Question

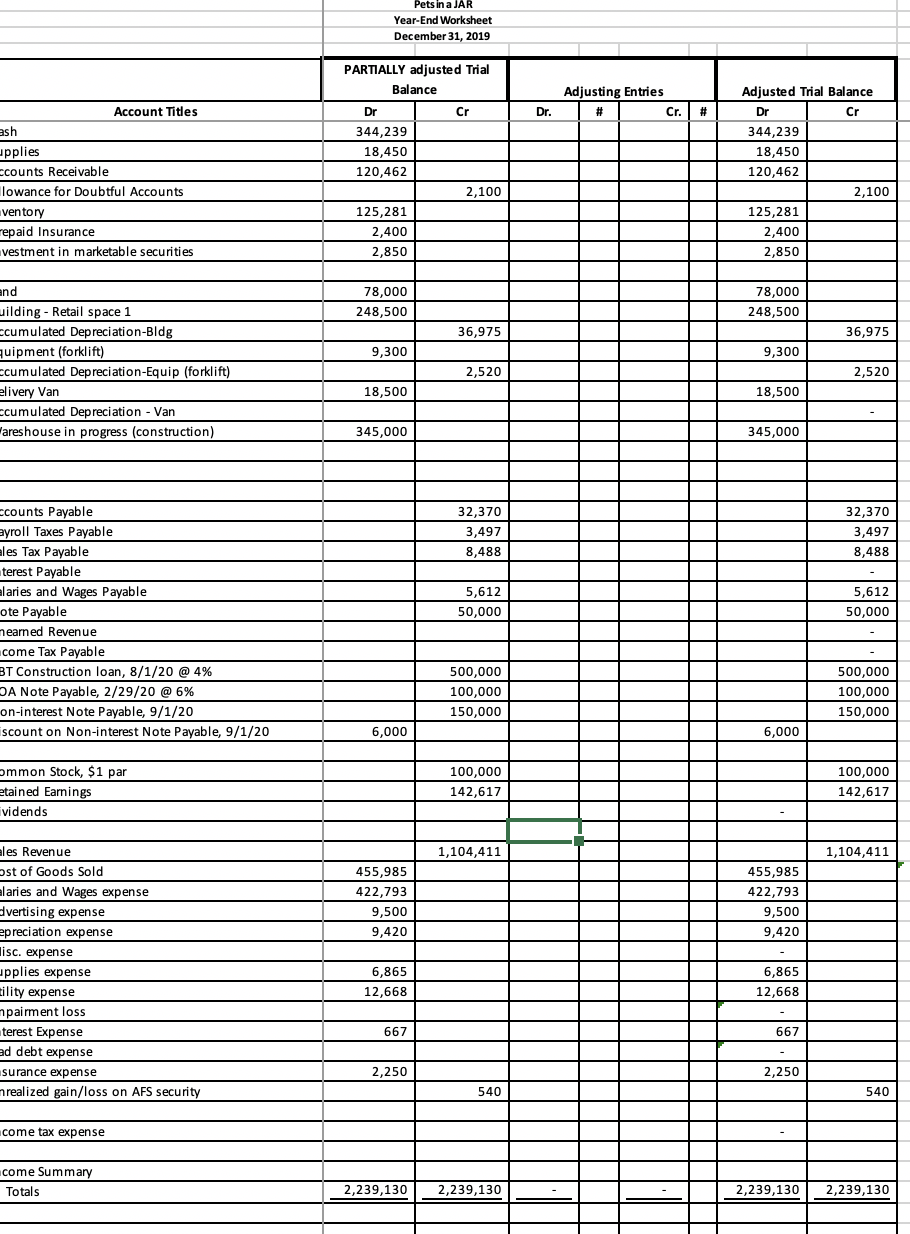

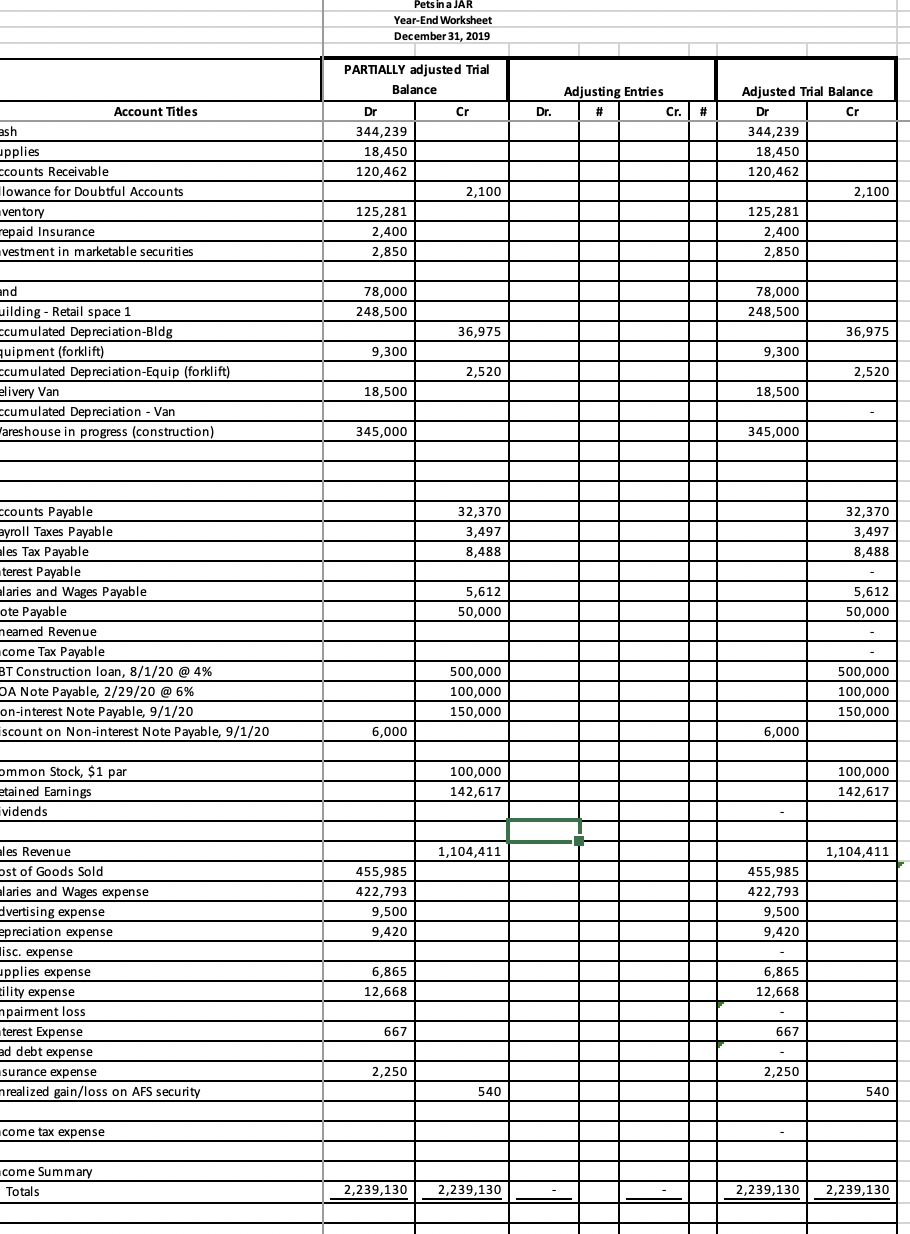

A. Perform calculations and record solutions as instructed for each item on the appropriate TAB. Preparing all appropriate additional adjusting entries in general journal form.

A. Perform calculations and record solutions as instructed for each item on the appropriate TAB. Preparing all appropriate additional adjusting entries in general journal form. Post the entries to the worksheet and extend the amounts to the remaining columns.

B. Prepare the adjusted trial balance that reflects your adjusting entries.

C. Prepare Income Statement and Comprehensive Income Statement

1.In 2019 Co determined that a $350 receivable from Cici was not collectible and wrote it if off using the allowance method in 2019.On Dec 31, 2020, Co received a check from Cici for $200 in partial payment of this previously written off account.(Record collection of previously written off receivable )

