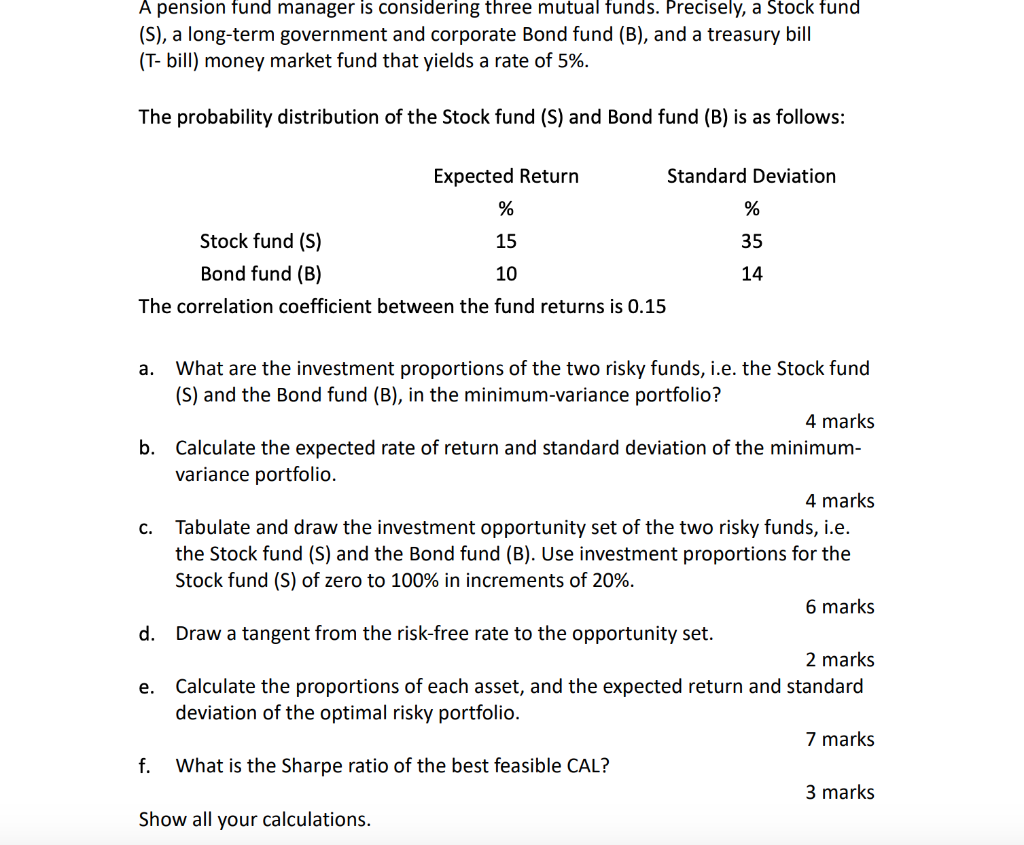

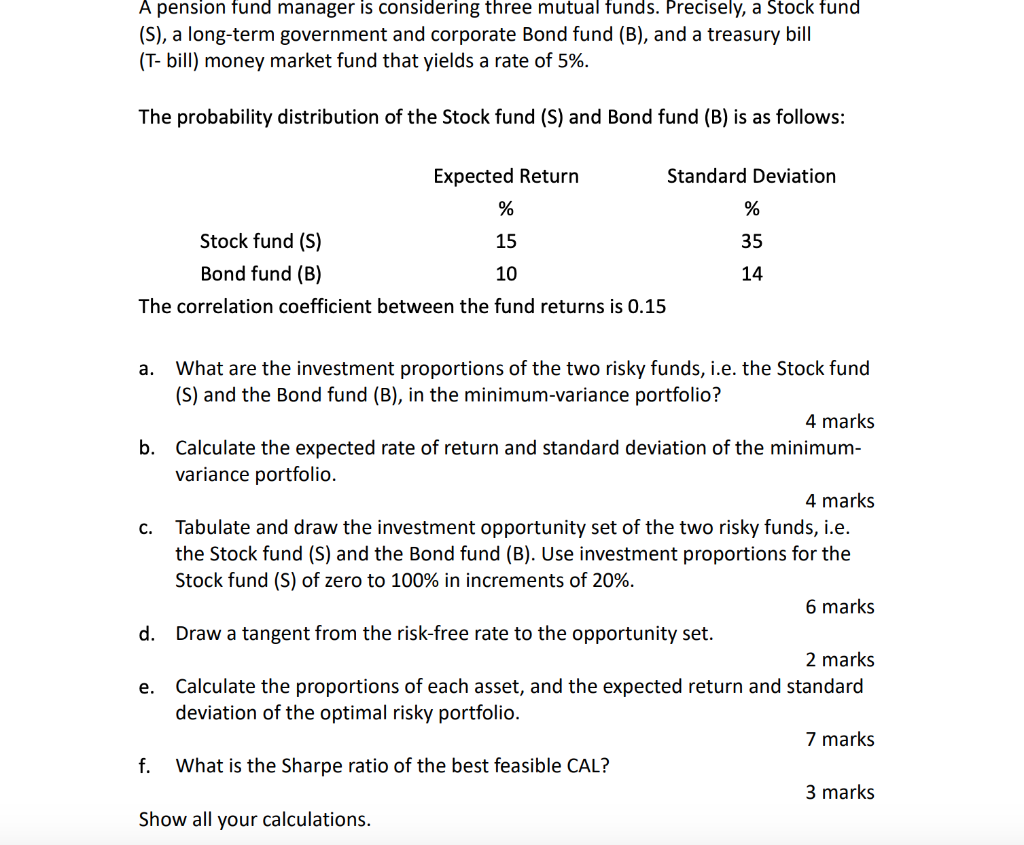

A pension fund manager is considering three mutual funds. Precisely, a Stock fund (S), a long-term government and corporate Bond fund (B), and a treasury bill (T-bill) money market fund that yields a rate of 5%. The probability distribution of the Stock fund (s) and Bond fund (B) is as follows: Expected Return Standard Deviation % % Stock fund (S) 15 35 Bond fund (B) 10 14 The correlation coefficient between the fund returns is 0.15 a. What are the investment proportions of the two risky funds, i.e. the Stock fund (S) and the Bond fund (B), in the minimum-variance portfolio? 4 marks b. Calculate the expected rate of return and standard deviation of the minimum- variance portfolio. 4 marks c. Tabulate and draw the investment opportunity set of the two risky funds, i.e. the Stock fund (S) and the Bond fund (B). Use investment proportions for the Stock fund (S) of zero to 100% in increments of 20%. 6 marks d. Draw a tangent from the risk-free rate to the opportunity set. 2 marks Calculate the proportions of each asset, and the expected return and standard deviation of the optimal risky portfolio. 7 marks f. What is the Sharpe ratio of the best feasible CAL? 3 marks Show all your calculations. e. A pension fund manager is considering three mutual funds. Precisely, a Stock fund (S), a long-term government and corporate Bond fund (B), and a treasury bill (T-bill) money market fund that yields a rate of 5%. The probability distribution of the Stock fund (s) and Bond fund (B) is as follows: Expected Return Standard Deviation % % Stock fund (S) 15 35 Bond fund (B) 10 14 The correlation coefficient between the fund returns is 0.15 a. What are the investment proportions of the two risky funds, i.e. the Stock fund (S) and the Bond fund (B), in the minimum-variance portfolio? 4 marks b. Calculate the expected rate of return and standard deviation of the minimum- variance portfolio. 4 marks c. Tabulate and draw the investment opportunity set of the two risky funds, i.e. the Stock fund (S) and the Bond fund (B). Use investment proportions for the Stock fund (S) of zero to 100% in increments of 20%. 6 marks d. Draw a tangent from the risk-free rate to the opportunity set. 2 marks Calculate the proportions of each asset, and the expected return and standard deviation of the optimal risky portfolio. 7 marks f. What is the Sharpe ratio of the best feasible CAL? 3 marks Show all your calculations. e