Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A paving company is buying 2 pavement recycling machines for 400k each with a service life of 7 years. They are estimating that there are

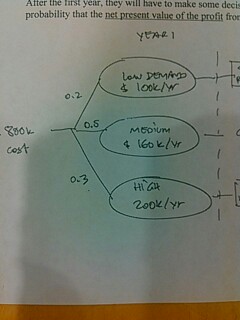

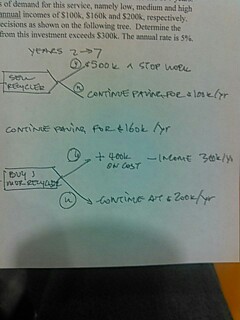

A paving company is buying 2 pavement recycling machines for 400k each with a service life of 7 years. They are estimating that there are 3 possible levels of demand for this service,namely low, medium and high with the probabilities of .2, .5 and .3, resulting in annual incomes of 100k, 160k and 200k respectively. After the first year, they will have to make some decisions as shown on the following tree. Determine the probability that the net present value of the profit from this investment exceeds 300k. The annual rate is 5%.

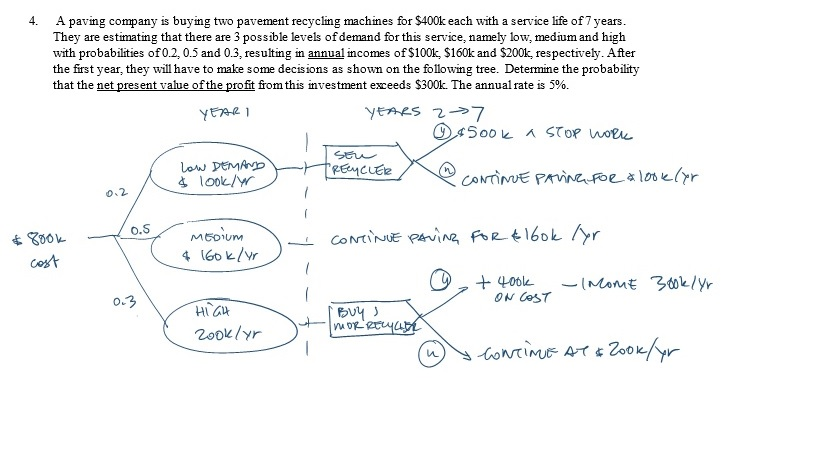

4. A paving company is buying two pavement recycling machines for $400k each with a service life of 7 years They are estimating that there are 3 possible levels of demand for this service, namely low, medium and high with probabilities of0.2, 0.5 and 0.3, resulting in annual incomes of$100k, $160k and $200k, respectively. After the first year, they will have to make some decisions as shown on the following tree. Determine the probability that the net present value ofthe profit from this investment exceeds $300k. The annual rate is 5% YEAR 1 ye AES 2- 7 look/yr o.S MEDIUM 4 (60 k/yr cost 400k rooklyrStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started