Question

A Partnership with Unlimited Possibilities: A Case of Allocation of Partnership Income You are a recent honors graduate in Accounting and both your family and

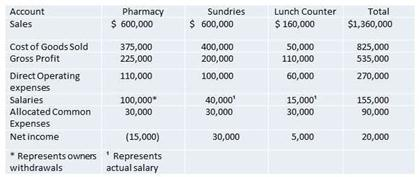

A Partnership with Unlimited Possibilities: A Case of Allocation of Partnership Income You are a recent honors graduate in Accounting and both your family and your alma mater are very proud of you. You have gone to work for the accounting firm of Pickem, Tracem, and Countem CPA, P.C., a prestigious accounting firm with a national reputation. After training, you were sent out on your first accounting assignment. The client is in the small southern town of City Point, USA. City Point was a major river port established before the American Revolution but has now evolved into a sleepy rural town resembling TVs Mayberry. There are two eateries appropriate for lunch: the lunch counter at the Grays Drug Store and the hot dog eatery called Rays Quick Lunch. You select the lunch counter at Grays Drug Store for your midday repast. You watch in awe as the sole food service engineer behind the counter efficiently prepares each entre and serves each customer. You notice that, without calling ahead, some sandwiches are prepared and placed on the table only seconds before the regular customer enters and sits down. Finally, you are taken aback when the sole employee of the eatery portion of the establishment begins to lecture you to order more salads and eat more healthy foods. At the beginning of the second week of the job, you go and sit down at the lunch counter and prepare to order. As you sit down, the sole worker places a healthy fruit-plate before you and says, Eat it. She then sits down with you and introduces herself as Nancy Blue. She also asks you for your expert accounting advice. She explains, I have been working here for the past forty years. I make around $50,000 a year in tips and salary and need to start planning for my future. Old Mr. Gray operates this business as a sole proprietorship. His son, Bubba Gray, is ready to take over. Bubba is a good ol boy but he does not know much about business. He also just got his pharmacy degree and license. I trust Old Mr. Gray to never make a mistake dispensing prescriptions but I am less sure about Bubba Gray. I remember him working here as a boy. He always made himself super ice-cream Sundays without paying. He is also not as careful as Old Mr. Gray. Old Mr. Gray has offered to let Mary Yellow and me buy in as partners. We will continue to run the business as a partnership with Bubba Gray, Mary Yellow and me as the three general partners. That will allow him to sell the pharmacy to Bubba. Mary is now in charge of selling Sundries while Bubba Gray will be the pharmacist. They will continue to operate those departments under the new arrangement. I, of course, will keep the lunch counter. Each of us will run our own department without any help. By letting us become partners, we can share the profits and help with the management of the business. Here is the income statement for last year (Table 1). The salary for the pharmacist is actually Old Mr. Grays withdrawals. Bubba will be able to withdraw the same amount. The other two salaries are Mary and my salaries. If we become partners, our salaries will become our withdrawals. The buy-in price is $50,000. I dont know anything about accounting and need your help and advice. I have three concerns. First, what risks and benefits do I get by being a partner? As an employee, there is little risk to me as a server, no one is ever unhappy with the foods I prepare and I have been doing it for forty years without any bad incidents. No one would ever sue the lunch counter or the sundries department for malpractice. But, there is a large risk if Mr. Gray fills a prescription wrong and hurts a customer. The store has to pay a large malpractice insurance premium to cover that contingency. What are the business risks I am assuming by becoming a partner? Second, the formula for allocating partnership income is complicated (Appendix A). Is the formula fair to Mary and to me? If the income stays the same as last year, how much I would make as a partner as opposed to being an employee? Finally, the $90,000 in common-costs is mostly for the pharmacy. There are basically only three items that make up the common-costs: malpractice insurance costing $60,000 a year, advertising for $25,000 and utilities of $2,000. The malpractice insurance costs sixty-thousand $60,000); all but $4,000 is for the pharmacy. The $4,000 for insurance for the sundries and lunch counter should be split evenly. There is about $25,000 in advertising. The pharmacy and lunch counter dont get any benefit from the advertising. I believe that all of the advertising benefits the sundries department. Utilities are about $2,000 a year. The lunch counter uses half of that and the other two departments use the remainder evenly. The remaining $3,000 in common costs are for taxes and similar expenses. Half of that should go to the pharmacy with the remainder going to sundries and the lunch counter. That is how I think the common costs should be allocated while Old Mr. Gray things the entire common costs should be split evenly. I think Old Mr. Grays method hurts Mary and me. Here is a box containing six jars of my famous berry jam. You can keep the jam if you answer my questions. After going back to work, you tell the story to your boss, the chief accountant. Your boss explains that Ms. Blues berry jam is the best jam ever made. She wants you to answer Nancys questions and the boss then takes five jars. She says that you should do the work outside of your normal business hours and that you can keep the remaining jar of Nancy Blues berry jam.. The section of the partnership agreement covering allocation of partnership income and losses is in Appendix A and last years financial statement is included in Table 1. You resolve to explain the situation and, in the future, to eat at Rays Quick Lunch where the most difficult accounting issue normally discussed is how much a 20% tip would be on a ten-dollar lunch. Question: 1. Describe three specific business risks associated with the proposed partnership? Income Statement

| Appendix 1: | The proposed income and loss sharing agreement is as follows: |

| a. | A salary allowance of $100,000 will be allocated to Bubba Gray, $40,000 to Mary. Yellow and $15,000 to Nancy Blue. |

| b. | Each partner will get 50% of the income or loss for his / her department without consideration of the allocation from part a above. The formula for each department is: ((gross profit less the sum of direct operating expenses and allocated common expenses) * 50%). |

| c. | All remaining profits or losses will be allocated to the partners evenly. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started