Answered step by step

Verified Expert Solution

Question

1 Approved Answer

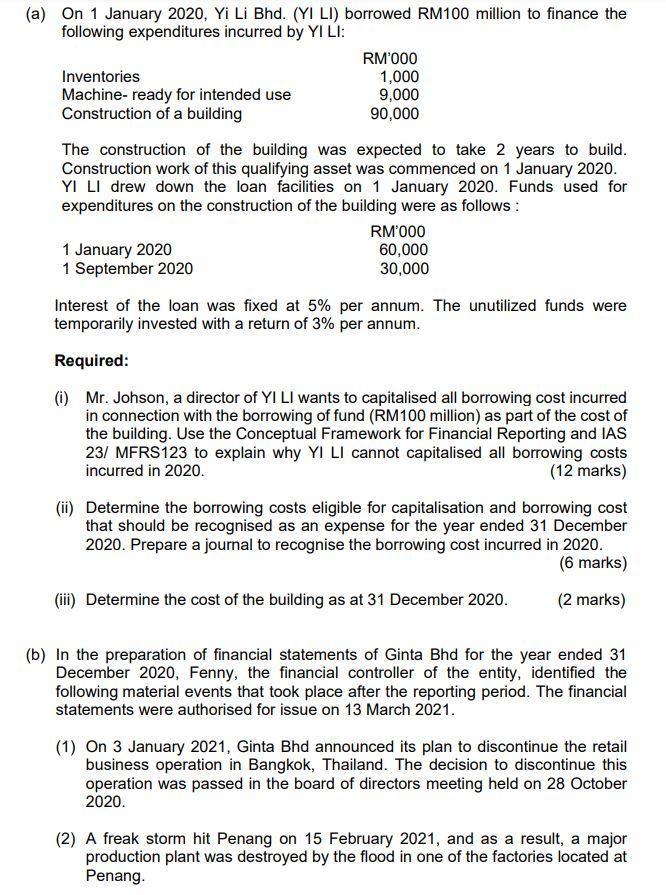

(a) On 1 January 2020, Yi Li Bhd. (YI LI) borrowed RM100 million to finance the following expenditures incurred by YILI: Inventories Machine- ready

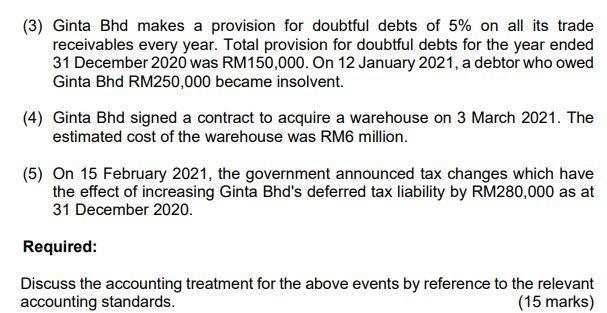

(a) On 1 January 2020, Yi Li Bhd. (YI LI) borrowed RM100 million to finance the following expenditures incurred by YILI: Inventories Machine- ready for intended use Construction of a building RM'000 1,000 9,000 90,000 The construction of the building was expected to take 2 years to build. Construction work of this qualifying asset was commenced on 1 January 2020. YI LI drew down the loan facilities on 1 January 2020. Funds used for expenditures on the construction of the building were as follows: 1 January 2020 1 September 2020 RM'000 60,000 30,000 Interest of the loan was fixed at 5% per annum. The unutilized funds were temporarily invested with a return of 3% per annum. Required: (i) Mr. Johson, a director of YI LI wants to capitalised all borrowing cost incurred in connection with the borrowing of fund (RM100 million) as part of the cost of the building. Use the Conceptual Framework for Financial Reporting and IAS 23/ MFRS123 to explain why YI LI cannot capitalised all borrowing costs incurred in 2020. (12 marks) (ii) Determine the borrowing costs eligible for capitalisation and borrowing cost that should be recognised as an expense for the year ended 31 December 2020. Prepare a journal to recognise the borrowing cost incurred in 2020. (6 marks) (2 marks) (iii) Determine the cost of the building as at 31 December 2020. (b) In the preparation of financial statements of Ginta Bhd for the year ended 31 December 2020, Fenny, the financial controller of the entity, identified the following material events that took place after the reporting period. The financial statements were authorised for issue on 13 March 2021. (1) On 3 January 2021, Ginta Bhd announced its plan to discontinue the retail business operation in Bangkok, Thailand. The decision to discontinue this operation was passed in the board of directors meeting held on 28 October 2020. (2) A freak storm hit Penang on 15 February 2021, and as a result, a major production plant was destroyed by the flood in one of the factories located at Penang. (3) Ginta Bhd makes a provision for doubtful debts of 5% on all its trade receivables every year. Total provision for doubtful debts for the year ended 31 December 2020 was RM150,000. On 12 January 2021, a debtor who owed Ginta Bhd RM250,000 became insolvent. (4) Ginta Bhd signed a contract to acquire a warehouse on 3 March 2021. The estimated cost of the warehouse was RM6 million. (5) On 15 February 2021, the government announced tax changes which have the effect of increasing Ginta Bhd's deferred tax liability by RM280,000 as at 31 December 2020. Required: Discuss the accounting treatment for the above events by reference to the relevant accounting standards. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a1 As per ias 23 borrowing costs that are directly attributed to the acquisition construc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started