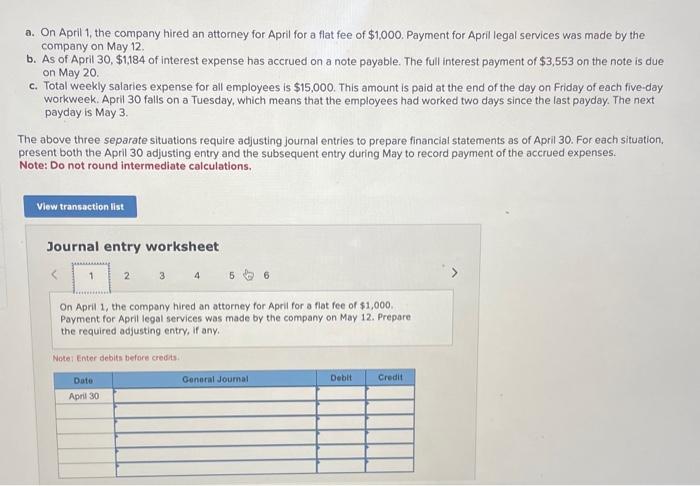

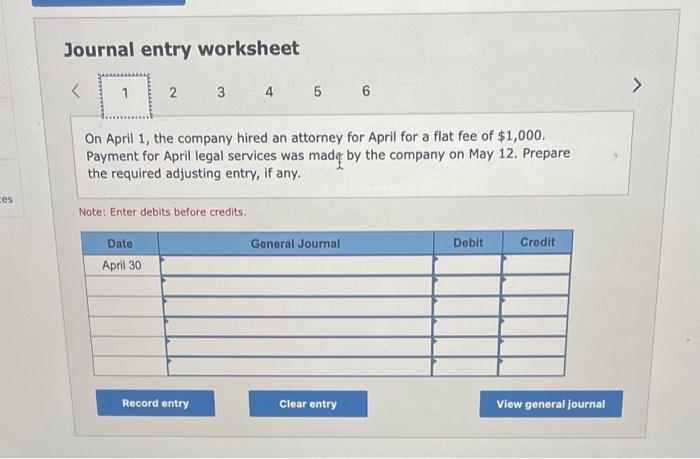

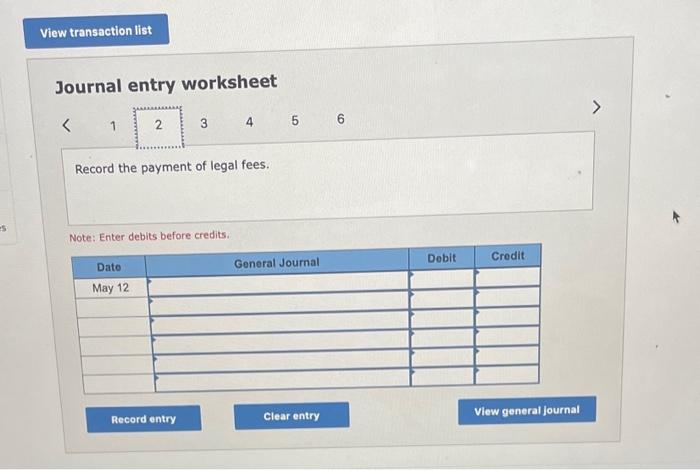

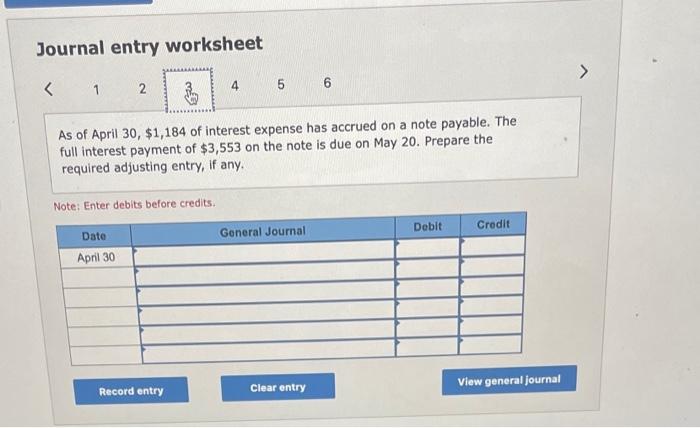

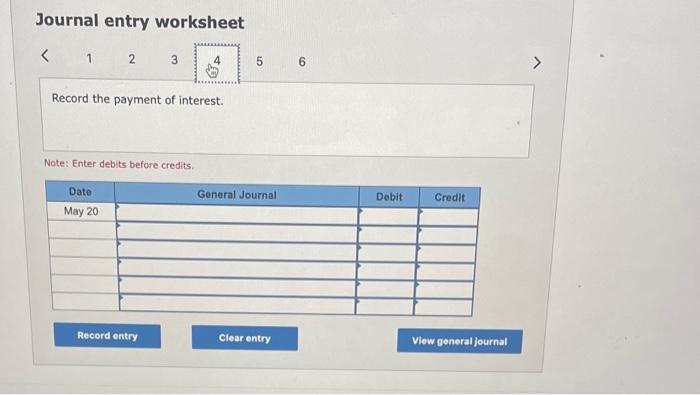

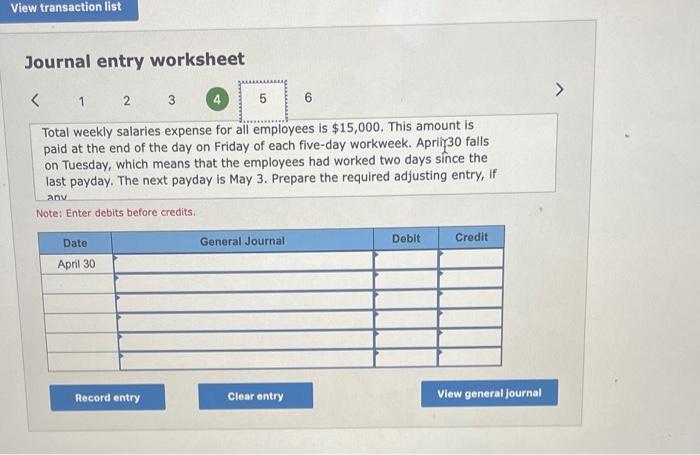

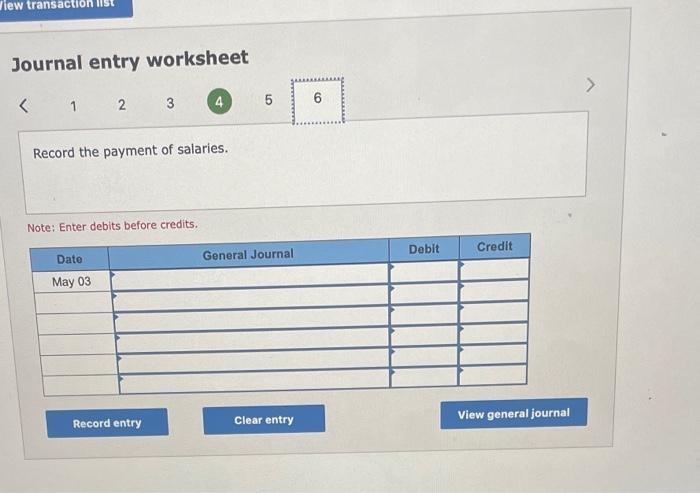

a. On April 1, the company hired an attorney for April for a flat fee of $1,000. Payment for April legal services was made by the company on May 12 b. As of April 30, $1,184 of interest expense has accrued on a note payable. The full interest payment of $3,553 on the note is due on May 20. c. Total weekly salaries expense for all employees is $15,000. This amount is paid at the end of the day on Friday of each five-day workweek. April 30 falls on a Tuesday, which means that the employees had worked two days since the last payday. The next payday is May 3. The above three separate situations require adjusting journal entries to prepare financial statements as of April 30 . For each situation. present both the April 30 adjusting entry and the subsequent entry during May to record payment of the accrued expenses. Note: Do not round intermediate calculations. Journal entry worksheet On April 1, the company hired an attorney for April for a flat fee of $1,000. Payment for April legal services was made by the company on May 12. Prepare the required adjusting entry, if any. Note: Enter debits before credits. Journal entry worksheet 6 On April 1, the company hired an attorney for April for a flat fee of $1,000. Payment for April legal services was madi by the company on May 12. Prepare the required adjusting entry, if any. Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet As of April 30, $1,184 of interest expense has accrued on a note payable. The full interest payment of $3,553 on the note is due on May 20 . Prepare the required adjusting entry, if any. Note: Enter debits before credits. Journal entry worksheet Record the payment of interest. Note: Enter debits before credits. Journal entry worksheet Total weekly salaries expense for all employees is $15,000. This amount is paid at the end of the day on Friday of each five-day workweek. Apriig 30 falls on Tuesday, which means that the employees had worked two days since the last payday. The next payday is May 3. Prepare the required adjusting entry, if anv Note: Enter debits before credits. Journal entry worksheet Record the payment of salaries. Note: Enter debits before credits