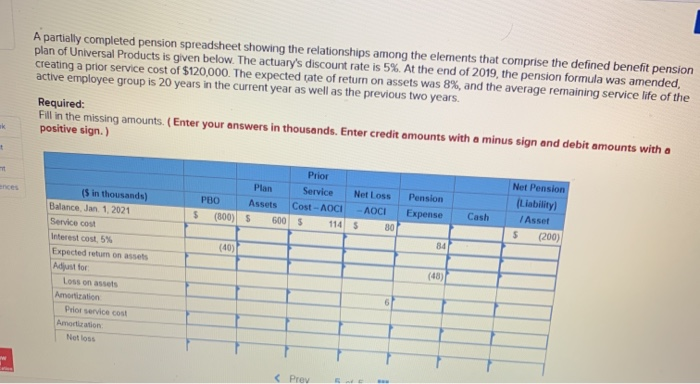

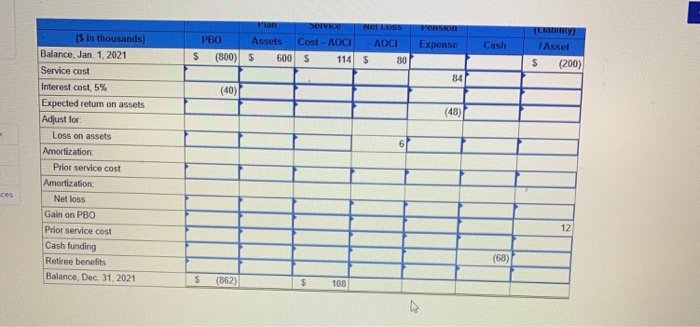

A partially completed pension spreadsheet showing the relationships among the elements that comprise the defined benefit pension plan of Universal Products is given below. The actuary's discount rate is 5%. At the end of 2019, the pension formula was amended, creating a prior service cost of $120,000. The expected rate of return on assets was 8%, and the average remaining service life of the active employee group is 20 years in the current year as well as the previous two years. Required: Fill in the missing amounts. (Enter your answers in thousands. Enter credit amounts with a minus sign and debit amounts with a positive sign.) Prior Plan Service Net Loss PBO Assets Cost - AOCIAOCI 300) S6005 114 5 80 Pension Expense Net Pension (Liability Asset Cash 5 2001 (5 in thousands) Balance, Jan 1, 2021 Sento cost Interest cost 5% Expected return on assets Aust for (40) Losons Amortization Prior service cost Amontiration Net PY Ly an DIVIDENELOSS Assets Cost - AOCIAOCI $ 600 S 114 Son Expense Cash PBO $ (800) TAsset (200) (40)| (5 in thousands Balance, Jan 1, 2021 Service cost Interest cost, 5% Expected return on assets Adjust for Loss on assets Amortization Prior service cost Amortization Net loss Gain on PBO Prior service cost Cash funding Retiree benefits Balance, Dec 31, 2021 (6 A partially completed pension spreadsheet showing the relationships among the elements that comprise the defined benefit pension plan of Universal Products is given below. The actuary's discount rate is 5%. At the end of 2019, the pension formula was amended, creating a prior service cost of $120,000. The expected rate of return on assets was 8%, and the average remaining service life of the active employee group is 20 years in the current year as well as the previous two years. Required: Fill in the missing amounts. (Enter your answers in thousands. Enter credit amounts with a minus sign and debit amounts with a positive sign.) Prior Plan Service Net Loss PBO Assets Cost - AOCIAOCI 300) S6005 114 5 80 Pension Expense Net Pension (Liability Asset Cash 5 2001 (5 in thousands) Balance, Jan 1, 2021 Sento cost Interest cost 5% Expected return on assets Aust for (40) Losons Amortization Prior service cost Amontiration Net PY Ly an DIVIDENELOSS Assets Cost - AOCIAOCI $ 600 S 114 Son Expense Cash PBO $ (800) TAsset (200) (40)| (5 in thousands Balance, Jan 1, 2021 Service cost Interest cost, 5% Expected return on assets Adjust for Loss on assets Amortization Prior service cost Amortization Net loss Gain on PBO Prior service cost Cash funding Retiree benefits Balance, Dec 31, 2021 (6