdingperiod return on the bond?

d Find the realized compound yield before taxes for a year holding period, assuming that i you sell the bond after two years, ii the

bond yield is at the end of the second year, and iii the coupon can be reinvested for one year at a interest rate.

e Use the tax rates in part b to compute the aftertax year realized compound yield. Remember to take account of OID tax rules.

Complete this question by entering your answers in the tabs below.

Required D

Find the realized compound yield before taxes for a year holding period, assuming that i you sell the bond after two years,

ii the bond yield is at the end of the second year, and iii the coupon can be reinvested for one year at a interest

rate.

Note: Do not round intermediate calculations. Round your answer to decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started