Answered step by step

Verified Expert Solution

Question

1 Approved Answer

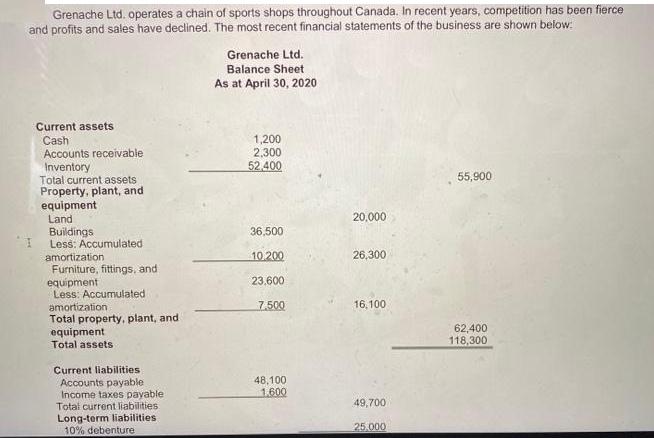

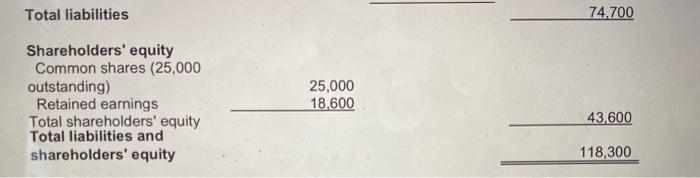

Grenache Ltd. operates a chain of sports shops throughout Canada. In recent years, competition has been fierce and profits and sales have declined. The

