Question

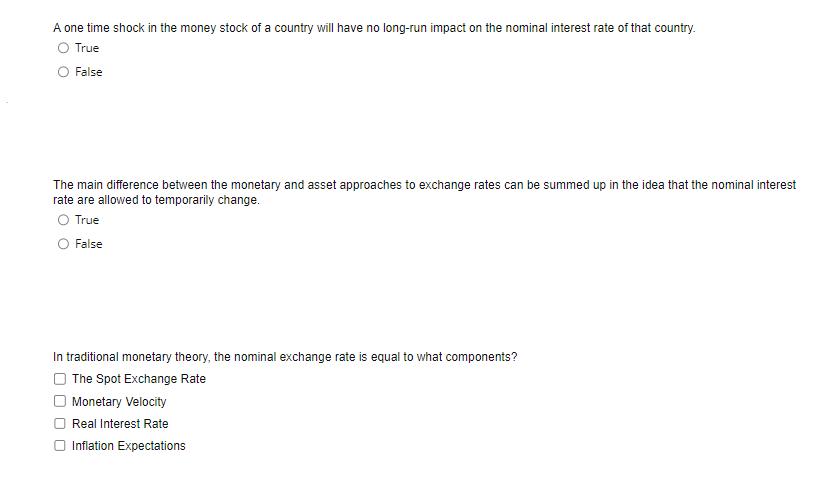

A one time shock in the money stock of a country will have no long-run impact on the nominal interest rate of that country.

A one time shock in the money stock of a country will have no long-run impact on the nominal interest rate of that country. True False The main difference between the monetary and asset approaches to exchange rates can be summed up in the idea that the nominal interest rate are allowed to temporarily change. O True False In traditional monetary theory, the nominal exchange rate is equal to what components? The Spot Exchange Rate Monetary Velocity Real Interest Rate Inflation Expectations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 False 2 False 3 In traditional monetary theory the nominal exchange rate is equal to the spot exch...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Exploring Economics

Authors: Robert L Sexton

5th Edition

978-1439040249, 1439040249

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App