Answered step by step

Verified Expert Solution

Question

1 Approved Answer

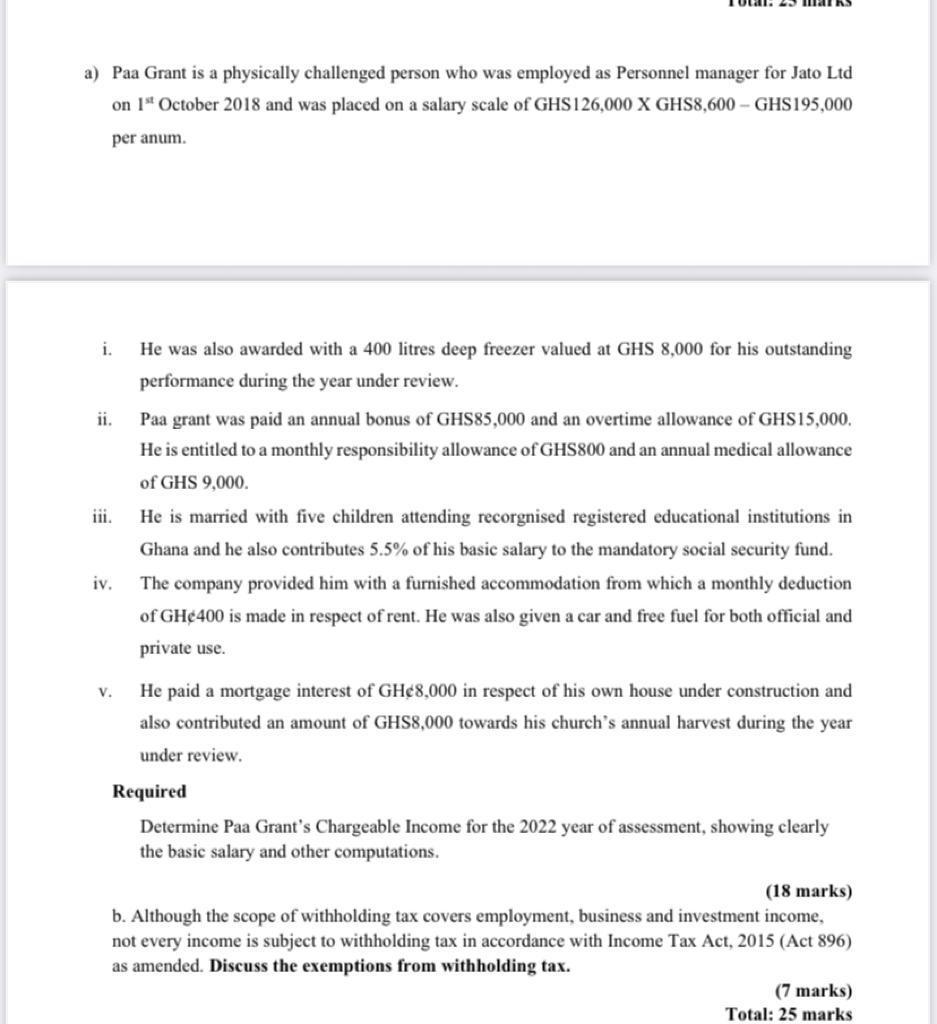

a) Paa Grant is a physically challenged person who was employed as Personnel manager for Jato Ltd on 1st October 2018 and was placed

a) Paa Grant is a physically challenged person who was employed as Personnel manager for Jato Ltd on 1st October 2018 and was placed on a salary scale of GHS126,000 X GHS8,600 - GHS195,000 per anum. i. ii. iii. iv. He was also awarded with a 400 litres deep freezer valued at GHS 8,000 for his outstanding performance during the year under review. V. Paa grant was paid an annual bonus of GHS85,000 and an overtime allowance of GHS15,000. He is entitled to a monthly responsibility allowance of GHS800 and an annual medical allowance of GHS 9,000. He is married with five children attending recorgnised registered educational institutions in Ghana and he also contributes 5.5% of his basic salary to the mandatory social security fund. The company provided him with a furnished accommodation from which a monthly deduction of GHe 400 is made in respect of rent. He was also given a car and free fuel for both official and private use. He paid a mortgage interest of GHe8,000 in respect of his own house under construction and also contributed an amount of GHS8,000 towards his church's annual harvest during the year under review. Required Determine Paa Grant's Chargeable Income for the 2022 year of assessment, showing clearly the basic salary and other computations. (18 marks) b. Although the scope of withholding tax covers employment, business and investment income, not every income is subject to withholding tax in accordance with Income Tax Act, 2015 (Act 896) as amended. Discuss the exemptions from withholding tax. (7 marks) Total: 25 marks

Step by Step Solution

★★★★★

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Paa Grants Chargeable Income for the 2022 year of assessment Basic Salary GHS126000 Bonus GHS85000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started