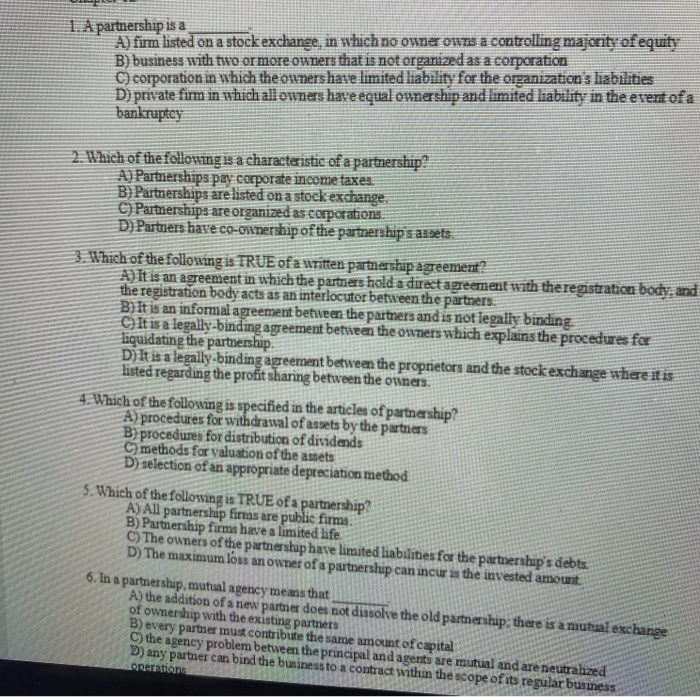

A partnership is a A) firm listed on a stock exchange, in which no owner owns a controlling majority of equity B) business with two or more owners that is not organized as a corporation C) corporation in which the owners have limited liability for the organizations liabilities D) private firm in which all owners have equal ownership and limited liability in the event of a bankruptcy 2. Which of the following is a characteristic of a partnership? A) Partnerships pay corporate income taxes. B) Partnerships are listed on a stock exchange C) Partnerships are organized as corporations D) Partners have co-ownership of the partnerships assets. 3. Which of the following is TRUE of a written partnership agreement? A) It is an agreement in which the partners hold a direct agreement with the registration body, and the registration body acts as an interlocutor between the partners B) It is an informal agreement between the partners and is not legally binding. C) It is a legally binding agreement between the owners which explains the procedures for liquidating the partnership D) It is a legally binding agreement between the proprietors and the stock exchange where it is listed regarding the profit sharing between the owners. 4. Which of the following is specified in the articles of partnership? A) procedures for withdrawal of assets by the partners B) procedures for distribution of dividends C) methods for valuation of the assets D) selection of an appropriate depreciation method 5. Which of the following is TRUE of a partnership A) All partnershp firms are public firms. B) Partnership firms have a limited life. C) The owners of the partnership have limited liabilities for the partnership's debts. D) The maximum loss an owner of a partnership can incur is the invested amount 6. In a partnership, mutual agency means that A) the addition of a new partner does not dissolve the old partnership, there is a mutual exchange of ownership with the existing partners B) every partner must contribute the same amount of capital C) the agency problem between the principal and agents are mutual and are neutralized D) any partner can bind the business to a contract within the scope of its regular business eneration