Question: XYZ, Inc. is considering a 5-year project. The production will require net working capital investments each year equal to 15% of the projected sales.

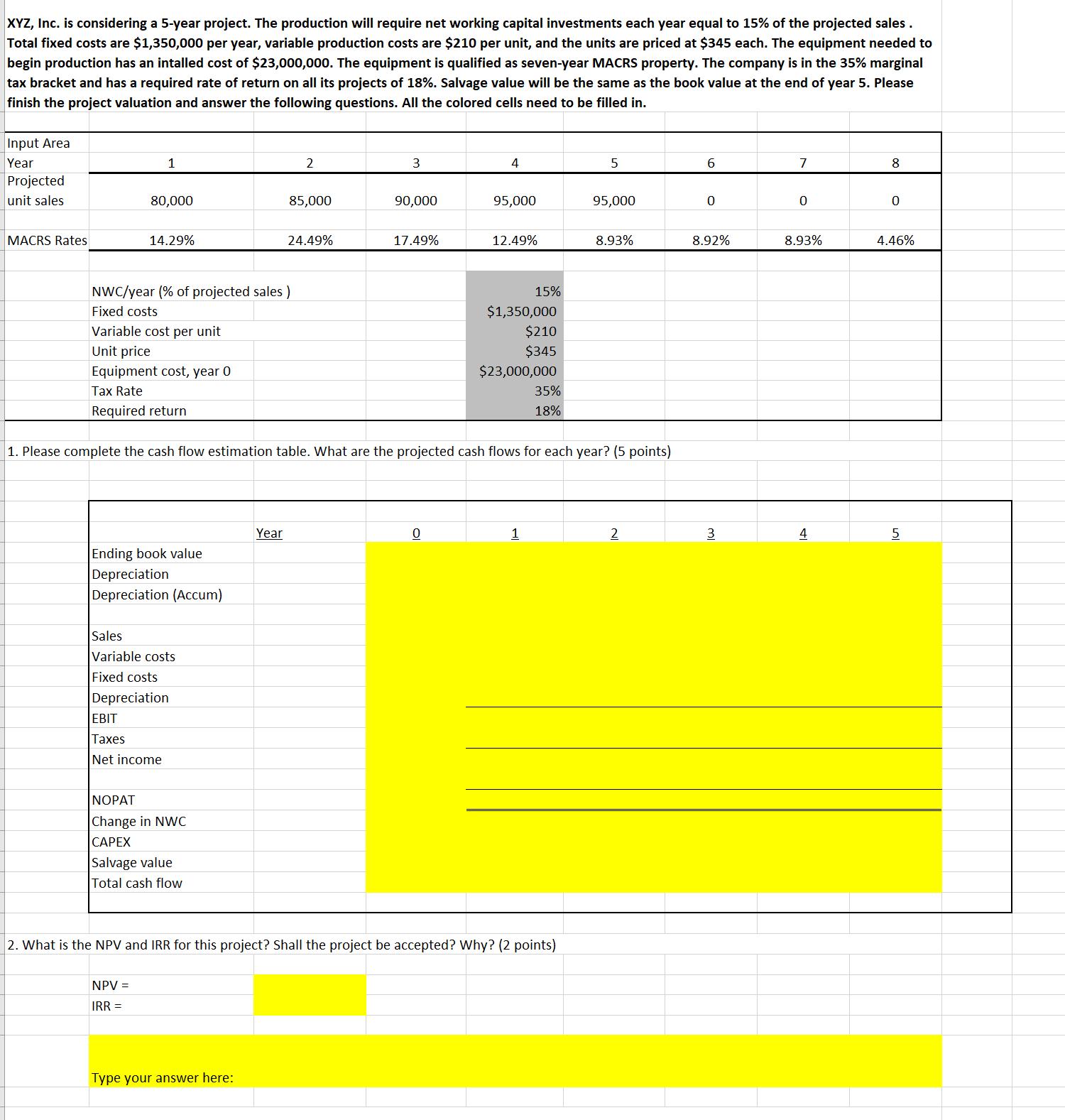

XYZ, Inc. is considering a 5-year project. The production will require net working capital investments each year equal to 15% of the projected sales. Total fixed costs are $1,350,000 per year, variable production costs are $210 per unit, and the units are priced at $345 each. The equipment needed to begin production has an intalled cost of $23,000,000. The equipment is qualified as seven-year MACRS property. The company is in the 35% marginal tax bracket and has a required rate of return on all its projects of 18%. Salvage value will be the same as the book value at the end of year 5. Please finish the project valuation and answer the following questions. All the colored cells need to be filled in. Input Area Year 1 2 3 4 6. 7 8 Projected unit sales 80,000 85,000 90,000 95,000 95,000 MACRS Rates 14.29% 24.49% 17.49% 12.49% 8.93% 8.92% 8.93% 4.46% NWC/year (% of projected sales ) 15% Fixed costs $1,350,000 Variable cost per unit $210 Unit price $345 Equipment cost, year 0 $23,000,000 Tax Rate 35% Required return 18% 1. Please complete the cash flow estimation table. What are the projected cash flows for each year? (5 points) Year 1 3 4 Ending book value Depreciation Depreciation (Accum) Sales Variable costs Fixed costs Depreciation EBIT xes Net income NOPAT Change in NWC Salvage value Total cash flow 2. What is the NPV and IRR for this project? Shall the project be accepted? Why? (2 points) NPV = IRR = Type your answer here:

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Operating cash flow OCF each year income after tax depreciation ... View full answer

Get step-by-step solutions from verified subject matter experts