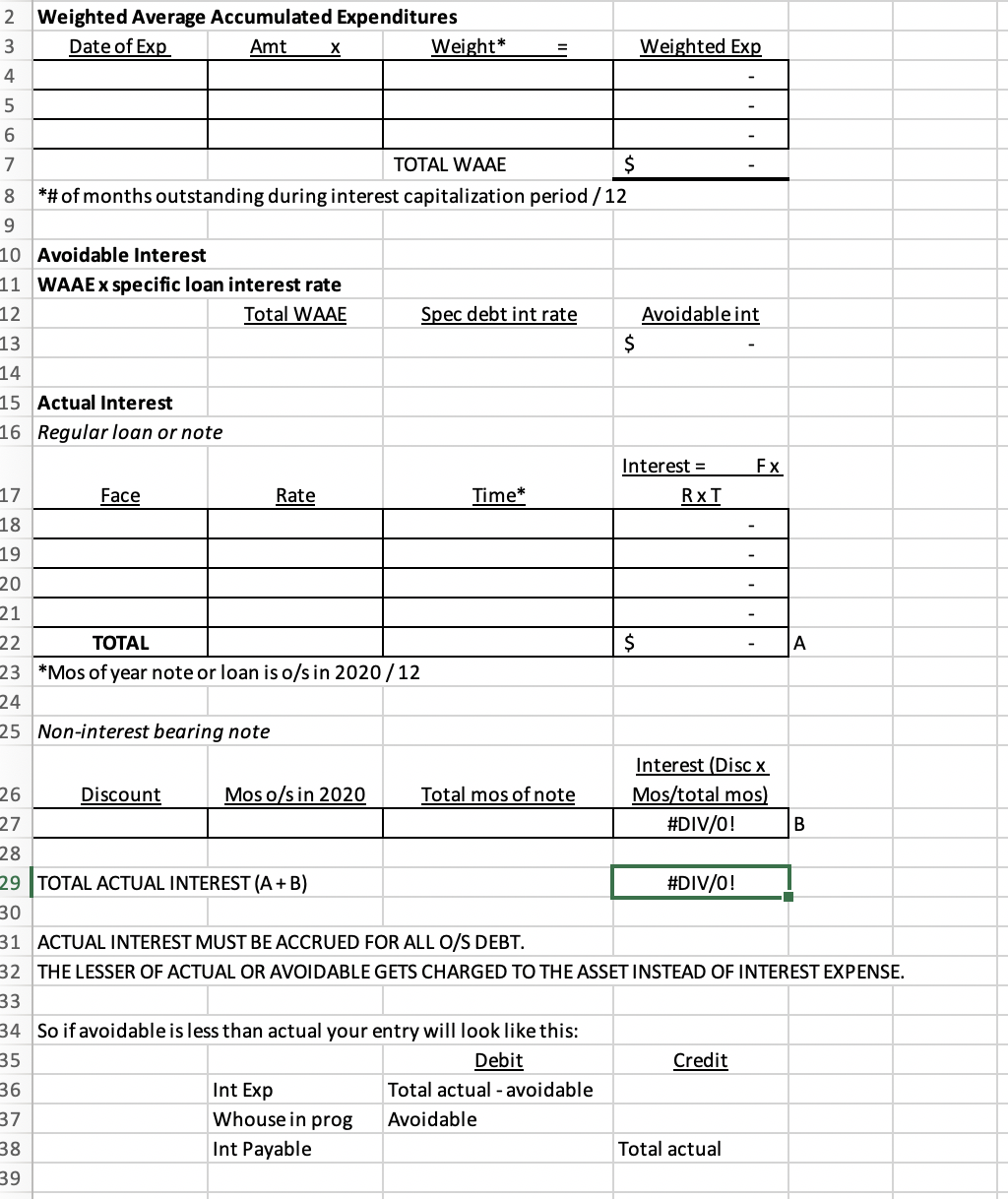

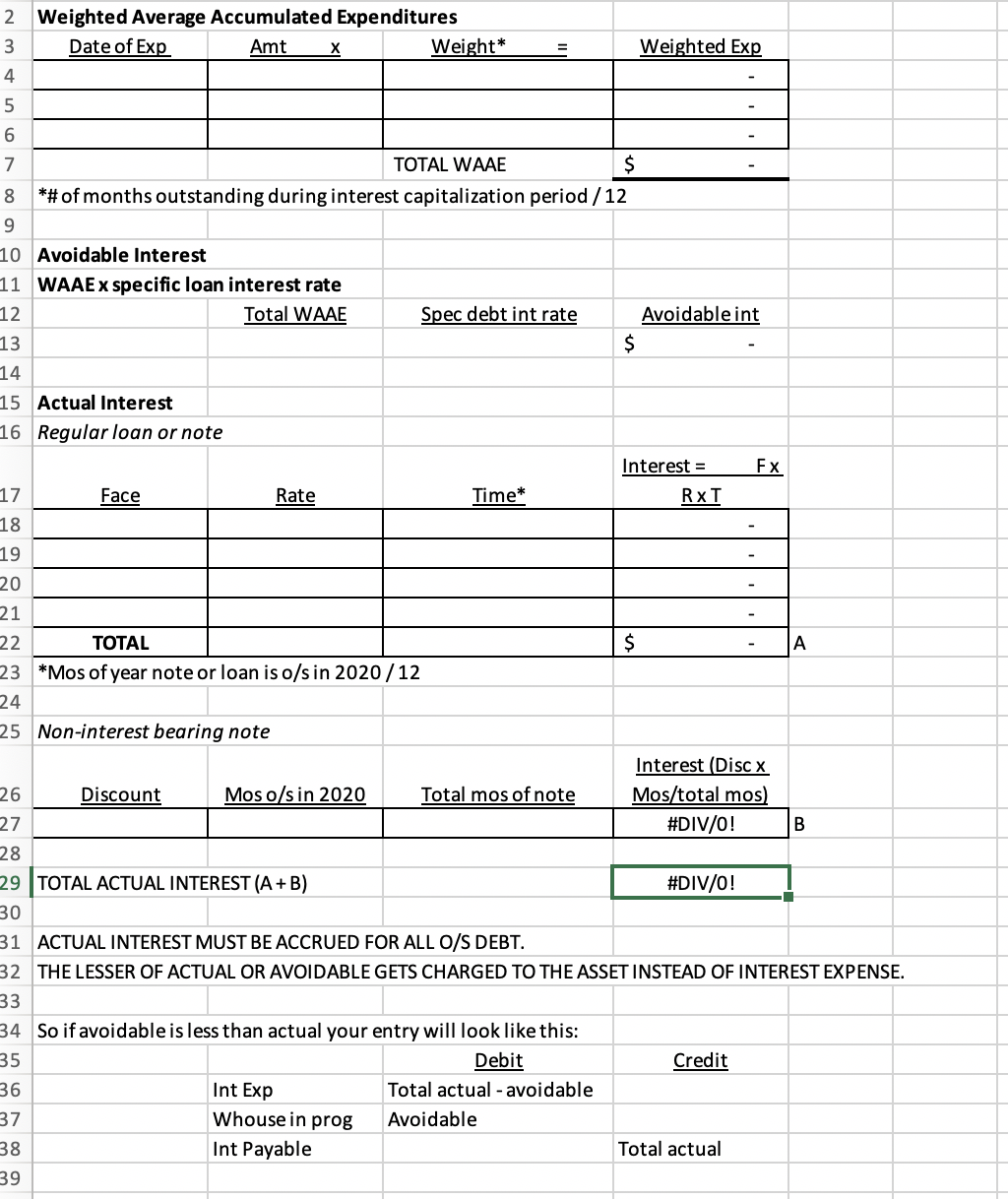

2.Co borrowed $500,000 at 4% on 8/1/20 from BBC specifically for the purpose of constructing the new warehouse.The loan was recorded on 8/1 but no interest has been accrued.Please accrue the interest appropriately on this loan as well as the notes in #3 and 4.Prior to recording the interest make sure to take into consideration the facts in #6 below regarding the construction of the new storage warehouse. You may round 2-5 to the nearest whole dollar. Items 2-6 may be done as one entry and labeled 2-6 on adj entry sheet.

3. On February 29, Co signed a $100,000, 5 year, 6% note payable to BB&T.No interest was accrued on this note yet in 2020.

