Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A parcel of land currently generates a return of $55.00 per acre and the return is expected to maintain it's purchasing power (on average)

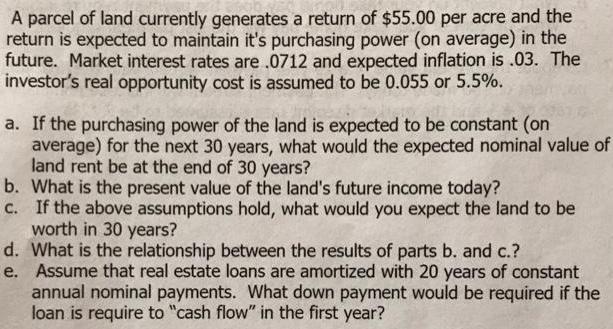

A parcel of land currently generates a return of $55.00 per acre and the return is expected to maintain it's purchasing power (on average) in the future. Market interest rates are .0712 and expected inflation is .03. The investor's real opportunity cost is assumed to be 0.055 or 5.5%. a. If the purchasing power of the land is expected to be constant (on average) for the next 30 years, what would the expected nominal value of land rent be at the end of 30 years? b. What is the present value of the land's future income today? c. If the above assumptions hold, what would you expect the land to be worth in 30 years? d. What is the relationship between the results of parts b. and c.? e. Assume that real estate loans are amortized with 20 years of constant annual nominal payments. What down payment would be required if the loan is require to "cash flow" in the first year?

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started