Answered step by step

Verified Expert Solution

Question

1 Approved Answer

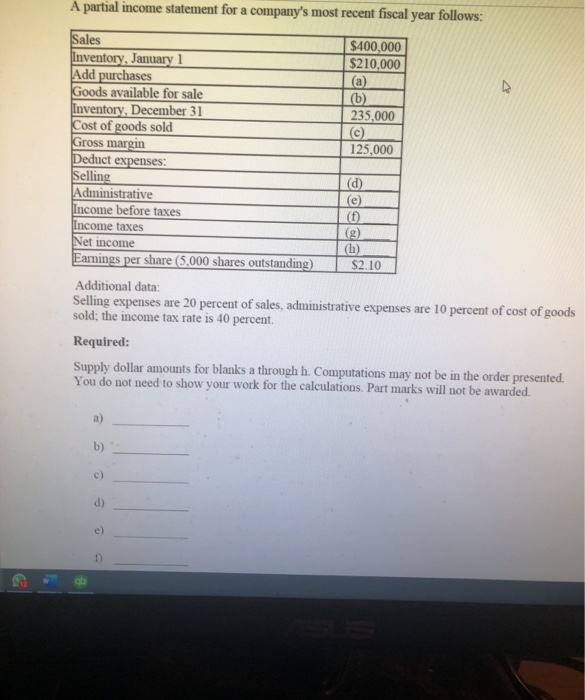

A partial income statement for a company's most recent fiscal year follows: Sales Inventory, January 1 Add purchases Goods available for sale Inventory, December

A partial income statement for a company's most recent fiscal year follows: Sales Inventory, January 1 Add purchases Goods available for sale Inventory, December 31 Cost of goods sold Gross margin Deduct expenses: Selling Administrative Income before taxes Income taxes $400,000 $210,000 (a) (b) 235,000 (c) 125,000 (d) (e) (f) (g) (h) $2.10 Net income Earnings per share (5,000 shares outstanding) Additional data: Selling expenses are 20 percent of sales, administrative expenses are 10 percent of cost of goods sold; the income tax rate is 40 percent. Required: Supply dollar amounts for blanks a through h. Computations may not be in the order presented. You do not need to show your work for the calculations. Part marks will not be awarded. a) b) c) d) e) 1)

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Net Income EPS No Of shares outstnading Net Income 210 5000 10500 Incom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started