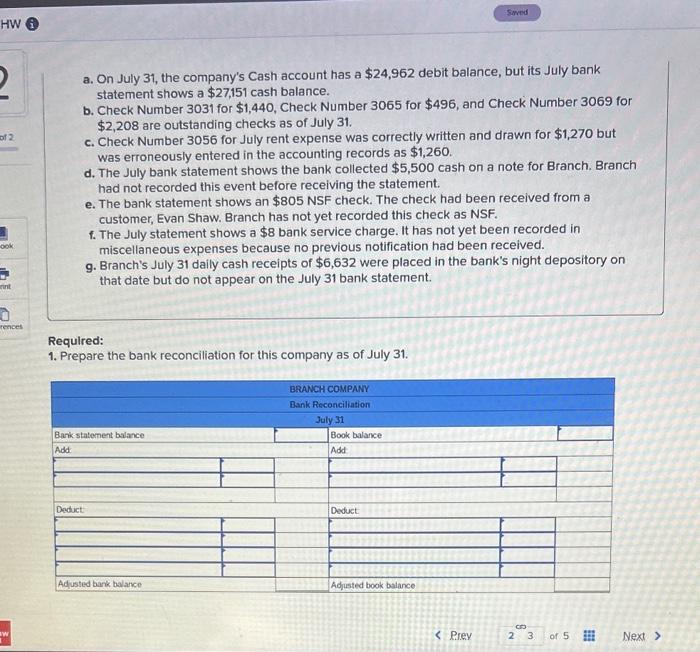

a. On July 31 , the company's Cash account has a $24,962 debit balance, but its July bank statement shows a $27,151 cash balance. b. Check Number 3031 for $1,440, Check Number 3065 for $496, and Check Number 3069 for $2,208 are outstanding checks as of July 31 . c. Check Number 3056 for July rent expense was correctly written and drawn for $1,270 but was erroneously entered in the accounting records as $1,260. d. The July bank statement shows the bank collected $5,500 cash on a note for Branch. Branch had not recorded this event before receiving the statement. e. The bank statement shows an $805 NSF check. The check had been received from a customer, Evan Shaw. Branch has not yet recorded this check as NSF. f. The July statement shows a $8 bank service charge. It has not yet been recorded in miscellaneous expenses because no previous notification had been received. g. Branch's July 31 daily cash receipts of $6,632 were placed in the bank's night depository on that date but do not appear on the July 31 bank statement. Required: 1. Prepare the bank reconciliation for this company as of July 31. a. On July 31 , the company's Cash account has a $24,962 debit balance, but its July bank statement shows a $27,151 cash balance. b. Check Number 3031 for $1,440, Check Number 3065 for $496, and Check Number 3069 for $2,208 are outstanding checks as of July 31 . c. Check Number 3056 for July rent expense was correctly written and drawn for $1,270 but was erroneously entered in the accounting records as $1,260. d. The July bank statement shows the bank collected $5,500 cash on a note for Branch. Branch had not recorded this event before receiving the statement. e. The bank statement shows an $805 NSF check. The check had been received from a customer, Evan Shaw. Branch has not yet recorded this check as NSF. f. The July statement shows a $8 bank service charge. It has not yet been recorded in miscellaneous expenses because no previous notification had been received. g. Branch's July 31 daily cash receipts of $6,632 were placed in the bank's night depository on that date but do not appear on the July 31 bank statement. Required: 1. Prepare the bank reconciliation for this company as of July 31 . a. On July 31 , the company's Cash account has a $24,962 debit balance, but its July bank statement shows a $27,151 cash balance. b. Check Number 3031 for $1,440, Check Number 3065 for $496, and Check Number 3069 for $2,208 are outstanding checks as of July 31 . c. Check Number 3056 for July rent expense was correctly written and drawn for $1,270 but was erroneously entered in the accounting records as $1,260. d. The July bank statement shows the bank collected $5,500 cash on a note for Branch. Branch had not recorded this event before receiving the statement. e. The bank statement shows an $805 NSF check. The check had been received from a customer, Evan Shaw. Branch has not yet recorded this check as NSF. f. The July statement shows a $8 bank service charge. It has not yet been recorded in miscellaneous expenses because no previous notification had been received. g. Branch's July 31 daily cash receipts of $6,632 were placed in the bank's night depository on that date but do not appear on the July 31 bank statement. Required: 1. Prepare the bank reconciliation for this company as of July 31. a. On July 31 , the company's Cash account has a $24,962 debit balance, but its July bank statement shows a $27,151 cash balance. b. Check Number 3031 for $1,440, Check Number 3065 for $496, and Check Number 3069 for $2,208 are outstanding checks as of July 31 . c. Check Number 3056 for July rent expense was correctly written and drawn for $1,270 but was erroneously entered in the accounting records as $1,260. d. The July bank statement shows the bank collected $5,500 cash on a note for Branch. Branch had not recorded this event before receiving the statement. e. The bank statement shows an $805 NSF check. The check had been received from a customer, Evan Shaw. Branch has not yet recorded this check as NSF. f. The July statement shows a $8 bank service charge. It has not yet been recorded in miscellaneous expenses because no previous notification had been received. g. Branch's July 31 daily cash receipts of $6,632 were placed in the bank's night depository on that date but do not appear on the July 31 bank statement. Required: 1. Prepare the bank reconciliation for this company as of July 31