Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) On Alexander's 35th birthday, his insurance company's estimates indicated that he is expected to live until the age of 85. He wants to retire

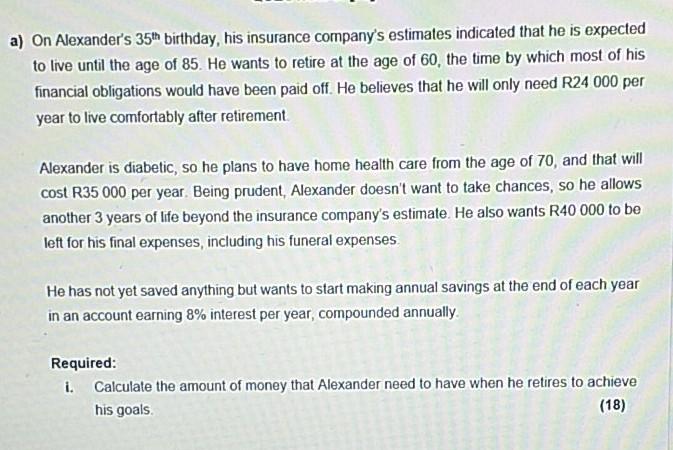

a) On Alexander's 35th birthday, his insurance company's estimates indicated that he is expected to live until the age of 85. He wants to retire at the age of 60, the time by which most of his financial obligations would have been paid off. He believes that he will only need R24 000 per year to live comfortably after retirement Alexander is diabetic, so he plans to have home health care from the age of 70, and that will cost R35 000 per year. Being prudent, Alexander doesn't want to take chances, so he allows another 3 years of life beyond the insurance company's estimate. He also wants R40 000 to be left for his final expenses, including his funeral expenses He has not yet saved anything but wants to start making annual savings at the end of each year in an account earning 8% interest per year, compounded annually Required: i. Calculate the amount of money that Alexander need to have when he retires to achieve his goals (18)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started