Question

ABC Limited balance sheet shows a total of Rs. 55 million long-term debts with an interest cost of 8.00%. This debt currently has a

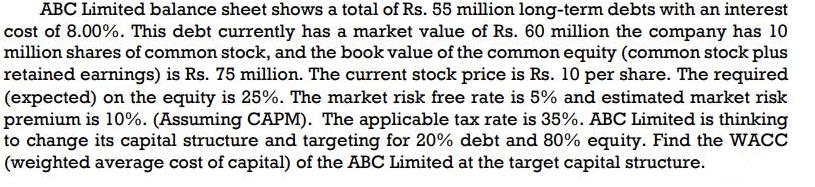

ABC Limited balance sheet shows a total of Rs. 55 million long-term debts with an interest cost of 8.00%. This debt currently has a market value of Rs. 60 million the company has 10 million shares of common stock, and the book value of the common equity (common stock plus retained earnings) is Rs. 75 million. The current stock price is Rs. 10 per share. The required (expected) on the equity is 25%. The market risk free rate is 5% and estimated market risk premium is 10%. (Assuming CAPM). The applicable tax rate is 35%. ABC Limited is thinking to change its capital structure and targeting for 20% debt and 80% equity. Find the WACC (weighted average cost of capital) of the ABC Limited at the target capital structure.

Step by Step Solution

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

WACC 02 x 8 08 x 10 96 Explanation The WACC is the weighted ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Structural Analysis

Authors: Russell C. Hibbeler

8th Edition

132570534, 013257053X, 978-0132570534

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App