Question: A passive long only Equity portfolio Manager with asset under management (AUM) of $ 1.5 Billion has the following investments: Index Dow Jones S&P

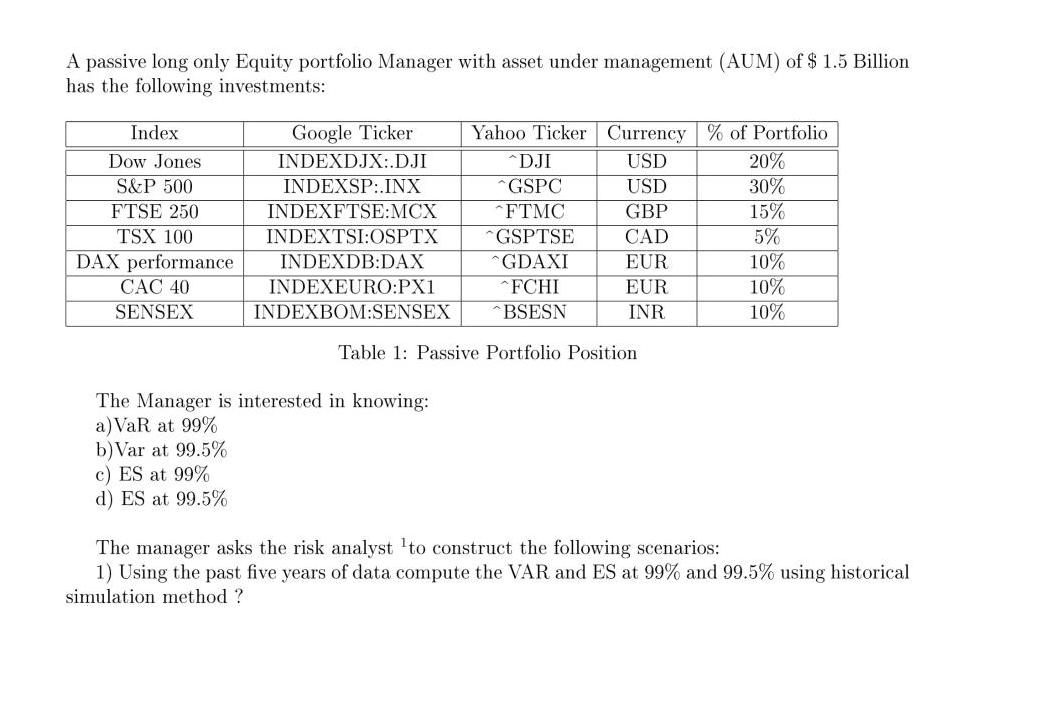

A passive long only Equity portfolio Manager with asset under management (AUM) of $ 1.5 Billion has the following investments: Index Dow Jones S&P 500 FTSE 250 TSX 100 DAX performance CAC 40 SENSEX Google Ticker INDEXDJX:.DJI INDEXSP:.INX INDEXFTSE:MCX INDEXTSI:OSPTX INDEXDB:DAX INDEXEURO:PX1 INDEXBOM:SENSEX c) ES at 99% d) ES at 99.5% The Manager is interested in knowing: a) VaR at 99% b) Var at 99.5% Yahoo Ticker Currency % of Portfolio USD USD GBP CAD EUR EUR INR ^DJI ^GSPC FTMC GSPTSE GDAXI ^FCHI ^BSESN Table 1: Passive Portfolio Position 20% 30% 15% 5% 10% 10% 10% The manager asks the risk analyst to construct the following scenarios: 1) Using the past five years of data compute the VAR and ES at 99% and 99.5% using historical simulation method ?

Step by Step Solution

3.35 Rating (158 Votes )

There are 3 Steps involved in it

a VaR at 99 The ValueatRisk VaR is a risk measure used to gauge the maximum potential loss of an investment portfolio over a specified time frame and probability level VaR at 99 is the maximum loss in ... View full answer

Get step-by-step solutions from verified subject matter experts