Answered step by step

Verified Expert Solution

Question

1 Approved Answer

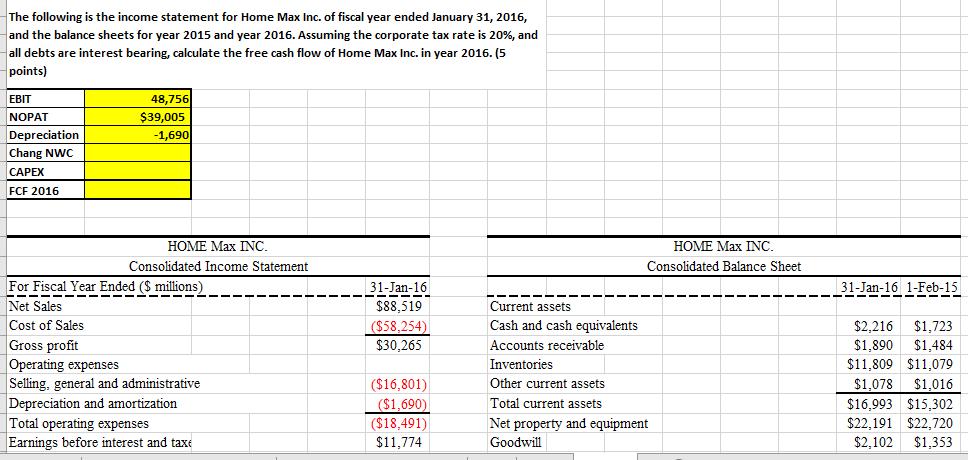

The following is the income statement for Home Max Inc. of fiscal year ended January 31, 2016, and the balance sheets for year 2015

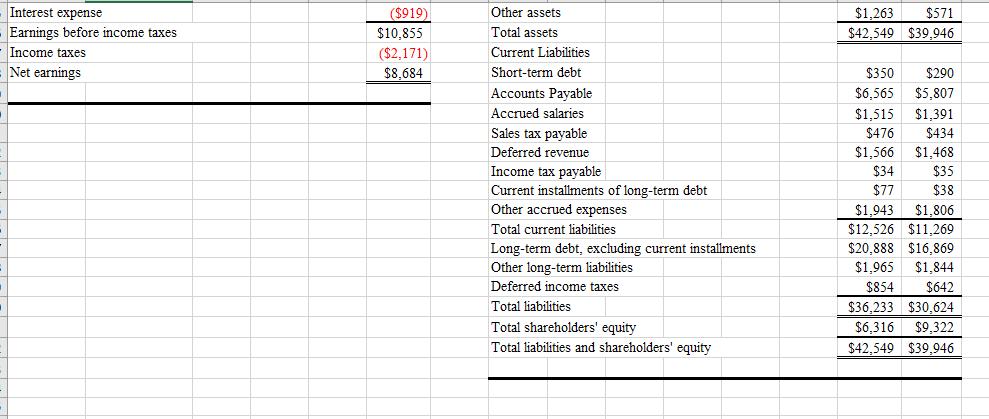

The following is the income statement for Home Max Inc. of fiscal year ended January 31, 2016, and the balance sheets for year 2015 and year 2016. Assuming the corporate tax rate is 20%, and all debts are interest bearing, calculate the free cash flow of Home Max Inc. in year 2016. (5 points) EBIT 48,756 NOPAT $39,005 Depreciation -1,690 Chang NWC FCF 2016 INC. HOME Max INC. Consolidated Income Statement Consolidated Balance Sheet For Fiscal Year Ended ($ millions) Net Sales 31-Jan-16 1-Feb-15 31-Jan-16 $88,519 Current assets Cost of Sales Gross profit Operating expenses Selling, general and administrative Depreciation and amortization Total operating expenses Earnings before interest and taxe Cash and cash equivalents ($58,254) $30,265 $2,216 $1,723 Accounts receivable $1,890 $1,484 Inventories $11,809 $11,079 ($16,801) ($1,690) ($18,491) $11,774 Other current assets $1,078 $1,016 $16,993 $15,302 $22,191 $22,720 $2,102 Total current assets Net property and equipment Goodwill $1,353 Interest expense Earnings before income taxes Other assets $1,263 $571 ($919) $10,855 ($2,171) $8,684 Total assets $42.549 $39,946 Income taxes Current Liabilities Net earnings Short-term debt $350 $290 Accounts Payable $6,565 $5,807 Accrued salaries $1,515 $1,391 Sales tax payable $476 $434 Deferred revenue $1,566 $1,468 Income tax payable Current installments of long-term debt Other accrued expenses $34 $35 $77 $38 $1.943 $1,806 Total current liabilities $12,526 $11,269 $20,888 $16,869 $1,965 $1,844 Long-term debt, excluding current installments Other long-term liabilities Deferred income taxes $854 $642 Total liabilities $36.233 $30.624 Total shareholders' equity $6,316 $9,322 Total liabilities and shareholders' equity $42,549 $39,946

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Free Cash flows for FirmCash Flows from OperationCapital Expenditure Incurred Free Cash flows in 2016 11465 WN 1 1161 WN 3 Free Cash flows in 2016 103...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started