Question

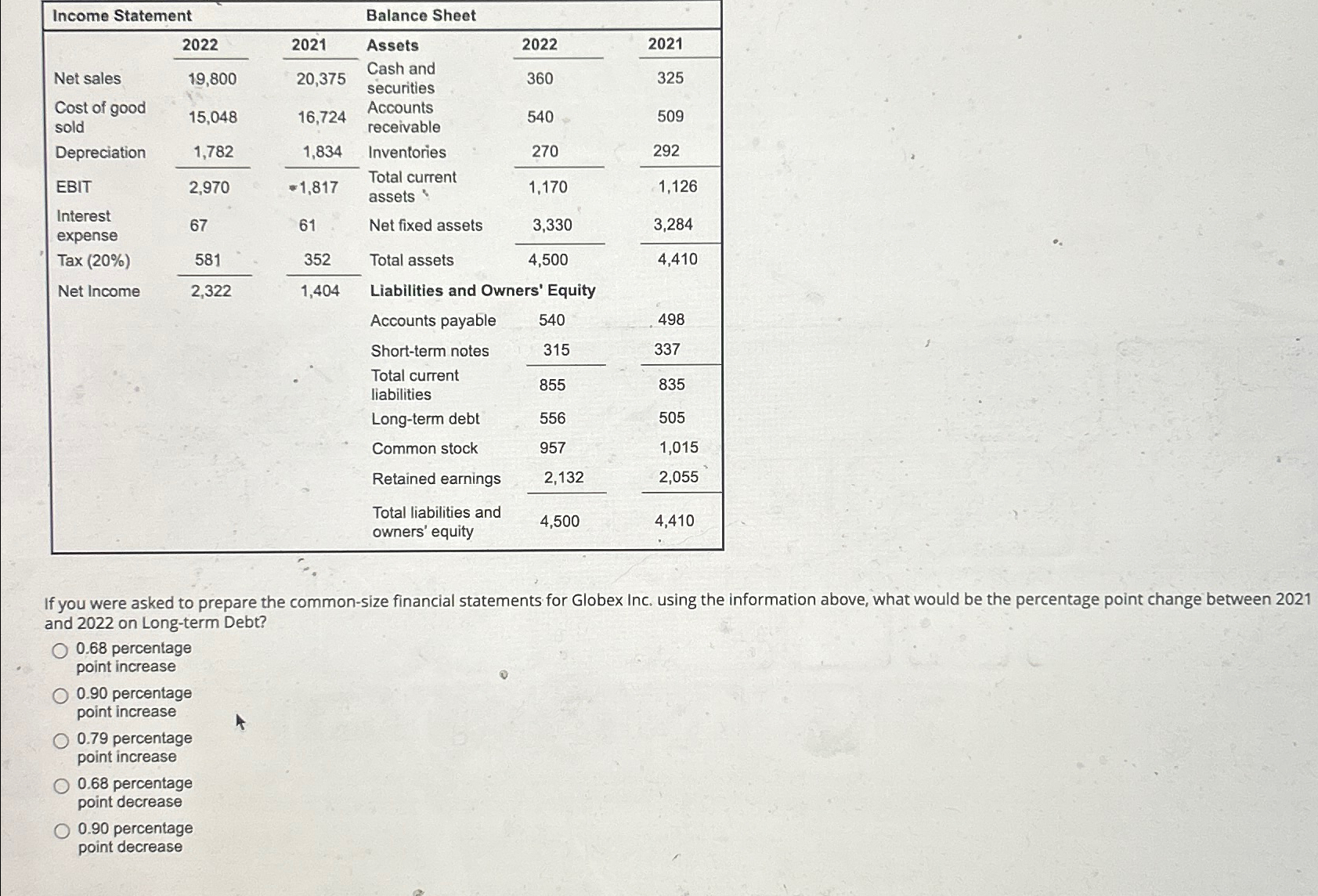

table[[Income Statement,Balance Sheet],[,2022,2021,Assets,2022,2021],[Net sales,19,800,20,375,table[[Cash and],[securities]],360,325],[table[[Cost of good],[sold]],15,048,16,724,table[[Accounts],[receivable]],540,509],[Depreciation,1,782,1,834,Inventories,270,292],[EBIT,2,970, -1,817 ,table[[Total current],[assets]],1,170,1,126],[table[[Interest],[expense]],67,61,Net fixed assets,3,330,3,284],[ Tax(20%) ,581,352,Total assets,4,500,4,410],[Net Income,2,322,1,404,Liabilities and Ow,ers' Equity,],[,,Accounts payable,540,498],[,,Short-term notes,315,337],[,.,table[[Total current],[liabilities]],855,835],[,,Long-term debt,556,505],[,,Common stock,957,1,015],[,0,Retained earnings,2,132,2,055],[,,table[[Total

\\\\table[[Income Statement,Balance Sheet],[,2022,2021,Assets,2022,2021],[Net sales,19,800,20,375,\\\\table[[Cash and],[securities]],360,325],[\\\\table[[Cost of good],[sold]],15,048,16,724,\\\\table[[Accounts],[receivable]],540,509],[Depreciation,1,782,1,834,Inventories,270,292],[EBIT,2,970,

-1,817,\\\\table[[Total current],[assets]],1,170,1,126],[\\\\table[[Interest],[expense]],67,61,Net fixed assets,3,330,3,284],[

Tax(20%),581,352,Total assets,4,500,4,410],[Net Income,2,322,1,404,Liabilities and Ow,ers' Equity,],[,,Accounts payable,540,498],[,,Short-term notes,315,337],[,.,\\\\table[[Total current],[liabilities]],855,835],[,,Long-term debt,556,505],[,,Common stock,957,1,015],[,0,Retained earnings,2,132,2,055],[,,\\\\table[[Total liabilities and],[owners' equity]],4,500,4,410]]\ If you were asked to prepare the common-size financial statements for Globex Inc. using the information above, what would be the percentage point change between 2021 and 2022 on Long-term Debt?\ 0.68 percentage\ point increase\ 0.90 percentage\ point increase\ 0.79 percentage\ point increase\ 0.68 percentage\ point decrease\ 0.90 percentage\ point decrease

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started