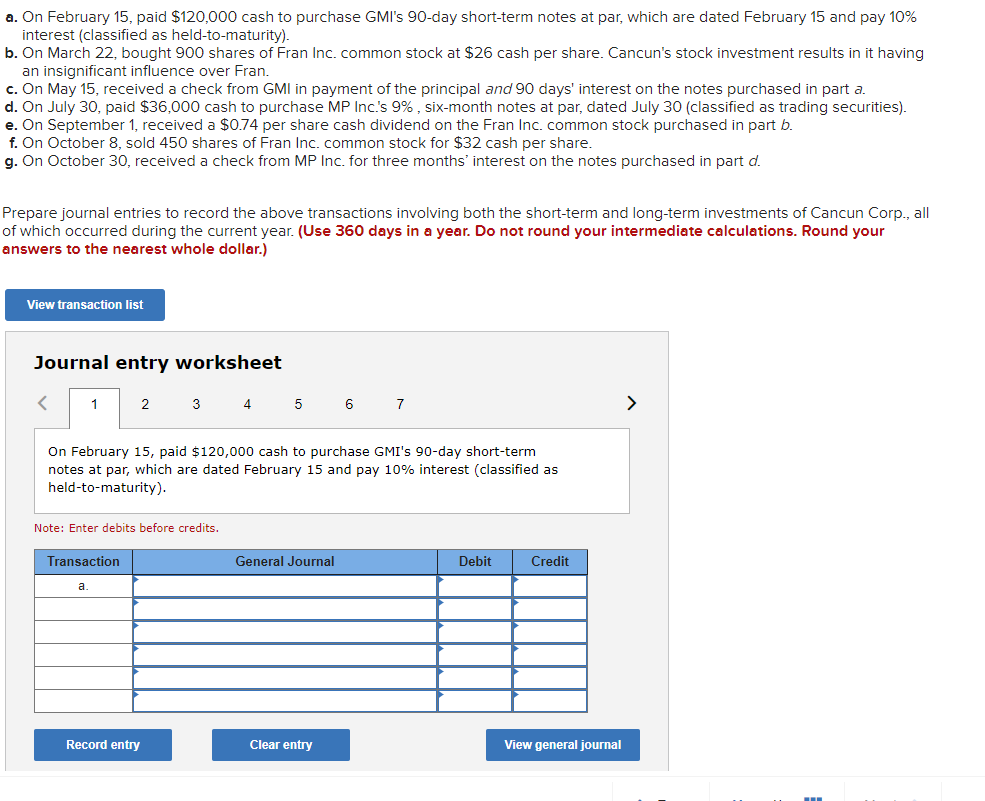

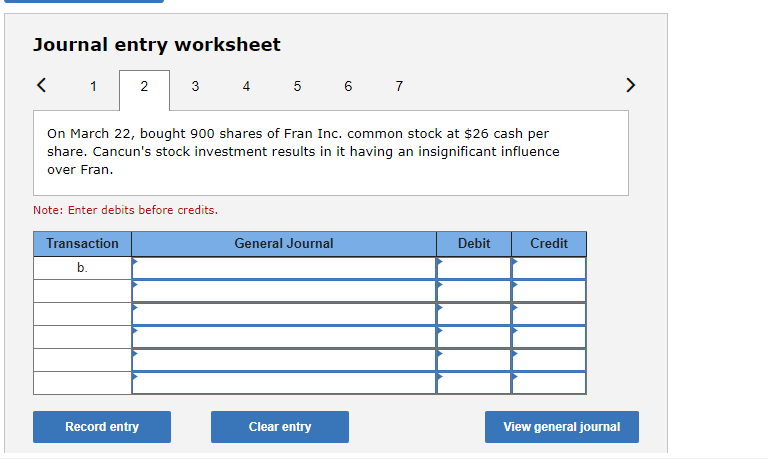

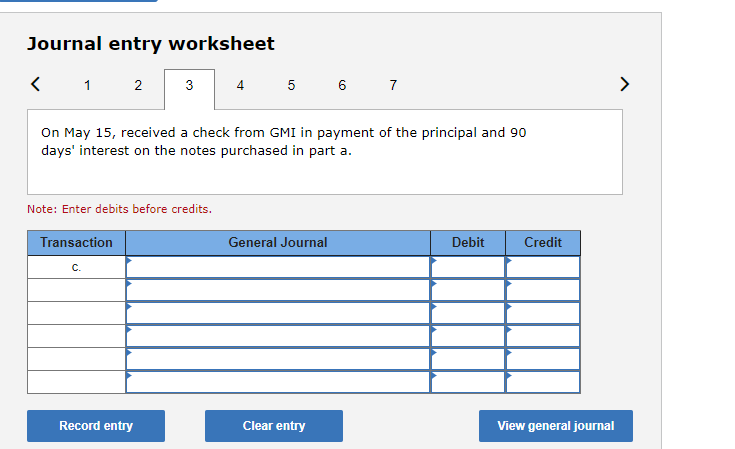

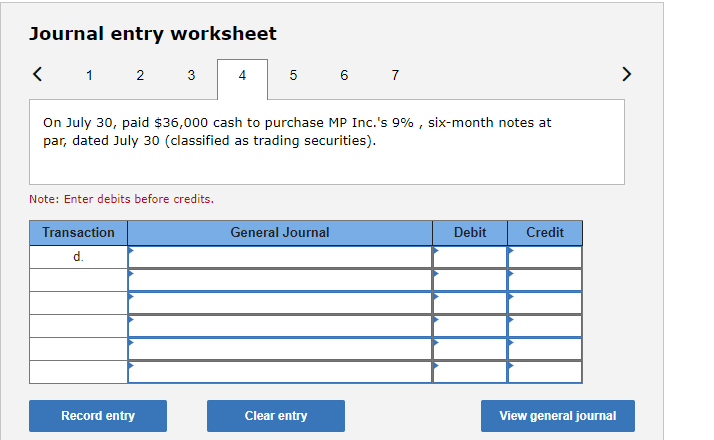

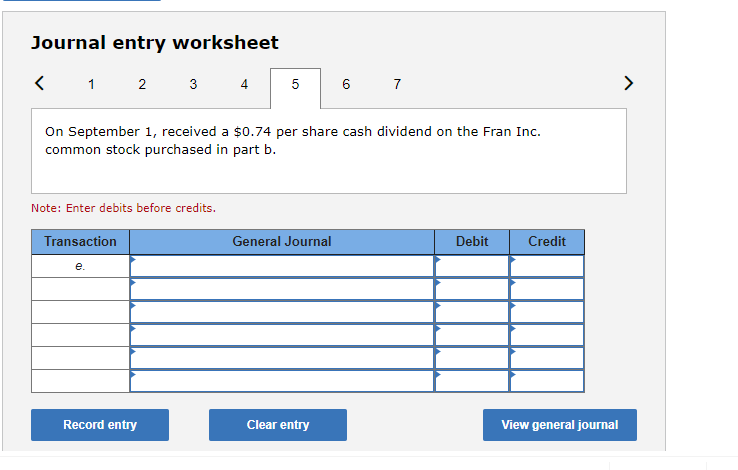

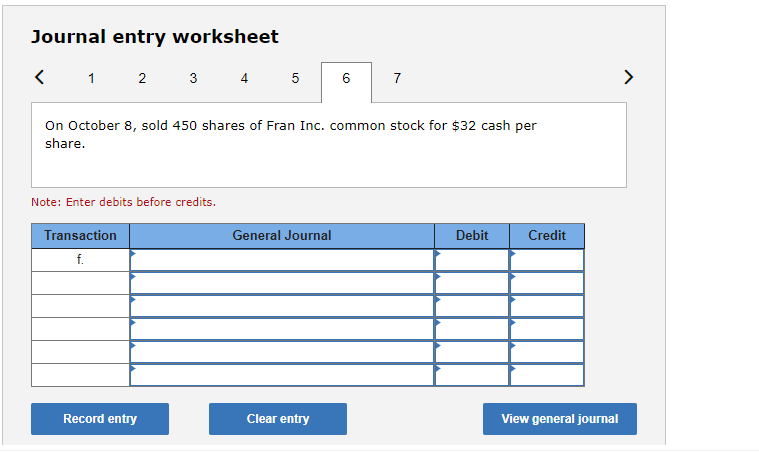

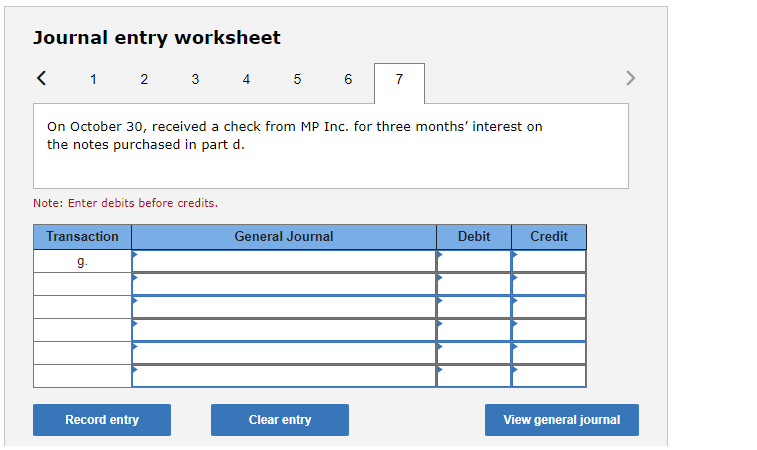

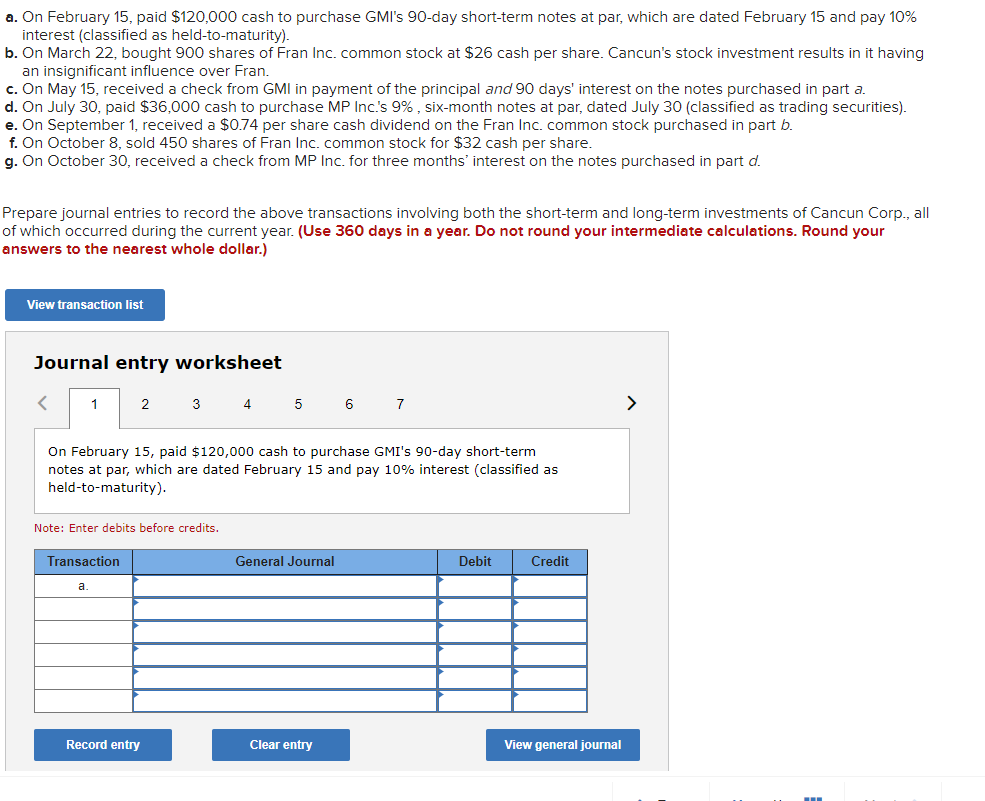

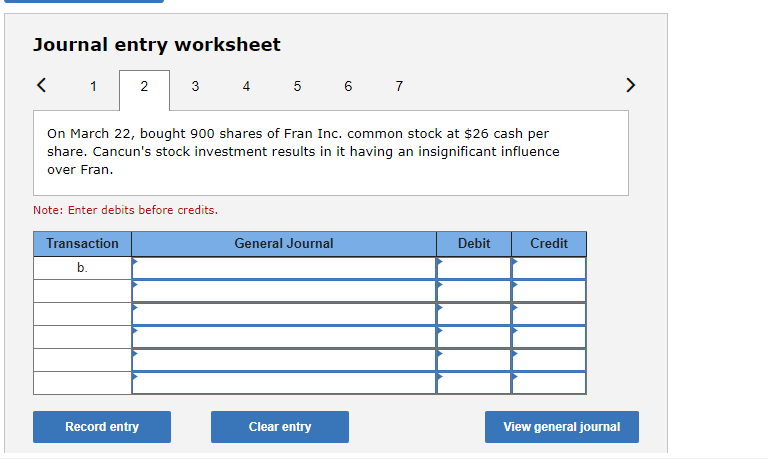

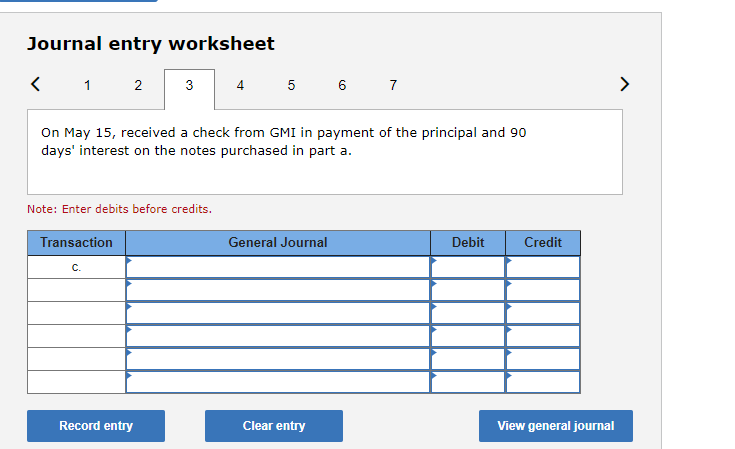

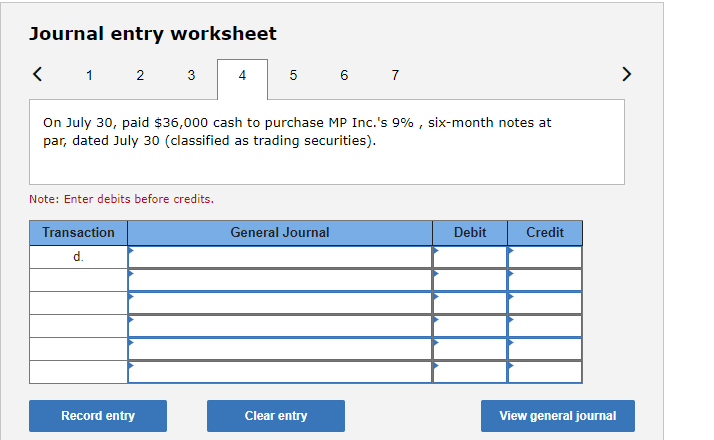

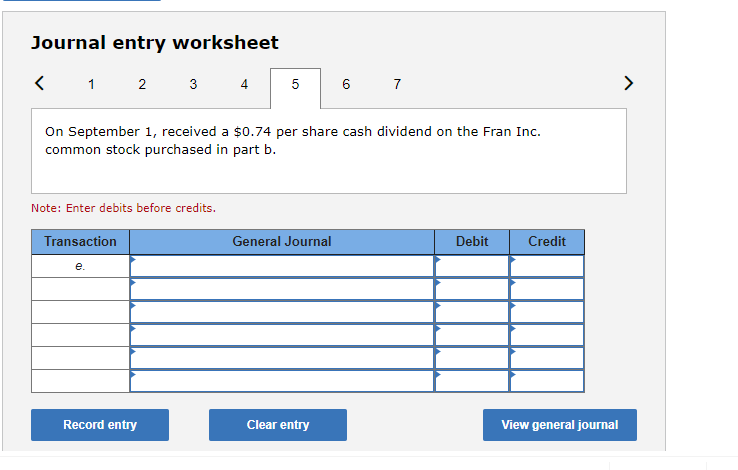

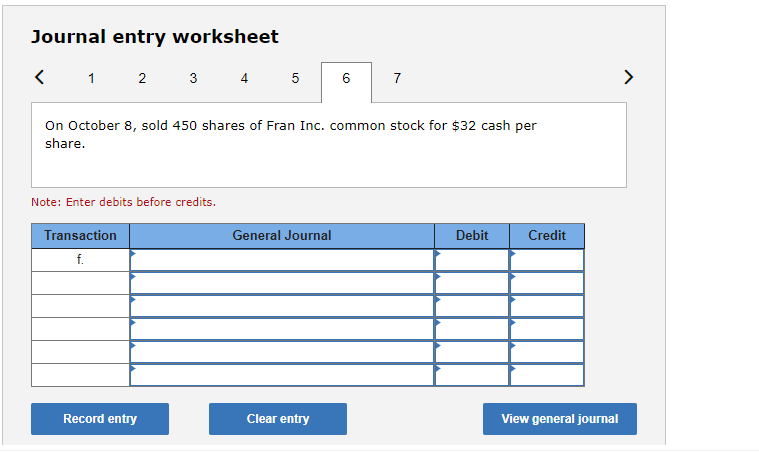

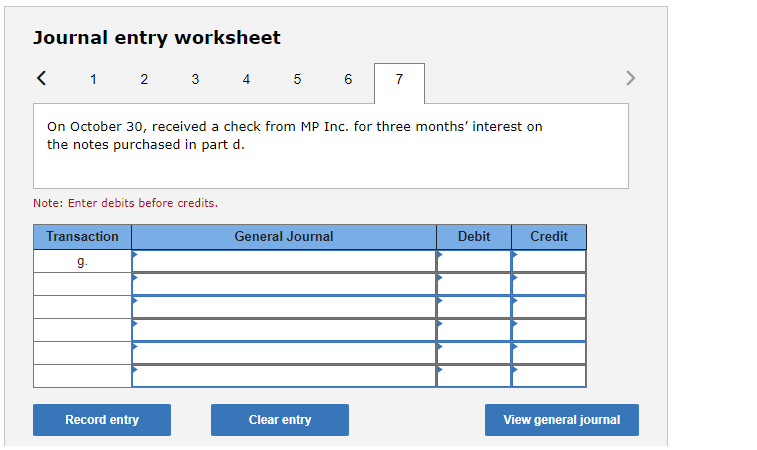

