Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Natick Industries leased high-tech instruments from Framingham Leasing on January 1, 2021. Natick has the option to renew the lease at the end of

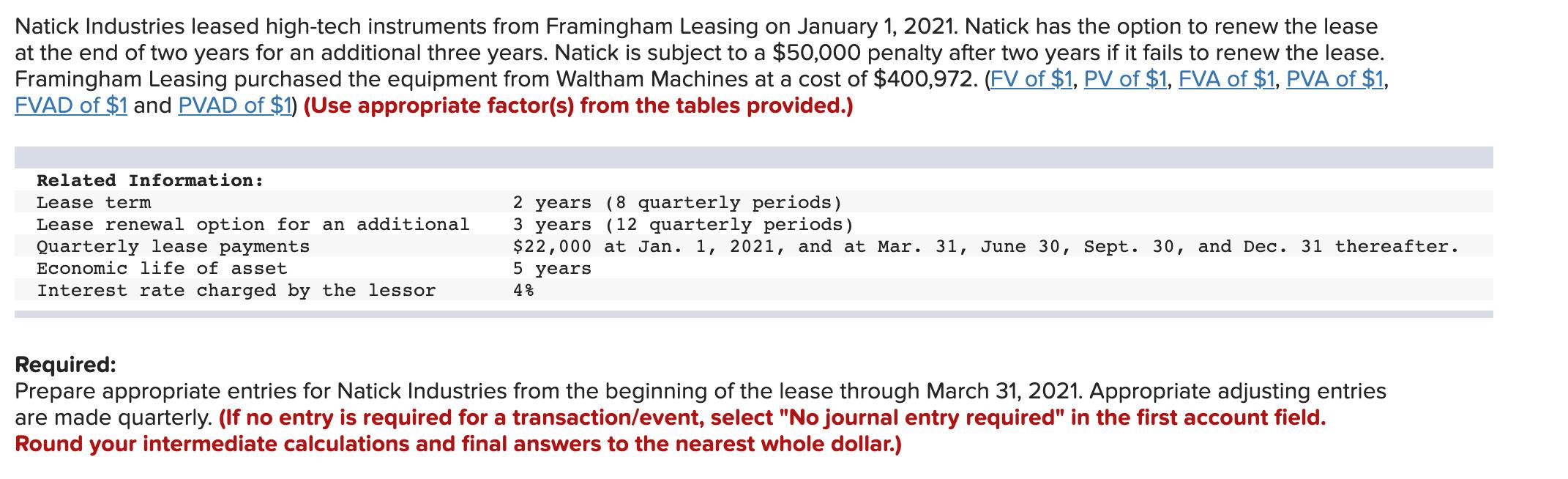

Natick Industries leased high-tech instruments from Framingham Leasing on January 1, 2021. Natick has the option to renew the lease at the end of two years for an additional three years. Natick is subject to a $50,000 penalty after two years if it fails to renew the lease. Framingham Leasing purchased the equipment from Waltham Machines at a cost of $400,972. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Related Information: Lease term Lease renewal option for an additional Quarterly lease payments Economic life of asset Interest rate charged by the lessor 2 years (8 quarterly periods) 3 years (12 quarterly periods) $22,000 at Jan. 1, 2021, and at Mar. 31, June 30, Sept. 30, and Dec. 31 thereafter. 5 years 4% Required: Prepare appropriate entries for Natick Industries from the beginning of the lease through March 31, 2021. Appropriate adjusting entries are made quarterly. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate calculations and final answers to the nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 January 1 2021 Lease Commencement Natick Industries leases the hightech instr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started