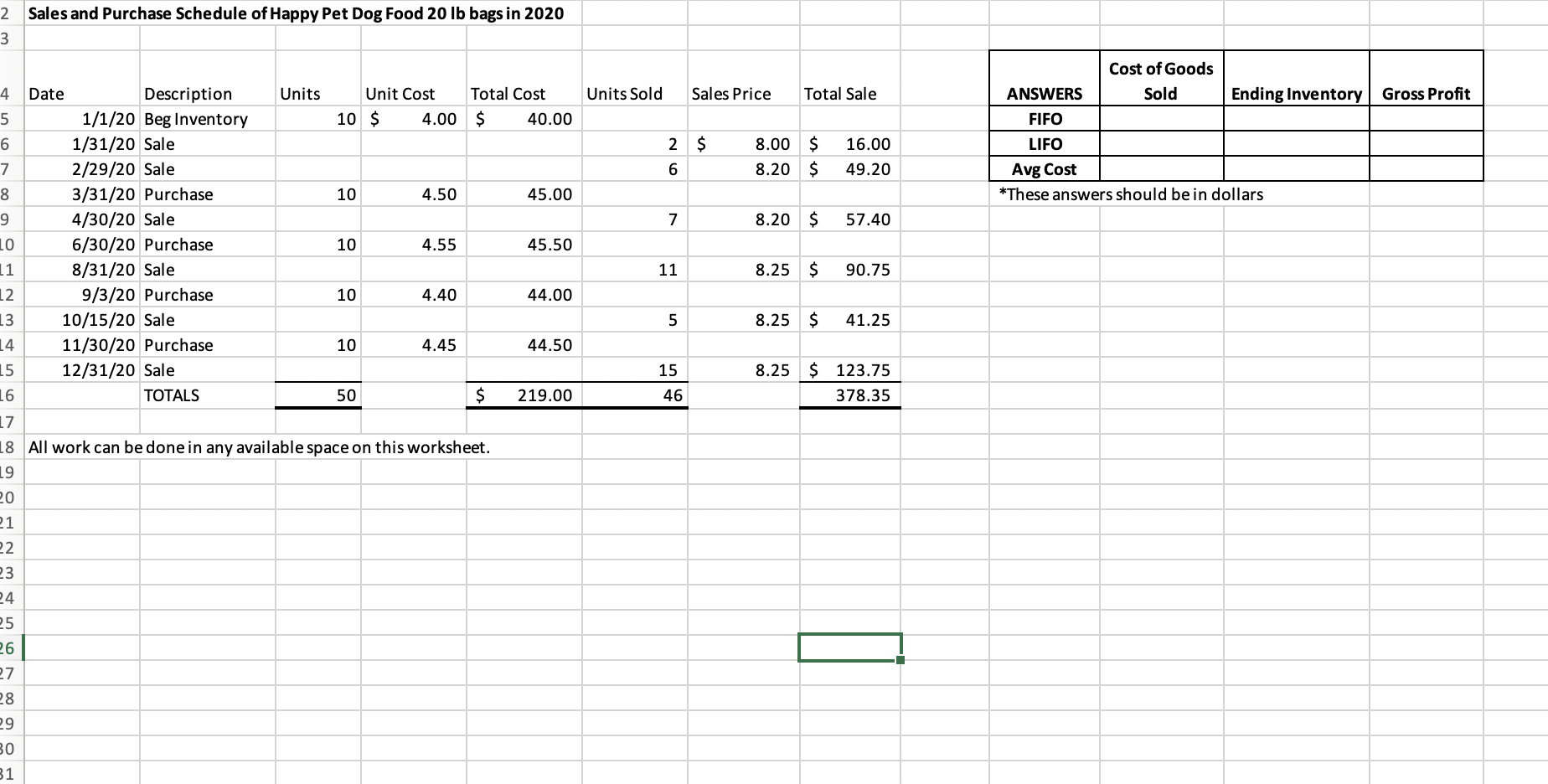

4.On September 1, 2020, Co signed a 1 year $150,000, non-interest-bearing note, Co received $144,000 cash for the note on Sept 1.No interest was accrued on this note yet in 2020.

5.Co has a note payable to BB&T for $50,000 at an annual interest rate of 3%.The five-year note is dated 4/30/19 and pays interest annually every 4/30.The interest on this note subsequent to 4/30 has not yet been accrued and must be used in the interest capitalization calculation along with other specific and non-specific debt.