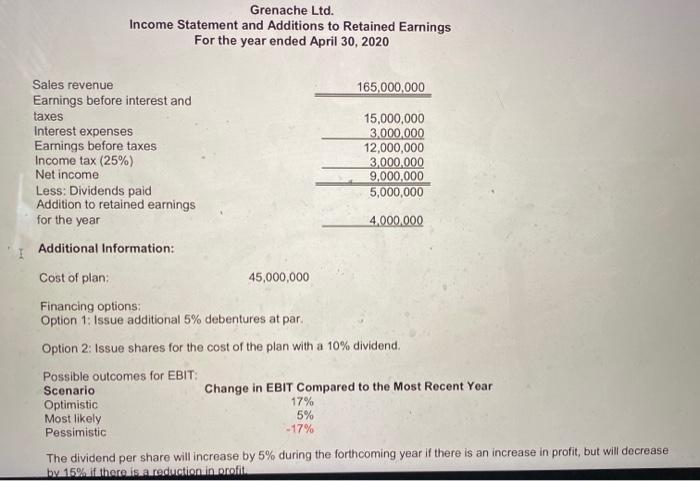

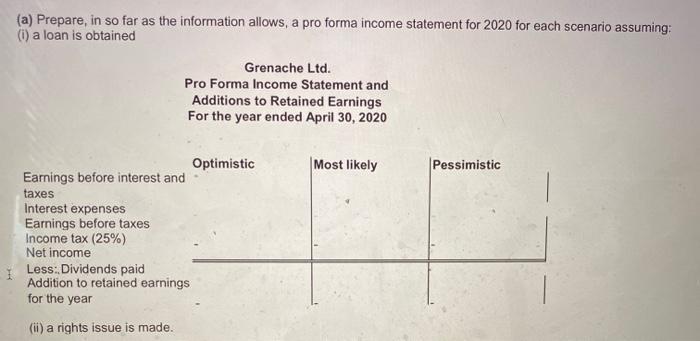

Grenache Ltd. operates a chain of sports shops throughout Canada. In recent years, competition has been fierce and profits and sales have declined. The most recent financial statements of the business are shown below: Grenache Ltd. Balance Sheet As at April 30, 2020 Current assets Cash Accounts receivable Inventory Total current assets Property, plant, and equipment 1,200 2,300 52,400 55,900 Land 20,000 Buildings Less: Accumulated 36,500 10.200 26,300 amortization Furniture, fittings, and equipment Less: Accumulated amortization Total property, plant, and equipment Total assets 23.600 7.500 16,100 62,400 118,300 Current liabilities Accounts payable Income taxes payable Total current liabilities Long-term liabilities 10% debenture 48,100 1.600 49,700 25.000 Total liabilities 74.700 Shareholders' equity Common shares (25,000 outstanding) Retained earnings Total shareholders' equity Total liabilities and 25,000 18,600 43,600 shareholders' equity 118,300 Grenache Ltd. Income Statement and Additions to Retained Earnings For the year ended April 30, 2020 Sales revenue 165,000,000 Earnings before interest and taxes Interest expenses Earnings before taxes Income tax (25%) Net income 15,000,000 3.000,000 12,000,000 3,000,000 9,000,000 5,000,000 Less: Dividends paid Addition to retained earnings for the year 4.000,000 Additional Information: Cost of plan: 45,000,000 Financing options: Option 1: Issue additional 5% debentures at par. Option 2: Issue shares for the cost of the plan with a 10% dividend. Possible outcomes for EBIT: Scenario Optimistic Most likely Pessimistic Change in EBIT Compared to the Most Recent Year 17% 5% -17% The dividend per share will increase by 5% during the forthcoming year if there is an increase in profit, but will decrease by 15% if there is a reduction in profit. (a) Prepare, in so far as the information allows, a pro forma income statement for 2020 for each scenario assuming: (i) a loan is obtained Grenache Ltd. Pro Forma Income Statement and Additions to Retained Earnings For the year ended April 30, 2020 Optimistic Most likely Pessimistic Earnings before interest and taxes Interest expenses Earnings before taxes Income tax (25%) Net income Less: Dividends paid Addition to retained earnings for the year (ii) a rights issue is made. Grenache Ltd. operates a chain of sports shops throughout Canada. In recent years, competition has been fierce and profits and sales have declined. The most recent financial statements of the business are shown below: Grenache Ltd. Balance Sheet As at April 30, 2020 Current assets Cash Accounts receivable Inventory Total current assets Property, plant, and equipment 1,200 2,300 52,400 55,900 Land 20,000 Buildings Less: Accumulated 36,500 10.200 26,300 amortization Furniture, fittings, and equipment Less: Accumulated amortization Total property, plant, and equipment Total assets 23.600 7.500 16,100 62,400 118,300 Current liabilities Accounts payable Income taxes payable Total current liabilities Long-term liabilities 10% debenture 48,100 1.600 49,700 25.000 Total liabilities 74.700 Shareholders' equity Common shares (25,000 outstanding) Retained earnings Total shareholders' equity Total liabilities and 25,000 18,600 43,600 shareholders' equity 118,300 Grenache Ltd. Income Statement and Additions to Retained Earnings For the year ended April 30, 2020 Sales revenue 165,000,000 Earnings before interest and taxes Interest expenses Earnings before taxes Income tax (25%) Net income 15,000,000 3.000,000 12,000,000 3,000,000 9,000,000 5,000,000 Less: Dividends paid Addition to retained earnings for the year 4.000,000 Additional Information: Cost of plan: 45,000,000 Financing options: Option 1: Issue additional 5% debentures at par. Option 2: Issue shares for the cost of the plan with a 10% dividend. Possible outcomes for EBIT: Scenario Optimistic Most likely Pessimistic Change in EBIT Compared to the Most Recent Year 17% 5% -17% The dividend per share will increase by 5% during the forthcoming year if there is an increase in profit, but will decrease by 15% if there is a reduction in profit. (a) Prepare, in so far as the information allows, a pro forma income statement for 2020 for each scenario assuming: (i) a loan is obtained Grenache Ltd. Pro Forma Income Statement and Additions to Retained Earnings For the year ended April 30, 2020 Optimistic Most likely Pessimistic Earnings before interest and taxes Interest expenses Earnings before taxes Income tax (25%) Net income Less: Dividends paid Addition to retained earnings for the year (ii) a rights issue is made.

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Loan is obtained Optimistic Most likely Pessimistic EBIT 17550000 15750000 12450000 Interest 52500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started