a. On February 15, paid $120,000 cash to purchase GMI's 90-day short-term notes at par, which are dated February 15 and pay 10% interest (classified as held-to-maturity). b. On March 22, bought 900 shares of Fran Inc. common stock at $26 cash per share. Cancun's stock investment results in it having an insignificant influence over Fran. c. On May 15, received a check from GMI in payment of the principal and 90 days' interest on the notes purchased in part a. d. On July 30, paid $36,000 cash to purchase MP Inc.'s 9%, six-month notes at par, dated July 30 (classified as trading securities). e. On September 1, received a $0.74 per share cash dividend on the Fran Inc. common stock purchased in part b. f. On October 8, sold 450 shares of Fran Inc. common stock for $32 cash per share. g. On October 30, received a check from MP Inc. for three months' interest on the notes purchased in part d. Prepare journal entries to record the above transactions involving both the short-term and long-term investments of Cancun Corp., all of which occurred during the current year. (Use 360 days in a year. Do not round your intermediate calculations. Round your answers to the nearest whole dollar.) View transaction list Journal entry worksheet On February 15, paid $120,000 cash to purchase GMI's 90-day short-term notes at par, which are dated February 15 and pay 10% interest (classified as held-to-maturity). Note: Enter debits before credits. Transaction General Journal Debit Credit a Record entry Clear entry View general journal Journal entry worksheet On March 22, bought 900 shares of Fran Inc. common stock at $26 cash per share. Cancun's stock investment results in it having an insignificant influence over Fran. Note: Enter debits before credits. General Journal Debit Credit Transaction b. Record entry Clear entry View general journal Journal entry worksheet On May 15, received a check from GMI in payment of the principal and 90 days' interest on the notes purchased in part a. Note: Enter debits before credits. Transaction General Journal Debit Credit C. Record entry Clear entry View general journal Journal entry worksheet On September 1, received a $0.74 per share cash dividend on the Fran Inc. common stock purchased in part b. Note: Enter debits before credits. Transaction General Journal Debit Credit e. Record entry Clear entry View general journal Journal entry worksheet 1 2 4 5 6 7 > On October 8, sold 450 shares of Fran Inc. common stock for $32 cash per share. Note: Enter debits before credits. Transaction General Journal Debit Credit f. Record entry Clear entry View general journal Journal entry worksheet On October 30, received a check from MP Inc. for three months' interest on the notes purchased in part d. Note: Enter debits before credits. Transaction General Journal Debit Credit g Record entry Clear entry View general journal