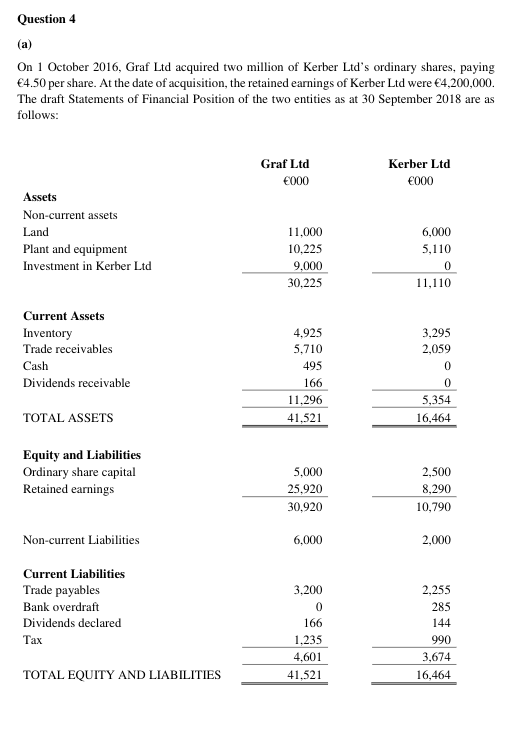

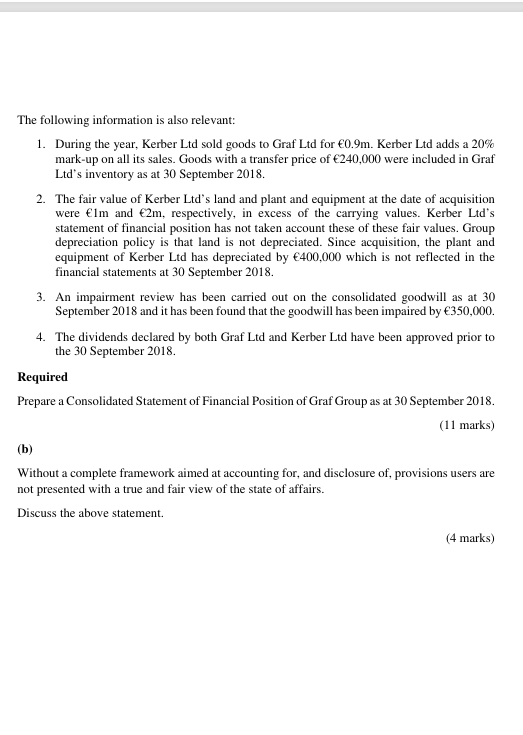

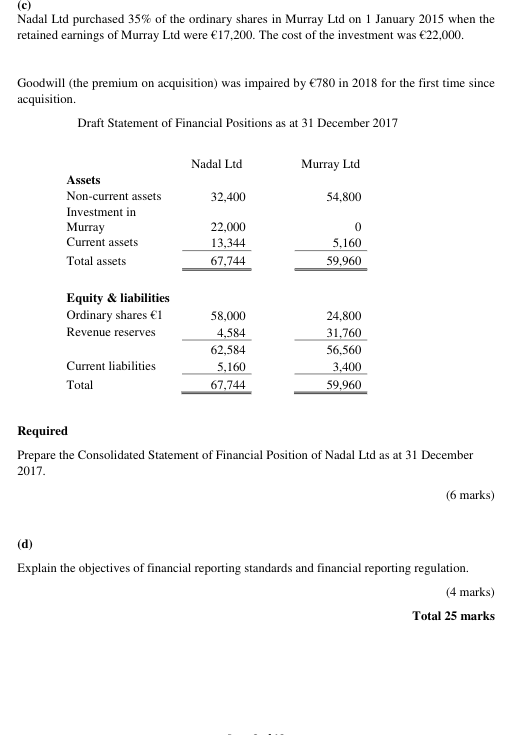

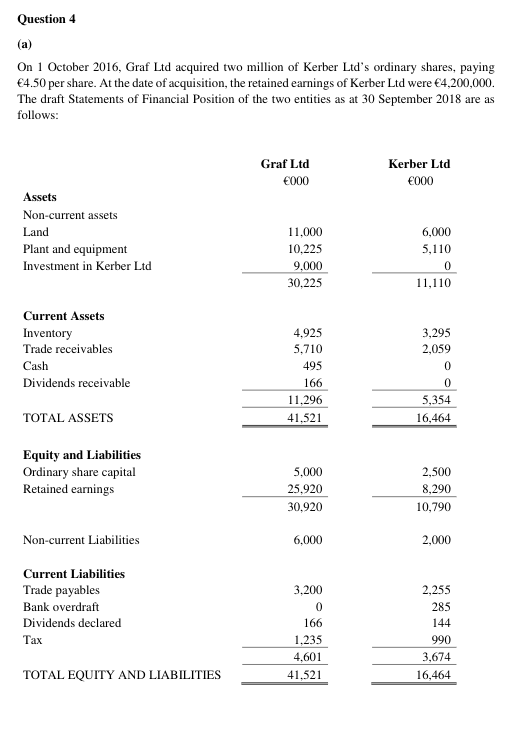

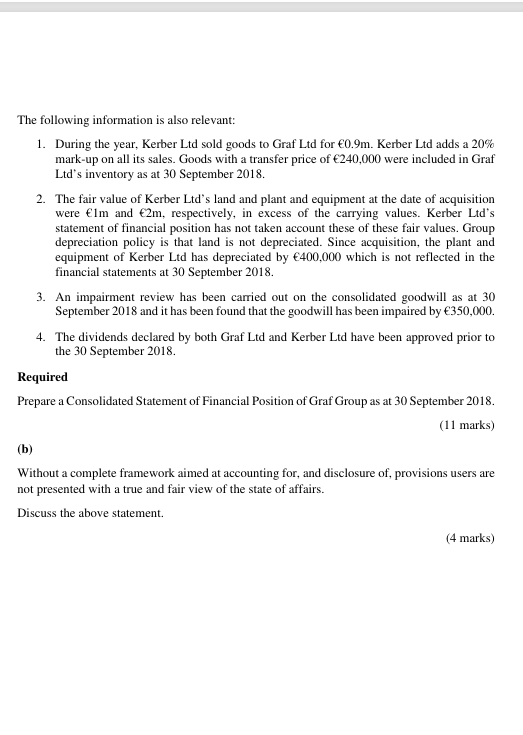

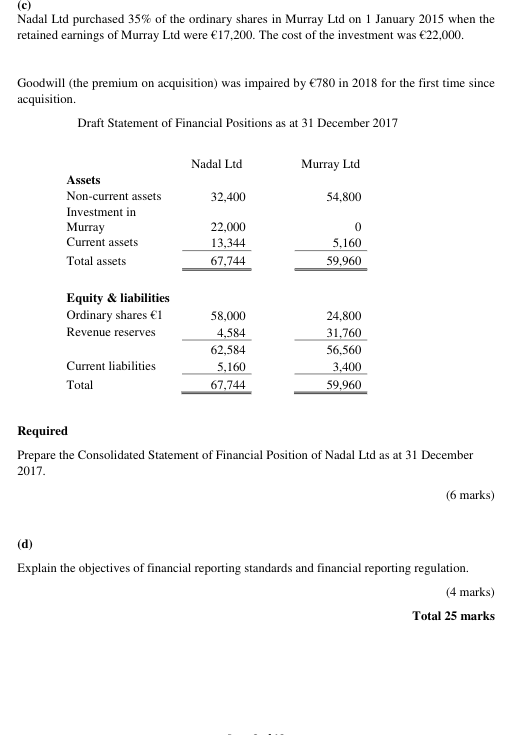

(a) On 1 October 2016, Graf Ltd acquired two million of Kerber Ltd's ordinary shares, paying 4.50 per share. At the date of acquisition, the retained earnings of Kerber Ltd were 4,200,000. The draft Statements of Financial Position of the two entities as at 30 September 2018 are as follows: The following information is also relevant: 1. During the year, Kerber Ltd sold goods to Graf Ltd for 0.9m. Kerber Ltd adds a 20% mark-up on all its sales. Goods with a transfer price of 240,000 were included in Graf Ltd's inventory as at 30 September 2018. 2. The fair value of Kerber Ltd's land and plant and equipment at the date of acquisition were 1m and 2m, respectively, in excess of the carrying values. Kerber Ltd's statement of financial position has not taken account these of these fair values. Group depreciation policy is that land is not depreciated. Since acquisition, the plant and equipment of Kerber Ltd has depreciated by 400,000 which is not reflected in the financial statements at 30 September 2018. 3. An impairment review has been carried out on the consolidated goodwill as at 30 September 2018 and it has been found that the goodwill has been impaired by 350,000. 4. The dividends declared by both Graf Ltd and Kerber Ltd have been approved prior to the 30 September 2018. Required Prepare a Consolidated Statement of Financial Position of Graf Group as at 30 September 2018. (11 marks) (b) Without a complete framework aimed at accounting for, and disclosure of, provisions users are not presented with a true and fair view of the state of affairs. Discuss the above statement. (4 marks) (c) Nadal Ltd purchased 35\% of the ordinary shares in Murray Ltd on 1 January 2015 when the retained earnings of Murray Ltd were 17,200. The cost of the investment was 22,000. Goodwill (the premium on acquisition) was impaired by 780 in 2018 for the first time since acquisition. Draft Statement of Financial Positions as at 31 December 2017 Required Prepare the Consolidated Statement of Financial Position of Nadal Ltd as at 31 December 2017. (6 marks) (d) Explain the objectives of financial reporting standards and financial reporting regulation