Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A parent with adequate personal insurance coverage and sound retirement planning already in operation would like to make an exchange of his daughter's $ 2

A parent with adequate personal insurance coverage and sound retirement planning already in operation would like to make an exchange of his daughter's $ whole life policy that has been maintained for years. This individual wants to retain ownership of some coverage on his daughter's life. The parent has a moderate investment risk profile. This individual wants to double the policy's death benefit right away and can certainly afford the associated increase in premium. This individual also wants to invest in an account that has the potential to achieve financial returns above those that are now being offered for fixedinterest accounts. Taking advantage of the benefits of Section you recommend he considers

A a graded premium whole life policy

B a universal life policy with an Option A death benefit

C a variable universal life policy with a guaranteed death benefit rider

D a year term policy

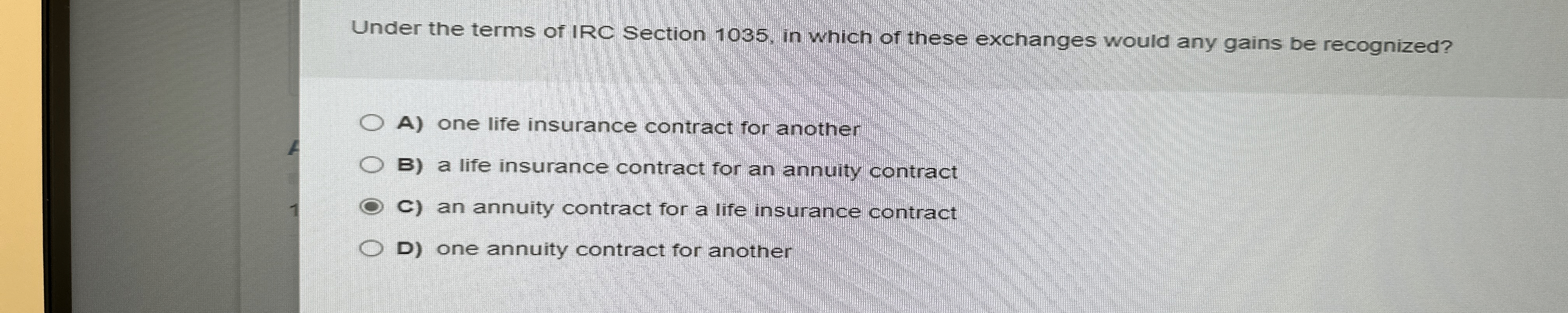

Under the terms of IRC Section in which of these exchanges would any gains be recognized?

A one life insurance contract for another

B a life insurance contract for an annuity contract

C an annuity contract for a life insurance contract

D one annuity contract for another

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started