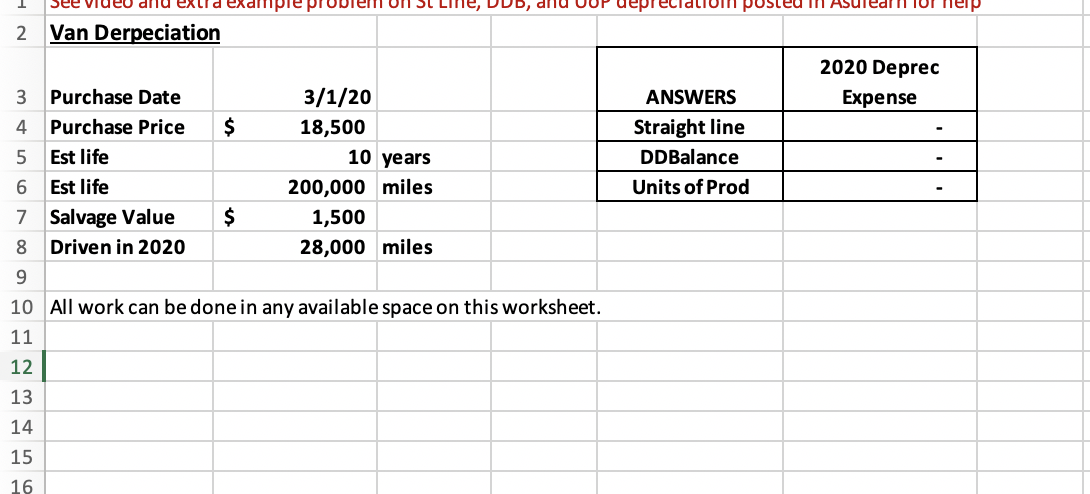

6.Co made the following cash disbursements for the new warehouse construction in 2020.On 8/1/20 $100,000; on 9/30/20 $165,000; on 11/1/20 $80,000.For this and the above problem, you must firstl calculate weighted average accumulated expenditures from the disbursement, then calculate actual and avoidable interest, the lesser of the two can be capitalized to the new warehouse account:Warehouse in progress.Construction on the warehouse was started on 7/1/20.

7.An analysis completed by the controller's office, using the balance sheet(A/R) approach, indicates that 3% of total accounts receivable is uncollectible. No accounts were written off during the year.

