Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A options: 71,000; 69,000; 76,538; 77,538; and 75,438 B options: 1.209, 1.113, 10.053, 10.153, and 10.253 C options: 108,423; 245,584; 98,423; 265,584; and 285,584 D

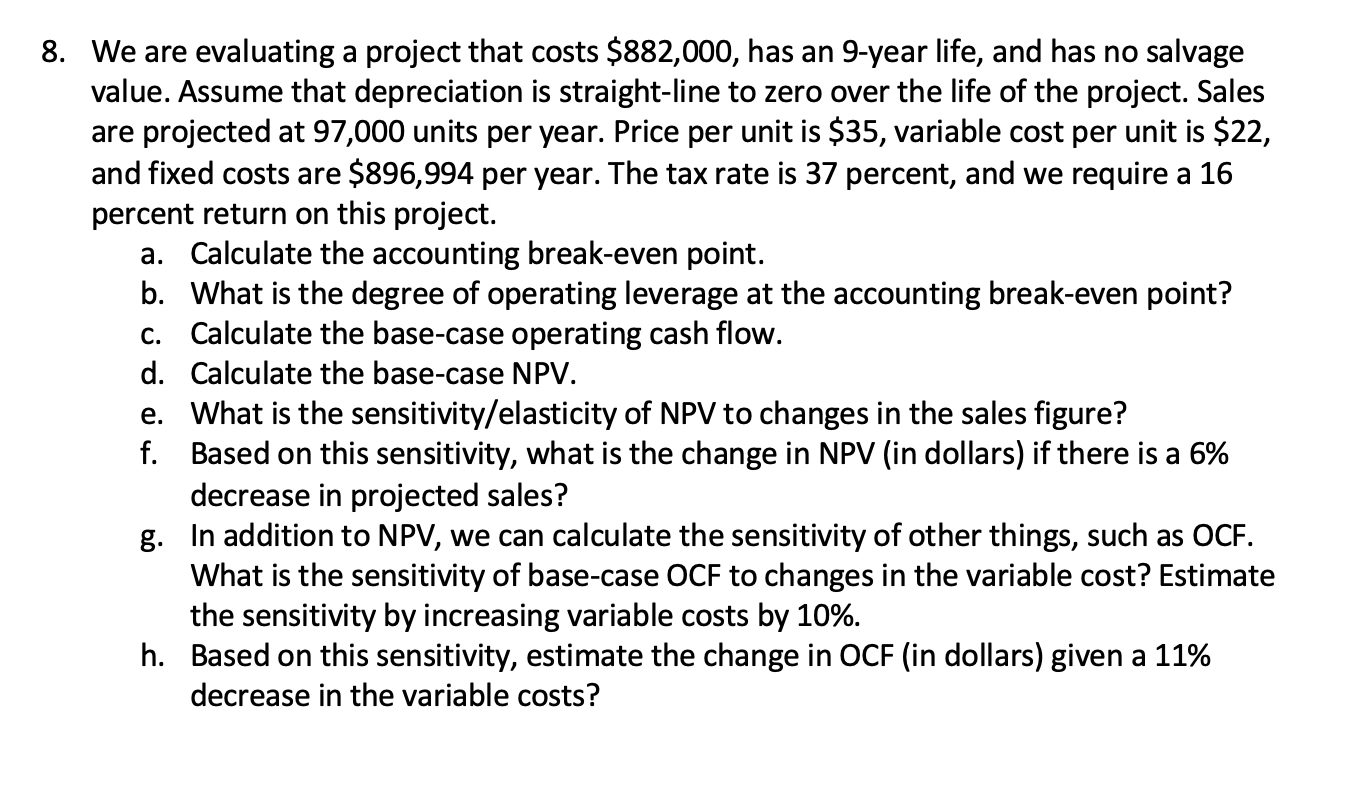

A options: 71,000; 69,000; 76,538; 77,538; and 75,438

B options: 1.209, 1.113, 10.053, 10.153, and 10.253

C options: 108,423; 245,584; 98,423; 265,584; and 285,584

D options: 351,423; 98,423; 341,423; 331,423; and 108,423

E options: 10.719, 37.828, 13.519, 3.98, and 37.628

F options: 219,574; -774; 97,423; -219,574; and -98,423

G options: 949; -25,005; -1,051; -5.06; and 32,977

H options: 77,538; 78,538; 1,056; -944; and 147,886

8. We are evaluating a project that costs $882,000, has an 9-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 97,000 units per year. Price per unit is $35, variable cost per unit is $22, and fixed costs are $896,994 per year. The tax rate is 37 percent, and we require a 16 percent return on this project. a. Calculate the accounting break-even point. b. What is the degree of operating leverage at the accounting break-even point? C. Calculate the base-case operating cash flow. d. Calculate the base-case NPV. e. What is the sensitivity/elasticity of NPV to changes in the sales figure? f. Based on this sensitivity, what is the change in NPV (in dollars) if there is a 6% decrease in projected sales? g. In addition to NPV, we can calculate the sensitivity of other things, such as OCF. What is the sensitivity of base-case OCF to changes in the variable cost? Estimate the sensitivity by increasing variable costs by 10%. h. Based on this sensitivity, estimate the change in OCF (in dollars) given a 11% decrease in the variable costs? 8. We are evaluating a project that costs $882,000, has an 9-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 97,000 units per year. Price per unit is $35, variable cost per unit is $22, and fixed costs are $896,994 per year. The tax rate is 37 percent, and we require a 16 percent return on this project. a. Calculate the accounting break-even point. b. What is the degree of operating leverage at the accounting break-even point? C. Calculate the base-case operating cash flow. d. Calculate the base-case NPV. e. What is the sensitivity/elasticity of NPV to changes in the sales figure? f. Based on this sensitivity, what is the change in NPV (in dollars) if there is a 6% decrease in projected sales? g. In addition to NPV, we can calculate the sensitivity of other things, such as OCF. What is the sensitivity of base-case OCF to changes in the variable cost? Estimate the sensitivity by increasing variable costs by 10%. h. Based on this sensitivity, estimate the change in OCF (in dollars) given a 11% decrease in the variable costsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started