Answered step by step

Verified Expert Solution

Question

1 Approved Answer

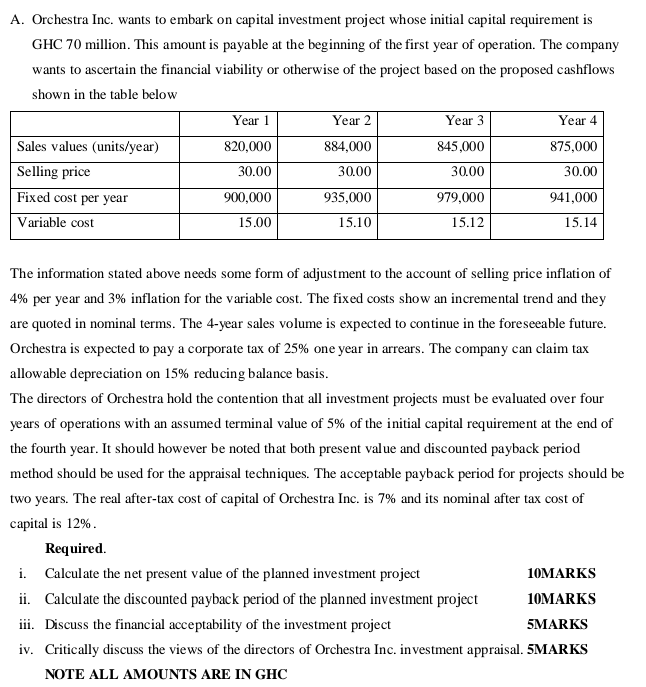

A. Orchestra Inc. wants to embark on capital investment project whose initial capital requirement is GHC 70 million. This amount is payable at the beginning

A. Orchestra Inc. wants to embark on capital investment project whose initial capital requirement is GHC 70 million. This amount is payable at the beginning of the first year of operation. The company wants to ascertain the financial viability or otherwise of the project based on the proposed cashflows shown in the table below Year 1 Year 2 Year 3 Year 4 Sales values (units/year) 820,000 884,000 845,000 875,000 Selling price 30.00 30.00 30.00 30.00 Fixed cost per year 900,000 935,000 979,000 941,000 Variable cost 15.00 15.10 15.12 15.14 The information stated above needs some form of adjustment to the account of selling price inflation of 4% per year and 3% inflation for the variable cost. The fixed costs show an incremental trend and they are quoted in nominal terms. The 4-year sales volume is expected to continue in the foreseeable future. Orchestra is expected to pay a corporate tax of 25% one year in arrears. The company can claim tax allowable depreciation on 15% reducing balance basis. The directors of Orchestra hold the contention that all investment projects must be evaluated over four years of operations with an assumed terminal value of 5% of the initial capital requirement at the end of the fourth year. It should however be noted that both present value and discounted payback period method should be used for the appraisal techniques. The acceptable payback period for projects should be two years. The real after-tax cost of capital of Orchestra Inc. is 7% and its nominal after tax cost of capital is 12%. Required. i. Calculate the net present value of the planned investment project 10MARKS ii. Calculate the discounted payback period of the planned investment project 10MARKS iii. Discuss the financial acceptability of the investment project 5MARKS iv. Critically discuss the views of the directors of Orchestra Inc. investment appraisal. 5MARKS NOTE ALL AMOUNTS ARE IN GHC A. Orchestra Inc. wants to embark on capital investment project whose initial capital requirement is GHC 70 million. This amount is payable at the beginning of the first year of operation. The company wants to ascertain the financial viability or otherwise of the project based on the proposed cashflows shown in the table below Year 1 Year 2 Year 3 Year 4 Sales values (units/year) 820,000 884,000 845,000 875,000 Selling price 30.00 30.00 30.00 30.00 Fixed cost per year 900,000 935,000 979,000 941,000 Variable cost 15.00 15.10 15.12 15.14 The information stated above needs some form of adjustment to the account of selling price inflation of 4% per year and 3% inflation for the variable cost. The fixed costs show an incremental trend and they are quoted in nominal terms. The 4-year sales volume is expected to continue in the foreseeable future. Orchestra is expected to pay a corporate tax of 25% one year in arrears. The company can claim tax allowable depreciation on 15% reducing balance basis. The directors of Orchestra hold the contention that all investment projects must be evaluated over four years of operations with an assumed terminal value of 5% of the initial capital requirement at the end of the fourth year. It should however be noted that both present value and discounted payback period method should be used for the appraisal techniques. The acceptable payback period for projects should be two years. The real after-tax cost of capital of Orchestra Inc. is 7% and its nominal after tax cost of capital is 12%. Required. i. Calculate the net present value of the planned investment project 10MARKS ii. Calculate the discounted payback period of the planned investment project 10MARKS iii. Discuss the financial acceptability of the investment project 5MARKS iv. Critically discuss the views of the directors of Orchestra Inc. investment appraisal. 5MARKS NOTE ALL AMOUNTS ARE IN GHC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started