Question

a. On 31 December 2013, Air France-KLM S.As paid 200,000 to acquire 75% of the ordinary share capital of Ryanair Ltd. On that date, the

a. On 31 December 2013, Air France-KLM S.As paid 200,000 to acquire 75% of the ordinary share capital of Ryanair Ltd. On that date, the retained earnings of Ryanair Ltd were 100,000 and the fair value of PPE was 15,000 more than the book value. All other assets and liabilities were shown at their fair values. Ryanair Ltd has issued no share since being acquired by Air France-KLM. Non-controlling interest are to be measured at the appropriate proportion of the subsidiarys identifiable net assets.

b. Air France-KLM S.As acquired 85% of shares of Air Baltic Corporation on 31 of December, 2014 by issuing 100 ordinary shares at 1 par-value when the market price of Air France-KLMs share was trading at 1.40 per share. As at the acquisition date retained earnings and revaluation reserve were 60,000 and 4,000 respectively. All other assets and liabilities were shown at their fair values. Air Baltic Corporation has issued no shares since being acquired by Air France-KLM.

c. Goodwill has been impaired by 25 percent.

Assuming these are not service companies:

d. Inter-company payable and receivables stands at 125,000

e. One-quarter of the goods sold to Air Baltic Corporation for 12,000 were not sold as at the close of accounting period. These goods were invoice at cost Plus mark-up of 40 percent.

Requirement: (40 points)

a. Prepare Air France-KLM S.As consolidated statement of financial position as at 31 December 2015. (35points)

b. Calculate Air France-KLM S.As consolidated dividends for the year ended 31 December, 2015. (5 points)

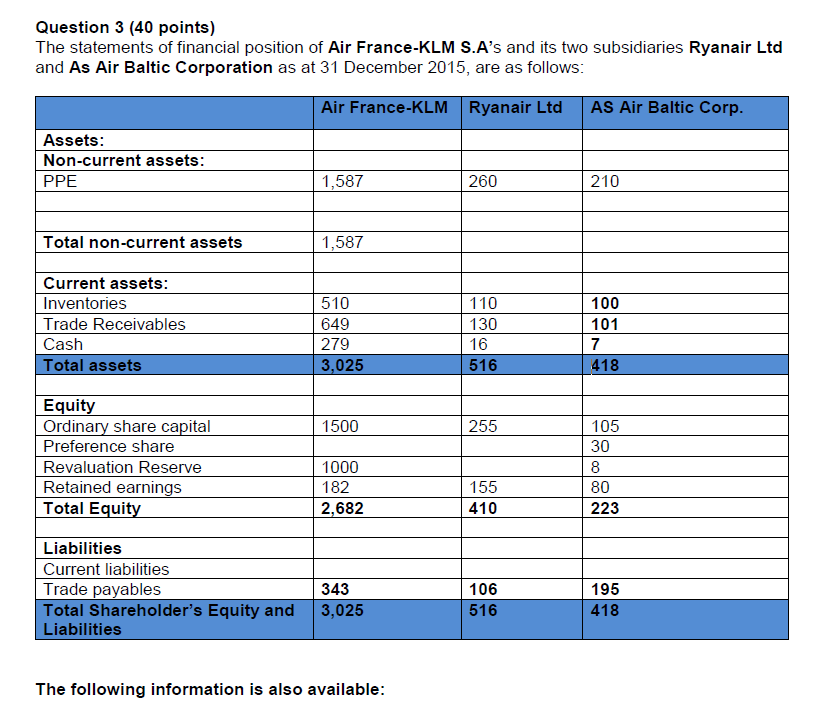

Question 3 (40 points) The statements of financial position of Air France-KLM S.A's and its two subsidiaries Ryanair Ltd and As Air Baltic Corporation as at 31 December 2015, are as follows: Air France-KLM Ryanair Ltd AS Air Baltic Corp. Assets: Non-current assets: PPE 1,587 260 210 Total non-current assets 1,587 Current assets: Inventories Trade Receivables Cash Total assets 510 649 279 3,025 110 130 16 516 100 101 7 418 1500 255 Equity Ordinary share capital Preference share Revaluation Reserve Retained earnings Total Equity 1000 182 2,682 105 30 8 80 223 155 410 Liabilities Current liabilities Trade payables 343 Total Shareholder's Equity and 3,025 Liabilities 106 516 195 418 The following information is also available: Question 3 (40 points) The statements of financial position of Air France-KLM S.A's and its two subsidiaries Ryanair Ltd and As Air Baltic Corporation as at 31 December 2015, are as follows: Air France-KLM Ryanair Ltd AS Air Baltic Corp. Assets: Non-current assets: PPE 1,587 260 210 Total non-current assets 1,587 Current assets: Inventories Trade Receivables Cash Total assets 510 649 279 3,025 110 130 16 516 100 101 7 418 1500 255 Equity Ordinary share capital Preference share Revaluation Reserve Retained earnings Total Equity 1000 182 2,682 105 30 8 80 223 155 410 Liabilities Current liabilities Trade payables 343 Total Shareholder's Equity and 3,025 Liabilities 106 516 195 418 The following information is also availableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started