Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Nguyen invested $45,000 in cash to start the business. b. Paid $12,000 for the current month's rent. c. Bought furniture for $21,160 in cash.

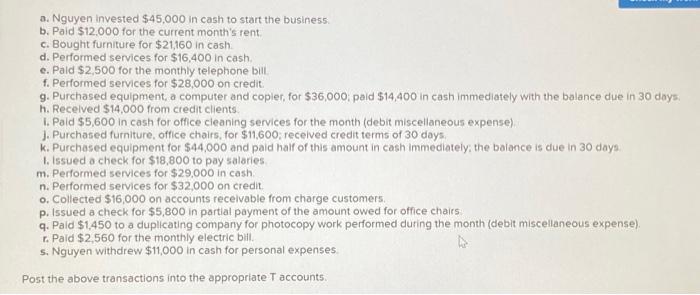

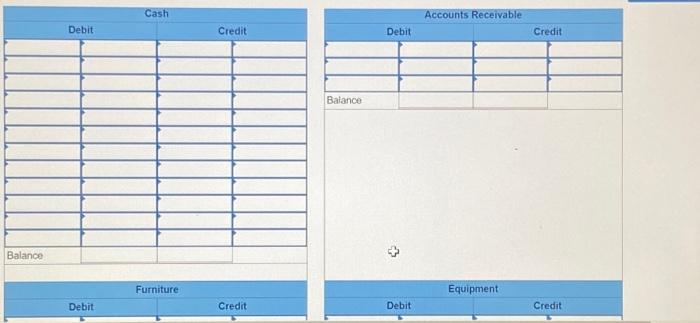

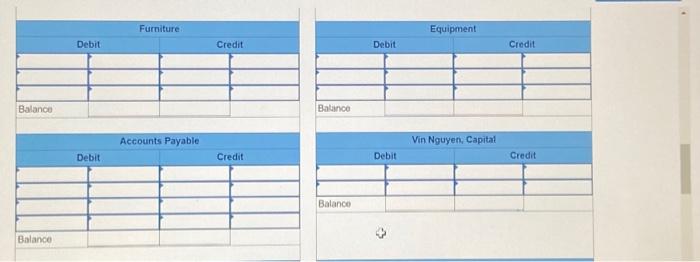

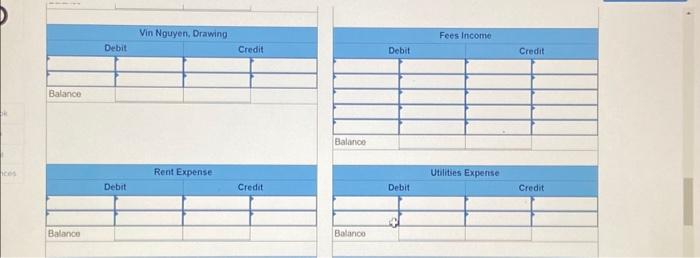

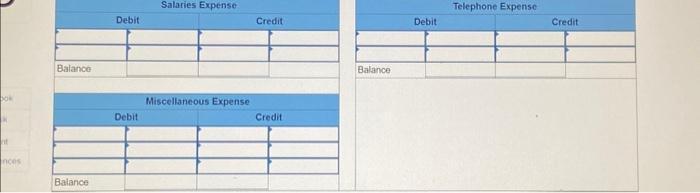

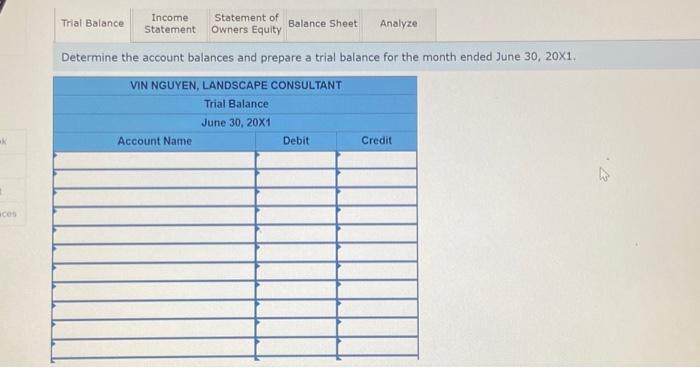

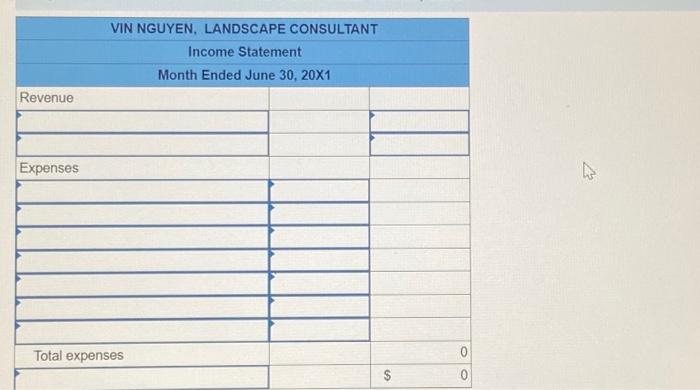

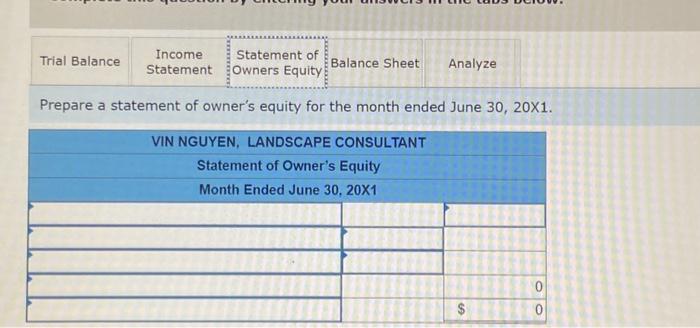

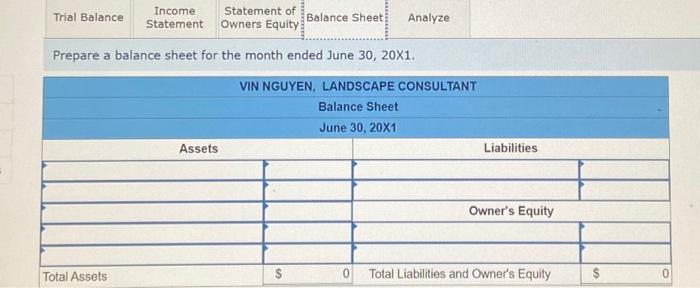

a. Nguyen invested $45,000 in cash to start the business. b. Paid $12,000 for the current month's rent. c. Bought furniture for $21,160 in cash. d. Performed services for $16,400 in cash. e. Paid $2,500 for the monthly telephone bill. f. Performed services for $28,000 on credit. g. Purchased equipment, a computer and copier, for $36,000; paid $14,400 in cash immediately with the balance due in 30 days. h. Received $14,000 from credit clients. i. Paid $5,600 in cash for office cleaning services for the month (debit miscellaneous expense). j. Purchased furniture, office chairs, for $11,600; received credit terms of 30 days. k. Purchased equipment for $44,000 and paid half of this amount in cash immediately; the balance is due in 30 days. I. Issued a check for $18,800 to pay salaries. m. Performed services for $29,000 in cash. n. Performed services for $32,000 on credit. o. Collected $16,000 on accounts receivable from charge customers. p. Issued a check for $5,800 in partial payment of the amount owed for office chairs. q. Paid $1,450 to a duplicating company for photocopy work performed during the month (debit miscellaneous expense). r. Paid $2,560 for the monthly electric bill. 4 s. Nguyen withdrew $11,000 in cash for personal expenses. Post the above transactions into the appropriate T accounts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started