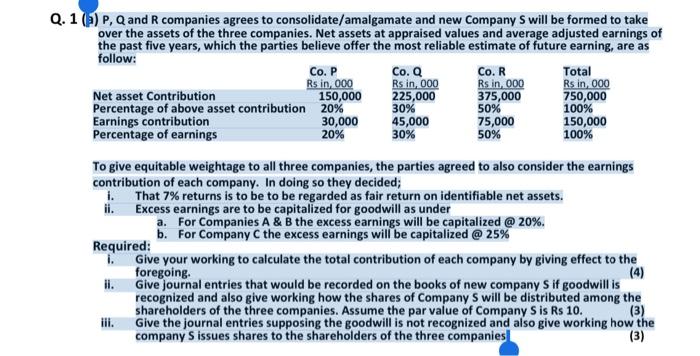

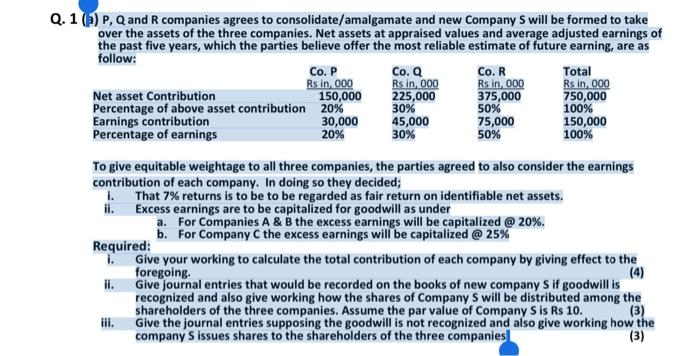

a) P, Q and R companies agrees to consolidate/amalgamate and new Company S will be formed to take over the assets of the three companies. Net assets at appraised values and average adjusted earnings of the past five years, which the parties believe offer the most reliable estimate of future earning, are as follow:

Co. P

Rs in, 000

Net asset Contribution 150,000 Percentage of above asset contribution 20% Earnings contribution 30,000 Percentage of earnings 20%

Co. Q

Rs in, 000

225,000 30% 45,000 30%

Co. R

Rs in, 000

375,000 50% 75,000 50%

Total

Rs in, 000

750,000 100% 150,000 100%

To give equitable weightage to all three companies, the parties agreed

to also consider the earnings

contribution of each company. In doing so they decided;

i. That 7% returns is to be to be regarded as fair return on identifiable net assets.

ii. Excess earnings are to be capitalized for goodwill as under

a. For Companies A & B the excess earnings will be capitalized @ 20%.

b. For Company C the excess earnings will be capitalized @ 25%

Required:

i. Give your working to calculate the total contribution of each company by giving effect to the foregoing. (4)

ii. Give journal entries that would be recorded on the books of new company S if goodwill is recognized and also give working how the shares of Company S will be distributed among the shareholders of the three companies. Assume the par value of Company S is Rs 10. (3)

iii. Give the journal entries supposing the goodwill is not recognized and also give working how the company S issues shares to the shareholders of the three companies.

