Question

a). Organization's ability to meet its short-term debt obligation in 2023 (b). Profitability position on revenue earned, capital employed and profit contributed to owners equity

a). Organization's ability to meet its short-term debt obligation in 2023

(b). Profitability position on revenue earned, capital employed and profit contributed to owners equity capital in 2023

(c). Calculate and comment on the lommf's ability to meet its long-term debts and other financial obligations in 2023

(d). Using relevant ratios, indicate what decision would be taken in the following situations:

1) lommi Ltd. wants to buy material of worth Rs. 70,000 on a three-month credit from ABC Supplier.

2) lommi Ltd. offers to sell 70,000 additional shares for Rs.s112 per share to a financial institution

3) lommi Ltd. wants to issue 16% debentures of Rs 3,00,000 with a ten-year maturity.

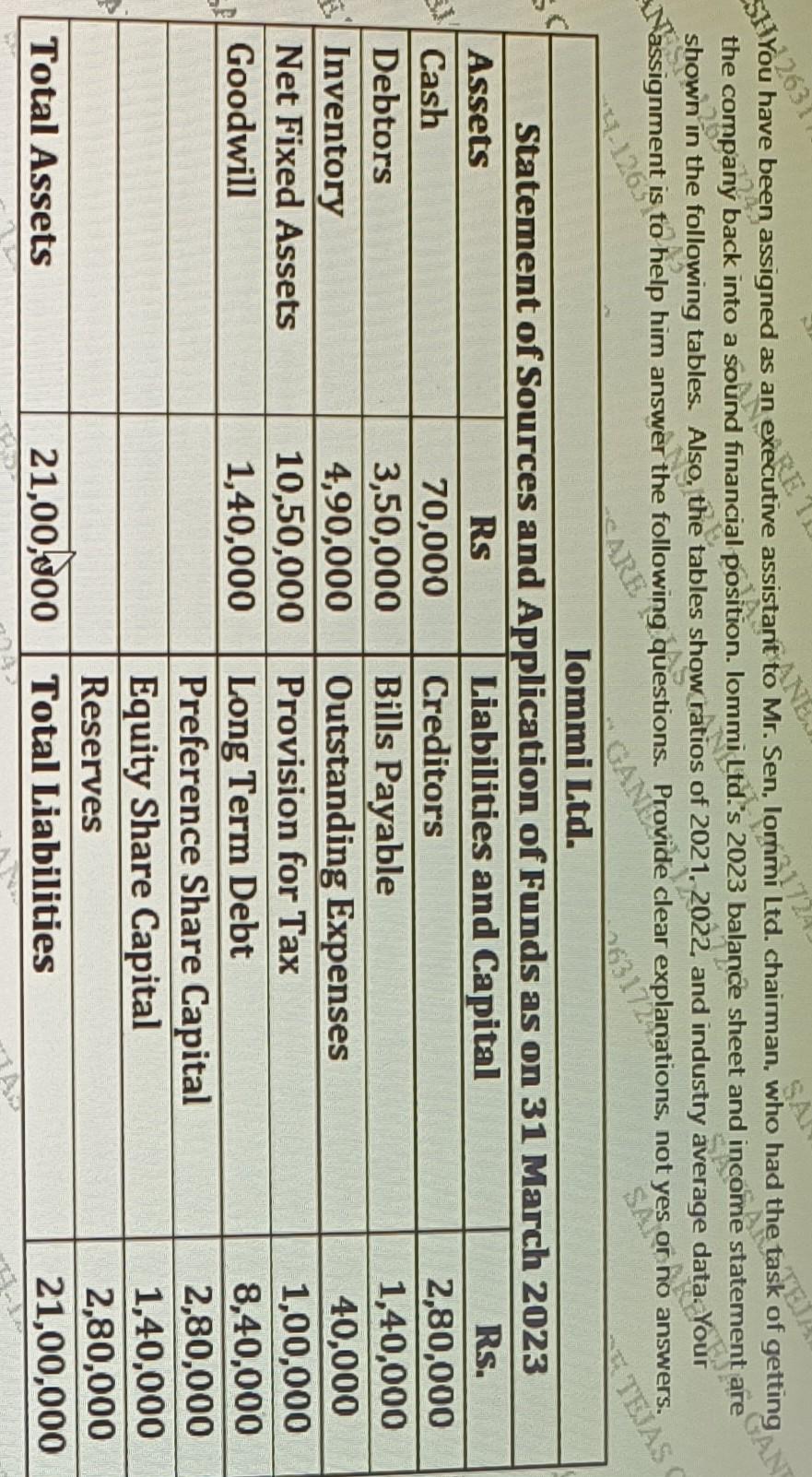

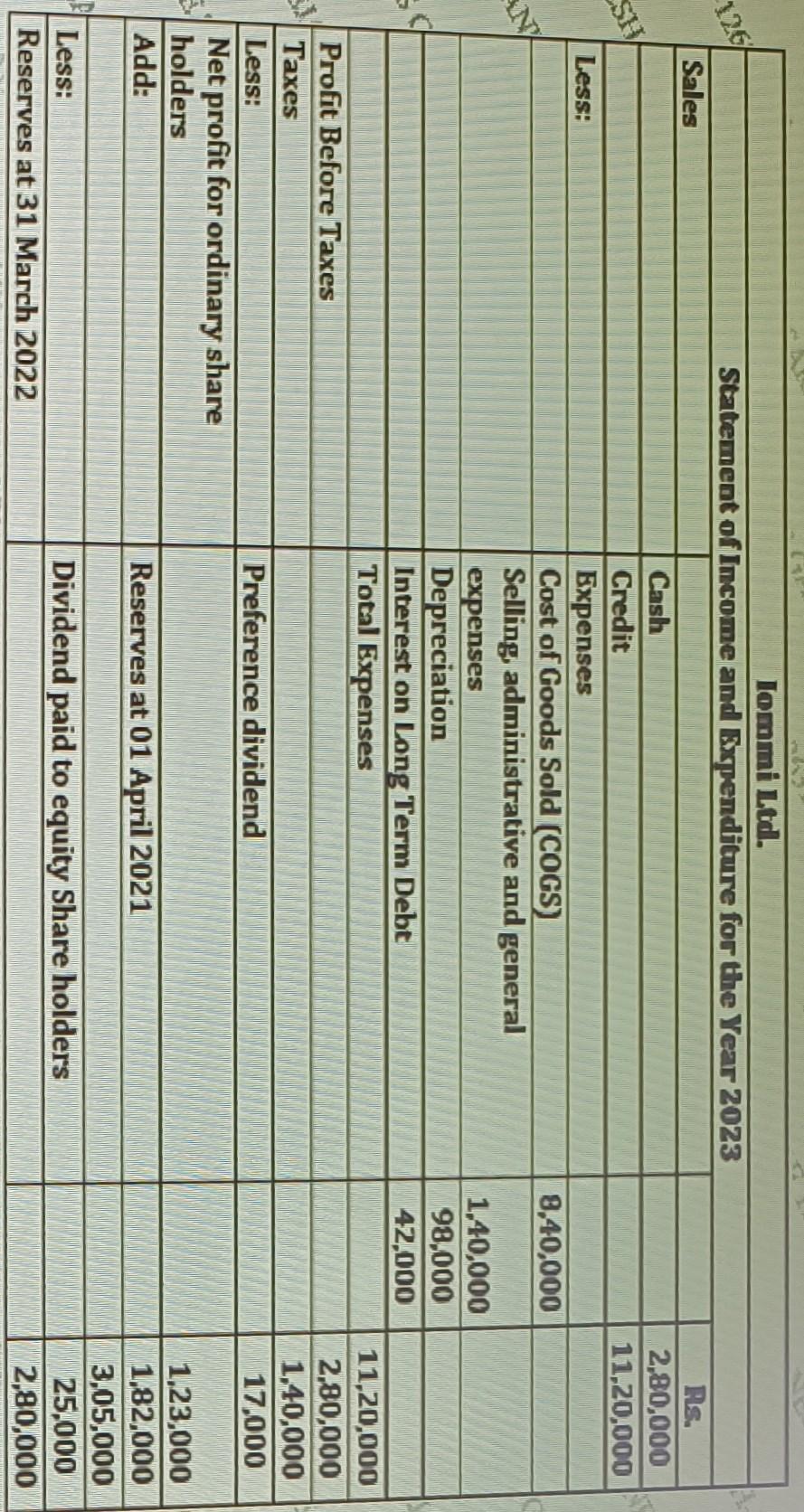

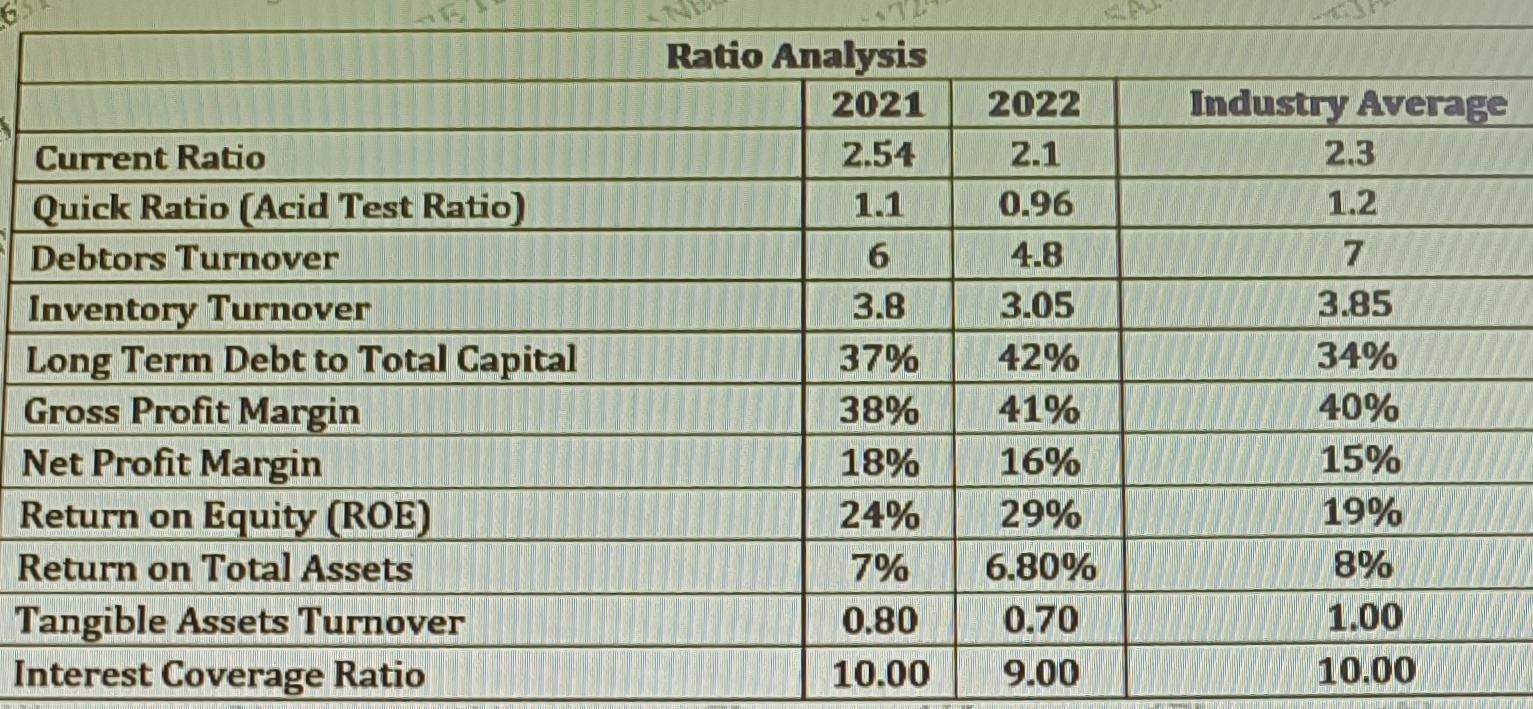

tyou have been assigned as an executive assistant to Mr. Sen, lommi Ltd. chairman, who had the task of getting the company back into a sound financial position. lommi Ltd:s 2023 balance sheet and income statement are shown in the following tables. Also, the tables show ratios of 2021.2022, and industry average data. Your Tassignment is to help him answer the following questions. Provide clear explanations, not yes or no answers. \begin{tabular}{|l|c|c|c|} \hline & Ratio Analysis \\ \hline & 2021 & 2022 & Industry Average \\ \hline Current Ratio & 2.54 & 2.1 & 2.3 \\ \hline Quick Ratio (Acid Test Ratio) & 1.1 & 0.96 & 1.2 \\ \hline Debtors Turnover & 6 & 4.8 & 7 \\ \hline Inventory Turnover & 3.8 & 3.05 & 3.85 \\ \hline Long Term Debt to Total Capital & 37% & 42% & 34% \\ \hline Gross Profit Margin & 38% & 41% & 40% \\ \hline Net Profit Margin & 18% & 16% & 15% \\ \hline Return on Equity (ROE) & 24% & 29% & 19% \\ \hline Return on Total Assets & 7% & 6.80% & 8% \\ \hline Tangible Assets Turnover & 0.80 & 0.70 & 1.00 \\ \hline Interest Coverage Ratio & 10.00 & 9.00 & 10.00 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started