Answered step by step

Verified Expert Solution

Question

1 Approved Answer

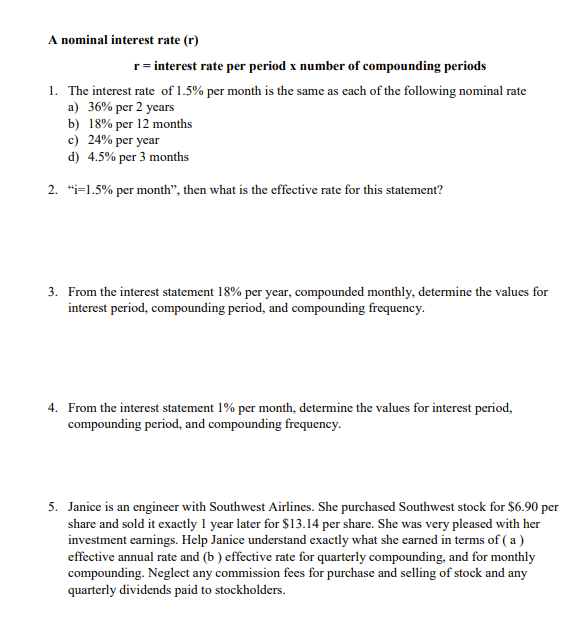

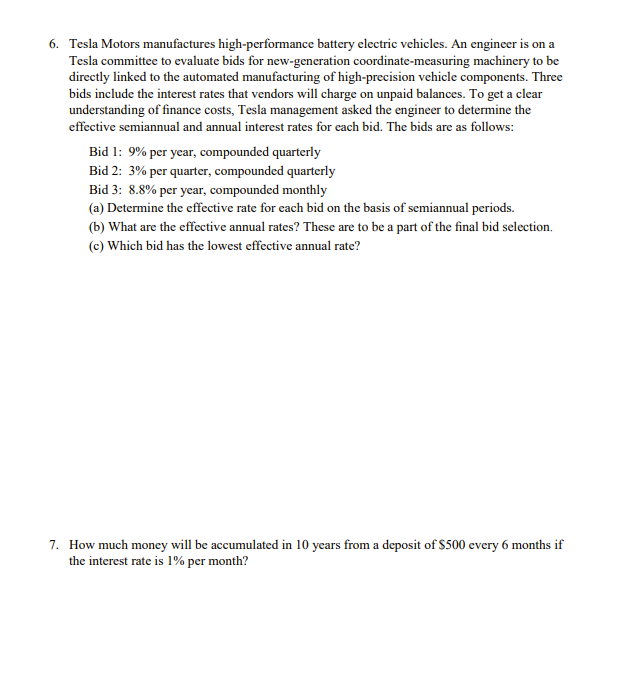

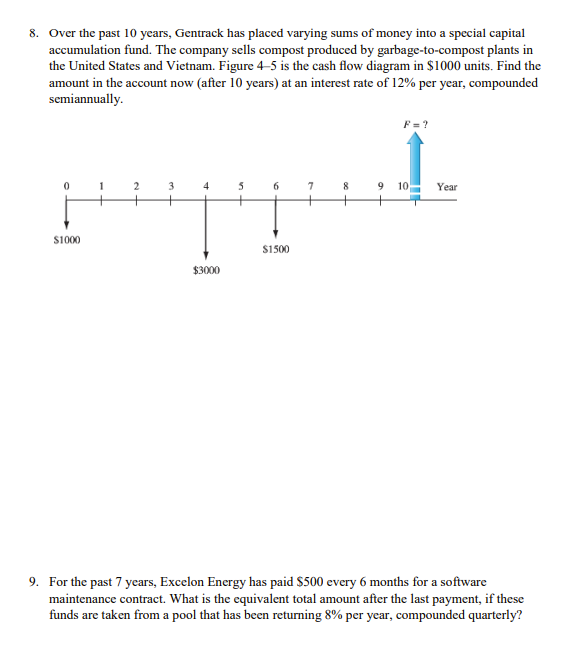

A nominal interest rate (r) r = interest rate per period x number of compounding periods 1. The interest rate of 1.5% per month

A nominal interest rate (r) r = interest rate per period x number of compounding periods 1. The interest rate of 1.5% per month is the same as each of the following nominal rate a) 36% per 2 years b) 18% per 12 months c) 24% per year d) 4.5% per 3 months 2. "i=1.5% per month", then what is the effective rate for this statement? 3. From the interest statement 18% per year, compounded monthly, determine the values for interest period, compounding period, and compounding frequency. 4. From the interest statement 1% per month, determine the values for interest period, compounding period, and compounding frequency. 5. Janice is an engineer with Southwest Airlines. She purchased Southwest stock for $6.90 per share and sold it exactly 1 year later for $13.14 per share. She was very pleased with her investment earnings. Help Janice understand exactly what she earned in terms of (a) effective annual rate and (b) effective rate for quarterly compounding, and for monthly compounding. Neglect any commission fees for purchase and selling of stock and any quarterly dividends paid to stockholders. 6. Tesla Motors manufactures high-performance battery electric vehicles. An engineer is on a Tesla committee to evaluate bids for new-generation coordinate-measuring machinery to be directly linked to the automated manufacturing of high-precision vehicle components. Three bids include the interest rates that vendors will charge on unpaid balances. To get a clear understanding of finance costs, Tesla management asked the engineer to determine the effective semiannual and annual interest rates for each bid. The bids are as follows: Bid 1: 9% per year, compounded quarterly Bid 2: 3% per quarter, compounded quarterly Bid 3: 8.8% per year, compounded monthly (a) Determine the effective rate for each bid on the basis of semiannual periods. (b) What are the effective annual rates? These are to be a part of the final bid selection. (c) Which bid has the lowest effective annual rate? 7. How much money will be accumulated in 10 years from a deposit of $500 every 6 months if the interest rate is 1% per month? 8. Over the past 10 years, Gentrack has placed varying sums of money into a special capital accumulation fund. The company sells compost produced by garbage-to-compost plants in the United States and Vietnam. Figure 4-5 is the cash flow diagram in $1000 units. Find the amount in the account now (after 10 years) at an interest rate of 12% per year, compounded semiannually. $1000 F= ? 1 2 3 4 5 6 7 8 9 10 Year $1500 $3000 9. For the past 7 years, Excelon Energy has paid $500 every 6 months for a software maintenance contract. What is the equivalent total amount after the last payment, if these funds are taken from a pool that has been returning 8% per year, compounded quarterly?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started