Answered step by step

Verified Expert Solution

Question

1 Approved Answer

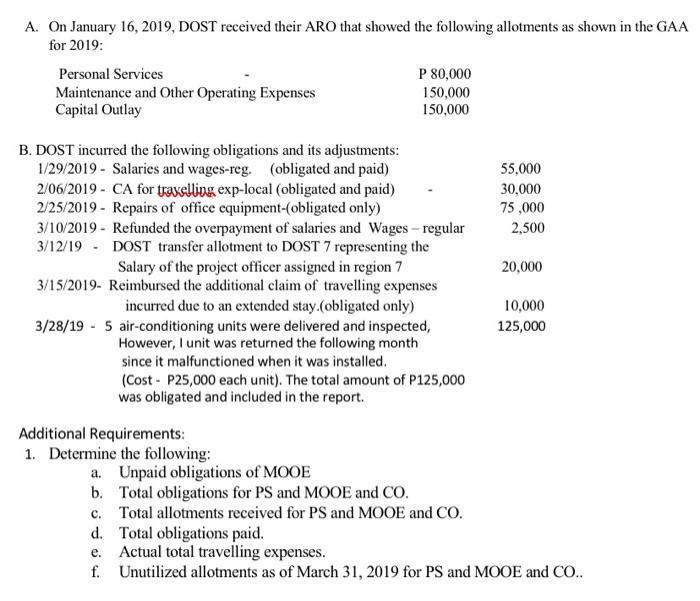

A. On January 16, 2019, DOST received their ARO that showed the following allotments as shown in the GAA for 2019: Personal Services P

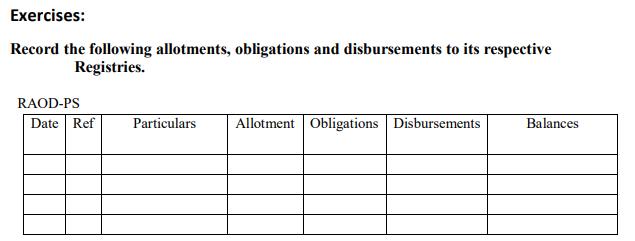

A. On January 16, 2019, DOST received their ARO that showed the following allotments as shown in the GAA for 2019: Personal Services P 80,000 Maintenance and Other Operating Expenses Capital Outlay 150,000 150,000 B. DOST incurred the following obligations and its adjustments: 1/29/2019 - Salaries and wages-reg. (obligated and paid) 2/06/2019 - CA for traxelling exp-local (obligated and paid) 2/25/2019 - Repairs of office equipment-(obligated only) 3/10/2019 - Refunded the overpayment of salaries and Wages - regular 3/12/19 DOST transfer allotment to DOST 7 representing the Salary of the project officer assigned in region 7 3/15/2019- Reimbursed the additional claim of travelling expenses incurred due to an extended stay.(obligated only) 3/28/19 - 5 air-conditioning units were delivered and inspected, However, I unit was returned the following month since it malfunctioned when it was installed. 55,000 30,000 75 ,000 2,500 20,000 10,000 125,000 (Cost - P25,000 each unit). The total amount of P125,000 was obligated and included in the report. Additional Requirements: 1. Determine the following: a. Unpaid obligations of MOOE b. Total obligations for PS and MOOE and CO. c. Total allotments received for PS and MOOE and CO. d. Total obligations paid. e. Actual total travelling expenses. f. Unutilized allotments as of March 31, 2019 for PS and MOOE and CO.. Exercises: Record the following allotments, obligations and disbursements to its respective Registries. RAOD-PS Date Ref Particulars Allotment Obligations Disbursements Balances

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer Explanation 1 Unpaid Obligations of MOOE Travel Exp 30...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started