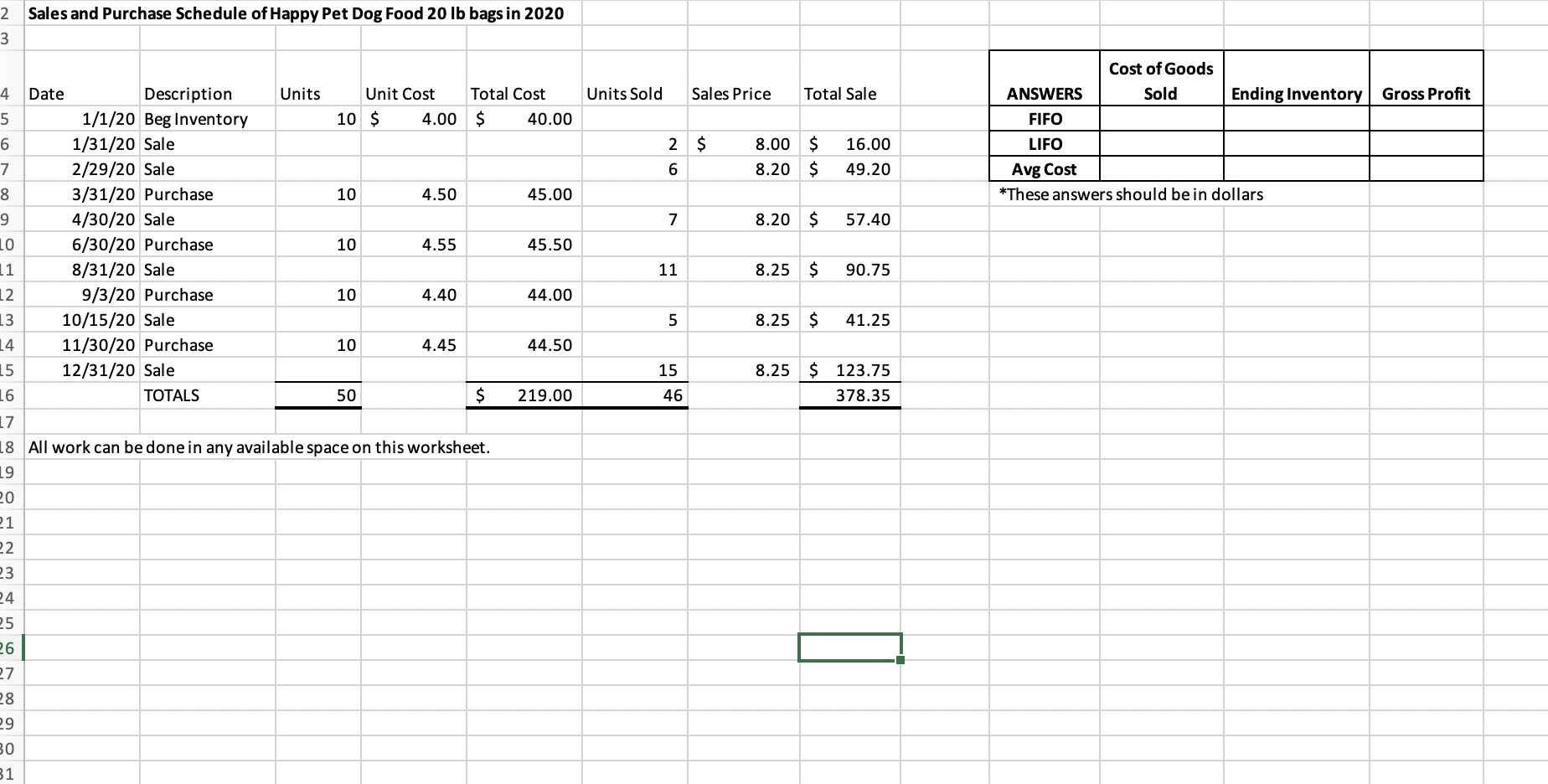

8.Co uses a FIFO perpetual inventory system.However, additional inventory of bags of dog food was discovered in a delivery van after the final inventory counts and adjustements.Using information on TAB 4; calculate the value of the dog food inventory using PERPETUAL FIFO, LIFO and Avg Cost.Put your work and answers where indicated on the Tab 4.Prior to the discovery of the dog food in the van, only one bag (cost of $4.45) of this brand of dog food was reported in ending inventory.Based on your calculation of the amount and cost of the dog food using PERPETUAL FIFO, prepare the adjusting entry to add the cost of the additional bags of inventory discovered to Inventory and subtract from COGS.

9.Co owns a forklift for moving freight that was purchased in 2016 for $9,300. The forklift is being depreciated using a straight line over a 10-year useful life and has a $2,100 salvage value.This depreciation for the forklift was already recorded in 2020, however, analysis indicates the undiscounted future cash flows the forklift will provide are $6,000 and its fair value is estimated to be $5,800.Determine if the forklift is impaired and if so, record the appropriate impairment as an adjusting entry.Co estimates the new salvage value of the forklift to be $1,200 and that the forklift will last for 4 more years (i.e. it will last until the end of 2024).Compute the newannual depreciation, but do not record it, list the new annual depreciation on the line to the right.Put new annual depreciation expense here

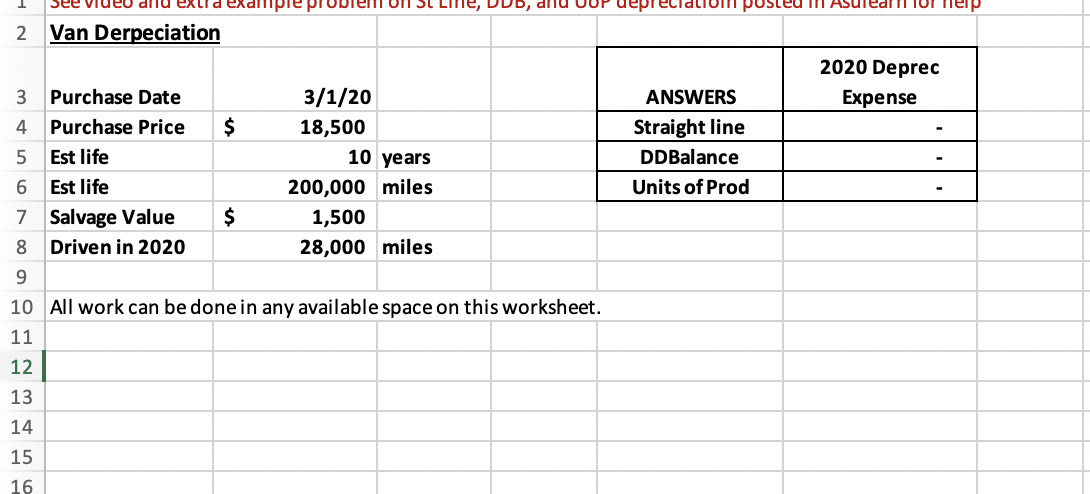

10.Co bought a delivery van on March 1, 2020 for $18,500.Co's controller wants to see how much depreciation is using each of the following methods:Straight-line, double declining balance, and units of production and record the one that is the HIGHEST for 2020.The van has a 10 year useful life and $1,500 salvage value, it is expected to last 200,000 miles and was driven 28,000 miles 2020.Put you calculations and solutions for each method on Tab 5.Use partial periods depreciation, not full years

