Answered step by step

Verified Expert Solution

Question

1 Approved Answer

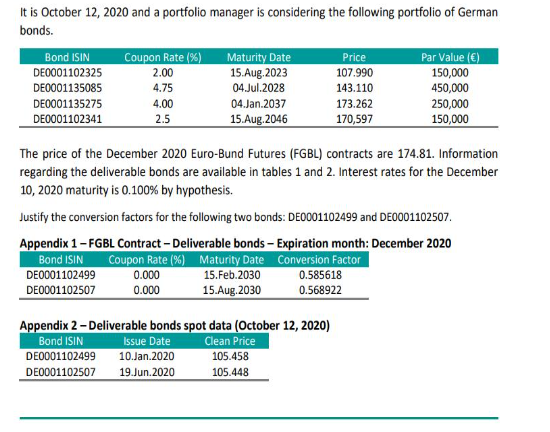

It is October 12, 2020 and a portfolio manager is considering the following portfolio of German bonds. Bond ISIN DE0001102325 DE0001135085 DE0001135275 DE0001102341 Coupon

It is October 12, 2020 and a portfolio manager is considering the following portfolio of German bonds. Bond ISIN DE0001102325 DE0001135085 DE0001135275 DE0001102341 Coupon Rate (%) 2.00 4.75 4.00 2.5 DE0001102499 DE0001102507 0.000 0.000 Maturity Date 15.Aug.2023 04.Jul.2028 04.Jan.2037 15.Aug.2046 The price of the December 2020 Euro-Bund Futures (FGBL) contracts are 174.81. Information regarding the deliverable bonds are available in tables 1 and 2. Interest rates for the December 10, 2020 maturity is 0.100% by hypothesis. Justify the conversion factors for the following two bonds: DE0001102499 and DE0001102507. Appendix 1 - FGBL Contract - Deliverable bonds - Expiration month: December 2020 Bond ISIN Coupon Rate (%) Maturity Date Conversion Factor DE0001102499 10.Jan.2020 DE0001102507 19.Jun.2020 15.Feb.2030 15.Aug.2030 Appendix 2-Deliverable bonds spot data (October 12, 2020) Issue Date Bond ISIN Clean Price Price 107.990 143.110 173.262 170,597 105.458 105.448 0.585618 0.568922 Par Value () 150,000 450,000 250,000 150,000

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

nswer 1 The weighted average cost of capital WACC is a measure of a companys cost of financing It is calculated by taking into account the companys co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started