Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How might your decision be affected if, rather than buying one stock for $0.8 million, you could construct a portfolio consisting of 100 stocks

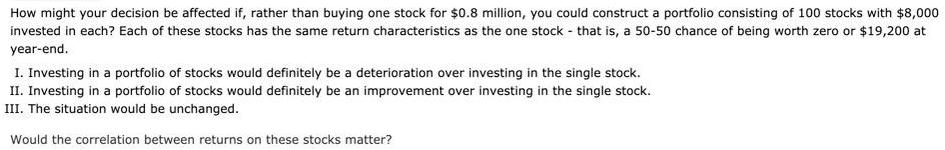

How might your decision be affected if, rather than buying one stock for $0.8 million, you could construct a portfolio consisting of 100 stocks with $8,000 invested in each? Each of these stocks has the same return characteristics as the one stock - that is, a 50-50 chance of being worth zero or $19,200 at year-end. I. Investing in a portfolio of stocks would definitely be a deterioration over investing in the single stock. II. Investing in a portfolio of stocks would definitely be an improvement over investing in the single stock. III. The situation would be unchanged. Would the correlation between returns on these stocks matter?

Step by Step Solution

★★★★★

3.37 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Portfolio Investment in more than one security is called as Portfolio Portfolio Ret Portfolio Return ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started