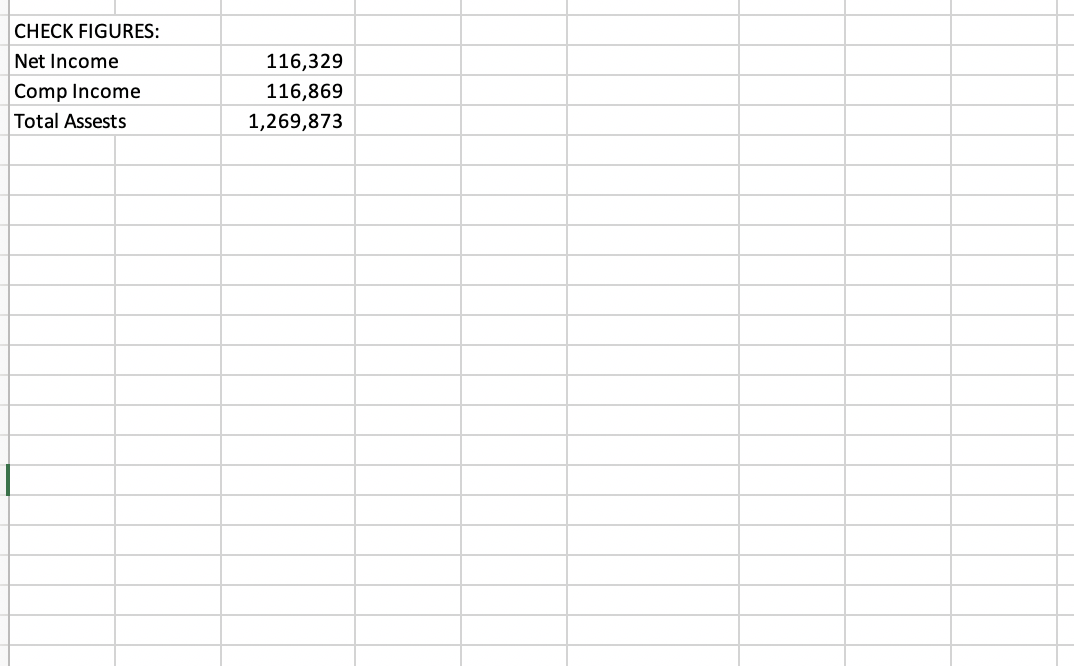

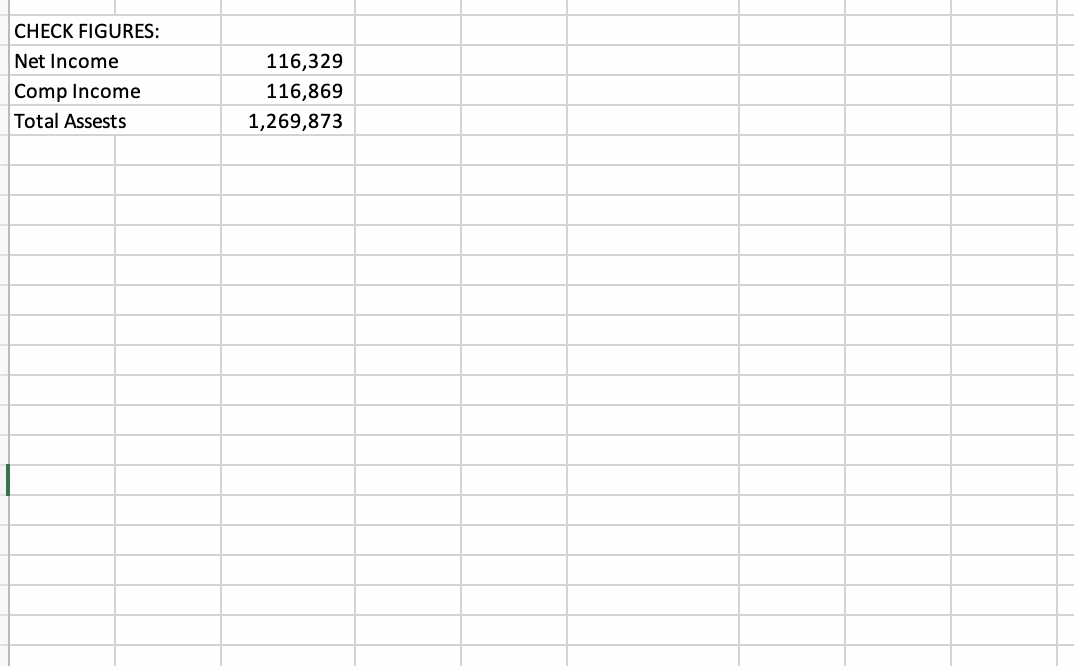

11.The tax rate is 30% which affects all items of income and expense at the same rate.Hint: you must determine income before taxes to calculate income tax expense. (Round total income tax expense to nearest whole dollar)

12.The 30% tax rate applies to "other comprehensive income" items as well as income statement items.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started