Question

A partially completed pension spreadsheet showing the relationships among the elements that comprise the defined benefit pension plan of Universal Products is given below. The

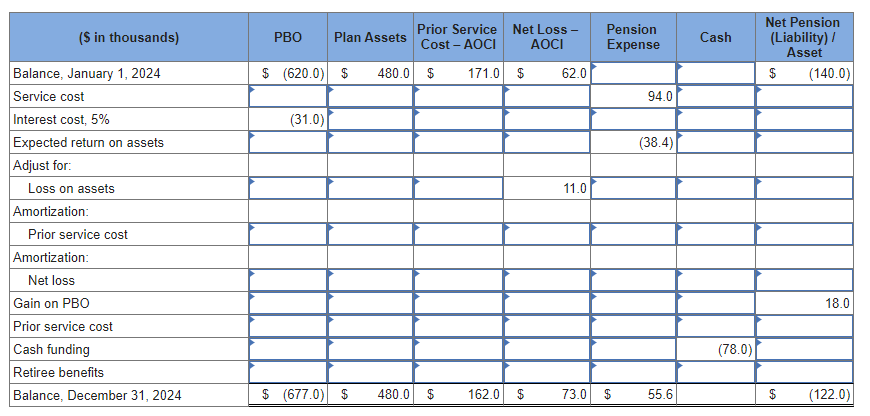

A partially completed pension spreadsheet showing the relationships among the elements that comprise the defined benefit pension plan of Universal Products is given below. The actuary's discount rate is 5%. At the end of 2022, the pension formula was amended, creating a prior service cost of $180,000. The expected rate of return on assets was 8%, and the average remaining service life of the active employee group is 20 years in the current year, as well as, the previous two years.

Required:

Fill in the missing amounts.

Note: Enter your answers in thousands (i.e., 5,500 should be entered as 5.5). Enter credit amounts with a minus sign.

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{|l|} (S in thousands) \\ Balance, January 1,2024 \\ \end{tabular}} & \multicolumn{2}{|r|}{ PBO } & \multicolumn{2}{|c|}{ Plan Assets } & \multicolumn{2}{|c|}{PriorServiceCost-AOCl} & \multicolumn{2}{|c|}{NetLoss-AOCI} & \multirow[t]{2}{*}{PensionExpense} & \multirow[t]{2}{*}{ Cash } & \multicolumn{2}{|c|}{NetPension(Liability)/Asset} \\ \hline & $ & (620.0) & $ & 480.0 & $ & 171.0 & $ & 62.0 & & & $ & (140.0) \\ \hline Service cost & & & & & & & & & 94.0 & & & \\ \hline Interest cost, 5% & & (31.0) & & & & & & & & & & \\ \hline Expected return on assets & & & & & & & & & (38.4) & & & \\ \hline \multicolumn{13}{|l|}{ Adjust for: } \\ \hline Loss on assets & & & & & & & & 11.0 & & & & \\ \hline \multicolumn{13}{|l|}{ Amortization: } \\ \hline \multicolumn{13}{|l|}{ Prior service cost } \\ \hline \multicolumn{13}{|l|}{ Amortization: } \\ \hline \multicolumn{13}{|l|}{ Net loss } \\ \hline Gain on PBO & & & & & & & & & & & & 18.0 \\ \hline \multicolumn{13}{|l|}{ Prior service cost } \\ \hline Cash funding & & & & & & & & & & (78.0) & & \\ \hline \multicolumn{13}{|l|}{ Retiree benefits } \\ \hline Balance, December 31, 2024 & $ & (677.0) & $ & 480.0 & $ & 162.0 & $ & 73.0 & 55.6 & & $ & (122.0) \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{|l|} (S in thousands) \\ Balance, January 1,2024 \\ \end{tabular}} & \multicolumn{2}{|r|}{ PBO } & \multicolumn{2}{|c|}{ Plan Assets } & \multicolumn{2}{|c|}{PriorServiceCost-AOCl} & \multicolumn{2}{|c|}{NetLoss-AOCI} & \multirow[t]{2}{*}{PensionExpense} & \multirow[t]{2}{*}{ Cash } & \multicolumn{2}{|c|}{NetPension(Liability)/Asset} \\ \hline & $ & (620.0) & $ & 480.0 & $ & 171.0 & $ & 62.0 & & & $ & (140.0) \\ \hline Service cost & & & & & & & & & 94.0 & & & \\ \hline Interest cost, 5% & & (31.0) & & & & & & & & & & \\ \hline Expected return on assets & & & & & & & & & (38.4) & & & \\ \hline \multicolumn{13}{|l|}{ Adjust for: } \\ \hline Loss on assets & & & & & & & & 11.0 & & & & \\ \hline \multicolumn{13}{|l|}{ Amortization: } \\ \hline \multicolumn{13}{|l|}{ Prior service cost } \\ \hline \multicolumn{13}{|l|}{ Amortization: } \\ \hline \multicolumn{13}{|l|}{ Net loss } \\ \hline Gain on PBO & & & & & & & & & & & & 18.0 \\ \hline \multicolumn{13}{|l|}{ Prior service cost } \\ \hline Cash funding & & & & & & & & & & (78.0) & & \\ \hline \multicolumn{13}{|l|}{ Retiree benefits } \\ \hline Balance, December 31, 2024 & $ & (677.0) & $ & 480.0 & $ & 162.0 & $ & 73.0 & 55.6 & & $ & (122.0) \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started