Answered step by step

Verified Expert Solution

Question

1 Approved Answer

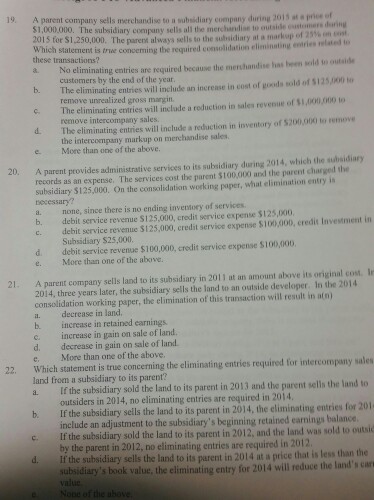

A parent company sells merchandise to a subsidiary company during 2015 at a price of $1,000,000. The subsidiary company sells all the merchandise to outside

A parent company sells merchandise to a subsidiary company during 2015 at a price of $1,000,000. The subsidiary company sells all the merchandise to outside during 2015 for $1, 250,000. The parent always sells to the at a markup of 25% on cost. Which statement is true concerning the required consolidation eliminating entries related to these transactions? No eliminating entries are required because the has been sold to outside customers by the end of the year. The eliminating entries will include an increase in cost of goods sold of $125,000 to remove unrealized gross margin. The eliminating entries will include a reduce in sales revenue of $1,000,000 to remove intercompany sales. The eliminating entries will include a reduction in inventory $200,000 to remove the intercompany markup on merchandise sales. More than one of the above. A parent provides administrative services to its subsidiary during 2014, which the subsidiary records as an expense. The services cost the parent $100,000 and the parent charged the subsidiary $125,000. On the consolidation working paper, what elimination entry is necessary? none, since there is no ending inventory of services debit service revenue $125,000, credit service expense $125,000. debit service revenue $125,000, credit service expense $100,000, credit Investment in Subsidiary $25,000. debit service revenue $100,000, credit service expense $100,000. More than one of the above. A parent company sells land to its subsidiary in 2011 at an amount above its original cost. 2014, three years later, the subsidiary sells the land to an outside developer. In the 2014 consolidation working paper, the elimination of this transaction will result in a(n) decrease in land increase in retained earnings increase in gain on sale of land. decrease in gain on sale of land. More than one of the above. Which statement is true concerning the eliminating entries required for intercompany sales land from a subsidiary to its parent? If the subsidiary sold the land to its parent in 2013 and the parent sells the land to outsides in 2014, no eliminating entries are required in 2014. If the subsidiary sells the land to its parent in 2014, the eliminating entries for 2014 include an adjustment to the subsidiary's beginning related earnings balance. If the subsidiary sold the land parent in 2012, and the land was sold by the parent in 2012, no eliminating entries are required in 2012. If the subsidiary sells the land to its parent in 2014 at a price that is less than the subsidiary's book value, the eliminating entry for 2014 will reduce the land's car value. None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started