Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A one-year forward transaction on the US dollar is an agreement in which we agree today to exchange $1 for F pounds one year from

A one-year forward transaction on the US dollar is an agreement in which we agree today to exchange $1 for F pounds one year from now. F denotes the forward quote.

Suppose that you see a forward quote of F = 0.8. Does there exist an option-based arbitrage strategy? If you answer no, explain why and if you answer yes construct this strategy and prove there is arbitrage.

Suppose that one-year pound interest rate is 5% and the current exchange rate is USD/GBP=0.7. What is the US dollar interest rate?

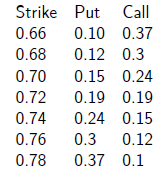

Strike Put Call 0.66 0.10 0.37 0.68 0.12 0.3 0.70 0.15 0.24 0.72 0.19 0.19 0.74 0.24 0.15 0.76 0.3 0.12 0.78 0.37 0.1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started