Q. 1) P, Q and R companies agrees to consolidate/amalgamate and new Company S will be formed to take over the assets of the three companies. Net assets at appraised values and average adjusted earnings of the past five years, which the parties believe offer the most reliable estimate of future earning, are as follow: Co. P Co. Q Co. R Total Rs in, 000 Rs in 000 Rs in, 000 Rs in 000 Net asset Contribution 150,000 225,000 375,000 750,000 Percentage of above asset contribution 20% 30% 50% 100% Earnings contribution 30,000 45,000 75,000 150,000 Percentage of earnings 20% 30% 50% 100% To give equitable weightage to all three companies, the parties agreed to also consider the earnings contribution of each company. In doing so they decided; 1. That 7% returns is to be to be regarded as fair return on identifiable net assets. ii. Excess earnings are to be capitalized for goodwill as under a. For Companies A & B the excess earnings will be capitalized @ 20%. b. For Company C the excess earnings will be capitalized @ 25% Required: i. Give your working to calculate the total contribution of each company by giving effect to the foregoing ii. Give journal entries that would be recorded on the books of new company s if goodwill is recognized and also give working how the shares of Company S will be distributed among the shareholders of the three companies. Assume the par value of Company S is Rs 10. iii. Give the journal entries supposing the goodwill is not recognized and also give working how the company issues shares to the shareholders of the three companies (3) (3) Q. 1) P, Q and R companies agrees to consolidate/amalgamate and new Company S will be formed to take over the assets of the three companies. Net assets at appraised values and average adjusted earnings of the past five years, which the parties believe offer the most reliable estimate of future earning, are as follow: Co. P Co. Q Co. R Total Rs in, 000 Rs in 000 Rs in, 000 Rs in 000 Net asset Contribution 150,000 225,000 375,000 750,000 Percentage of above asset contribution 20% 30% 50% 100% Earnings contribution 30,000 45,000 75,000 150,000 Percentage of earnings 20% 30% 50% 100% To give equitable weightage to all three companies, the parties agreed to also consider the earnings contribution of each company. In doing so they decided; 1. That 7% returns is to be to be regarded as fair return on identifiable net assets. ii. Excess earnings are to be capitalized for goodwill as under a. For Companies A & B the excess earnings will be capitalized @ 20%. b. For Company C the excess earnings will be capitalized @ 25% Required: i. Give your working to calculate the total contribution of each company by giving effect to the foregoing ii. Give journal entries that would be recorded on the books of new company s if goodwill is recognized and also give working how the shares of Company S will be distributed among the shareholders of the three companies. Assume the par value of Company S is Rs 10. iii. Give the journal entries supposing the goodwill is not recognized and also give working how the company issues shares to the shareholders of the three companies (3) (3) Q. 1) P, Q and R companies agrees to consolidate/amalgamate and new Company S will be formed to take over the assets of the three companies. Net assets at appraised values and average adjusted earnings of the past five years, which the parties believe offer the most reliable estimate of future earning, are as follow: Co. P Co. Q Co. R Total Rs in, 000 Rs in 000 Rs in, 000 Rs in 000 Net asset Contribution 150,000 225,000 375,000 750,000 Percentage of above asset contribution 20% 30% 50% 100% Earnings contribution 30,000 45,000 75,000 150,000 Percentage of earnings 20% 30% 50% 100% To give equitable weightage to all three companies, the parties agreed to also consider the earnings contribution of each company. In doing so they decided; 1. That 7% returns is to be to be regarded as fair return on identifiable net assets. ii. Excess earnings are to be capitalized for goodwill as under a. For Companies A & B the excess earnings will be capitalized @ 20%. b. For Company C the excess earnings will be capitalized @ 25% Required: i. Give your working to calculate the total contribution of each company by giving effect to the foregoing ii. Give journal entries that would be recorded on the books of new company s if goodwill is recognized and also give working how the shares of Company S will be distributed among the shareholders of the three companies. Assume the par value of Company S is Rs 10. iii. Give the journal entries supposing the goodwill is not recognized and also give working how the company issues shares to the shareholders of the three companies (3) (3) Q. 1) P, Q and R companies agrees to consolidate/amalgamate and new Company S will be formed to take over the assets of the three companies. Net assets at appraised values and average adjusted earnings of the past five years, which the parties believe offer the most reliable estimate of future earning, are as follow: Co. P Co. Q Co. R Total Rs in, 000 Rs in 000 Rs in, 000 Rs in 000 Net asset Contribution 150,000 225,000 375,000 750,000 Percentage of above asset contribution 20% 30% 50% 100% Earnings contribution 30,000 45,000 75,000 150,000 Percentage of earnings 20% 30% 50% 100% To give equitable weightage to all three companies, the parties agreed to also consider the earnings contribution of each company. In doing so they decided; 1. That 7% returns is to be to be regarded as fair return on identifiable net assets. ii. Excess earnings are to be capitalized for goodwill as under a. For Companies A & B the excess earnings will be capitalized @ 20%. b. For Company C the excess earnings will be capitalized @ 25% Required: i. Give your working to calculate the total contribution of each company by giving effect to the foregoing ii. Give journal entries that would be recorded on the books of new company s if goodwill is recognized and also give working how the shares of Company S will be distributed among the shareholders of the three companies. Assume the par value of Company S is Rs 10. iii. Give the journal entries supposing the goodwill is not recognized and also give working how the company issues shares to the shareholders of the three companies (3) (3)