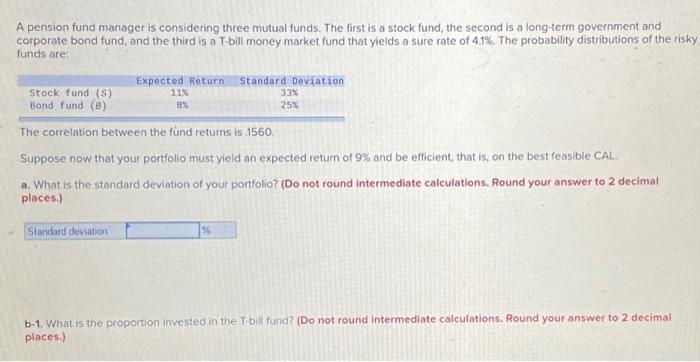

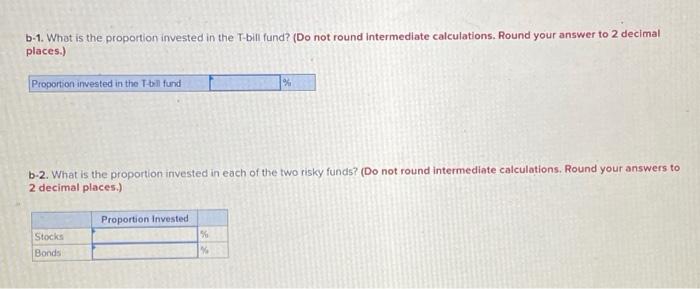

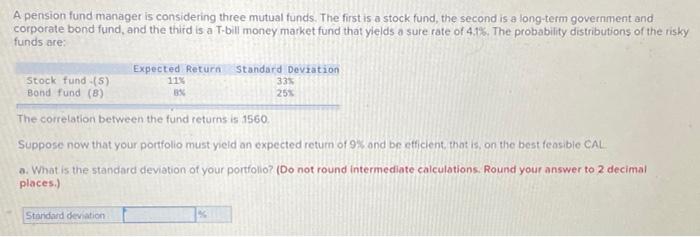

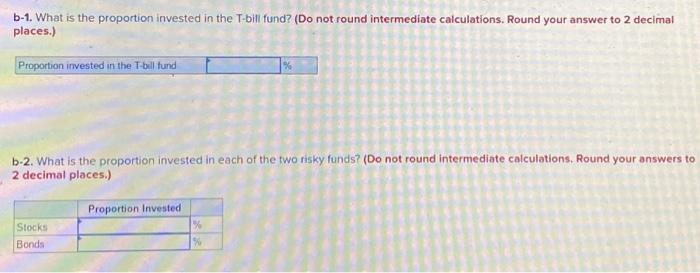

A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a sure rate of 4.1%. The probability distributions of the risky funds are: 8% 25% Expected Return Standard deviation Stock fund (5) 11% 33% Bond fund (8) The correlation between the fund returns is 1560 Suppose now that your portfolio must yield on expected return of 9% and be efficient, that is, on the best feasible CAL a. What is the standard deviation of your portfolio? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Standard deviation b-1. What is the proportion invested in the Tbill fund? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) b-1. What is the proportion invested in the T-bill fund? (Do not found Intermediate calculations. Round your answer to 2 decimal places.) Proportion invested in the Tbilfund b-2. What is the proportion invested in each of the two risky funds? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Proportion Invested % Stocks Bonds 33% 25% A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that ylelds a sure rate of 4,1%. The probability distributions of the risky funds are Expected Return Standard deviation Stock fund (5) 11% Bond fund (8) The correlation between the fund returns is 1560 Suppose now that your portfolio must yield an expected return of 9% and be efficient, that is on the best feasible CAL a. What is the standard deviation of your portfolio? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Standard deviation b-1. What is the proportion invested in the T-bill fund? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Proportion invested in the T-bill tund b-2. What is the proportion invested in each of the two risky funds? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Proportion Invested Stocks Bonds