Question

a) One year ago, Alpha Supply issued 15-year bonds at par. The bonds have a coupon rate of 6.5 percent and pay interest annually.

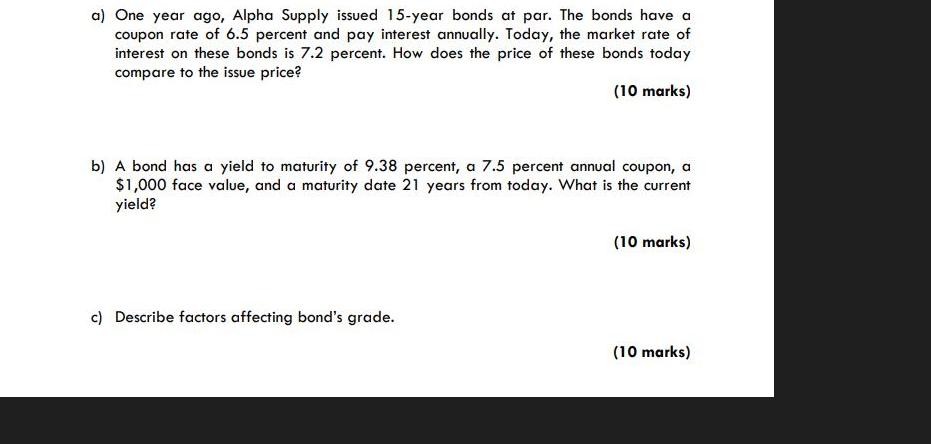

a) One year ago, Alpha Supply issued 15-year bonds at par. The bonds have a coupon rate of 6.5 percent and pay interest annually. Today, the market rate of interest on these bonds is 7.2 percent. How does the price of these bonds today compare to the issue price? (10 marks) b) A bond has a yield to maturity of 9.38 percent, a 7.5 percent annual coupon, a $1,000 face value, and a maturity date 21 years from today. What is the current yield? c) Describe factors affecting bond's grade. (10 marks) (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Bond Pricing and Factors Affecting Bond Grades a Price Comparison of Alpha Supply Bonds When a bond is issued at par it means the issue price equals the face value In this case the bonds were issued a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Robert Libby, Patricia Libby, Daniel Short, George Kanaan, M

5th Canadian edition

9781259105692, 978-1259103285

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App