Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a perpetual inventory system. The adjusted trial balance of King C (Click the icon to view the adjusted trial balance.) Read the requirements. Prepare the

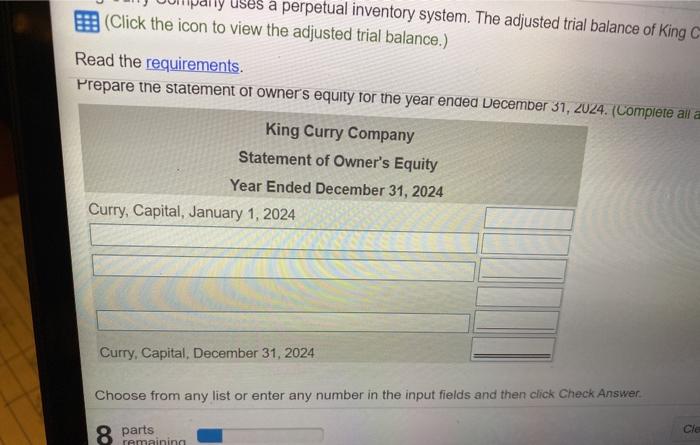

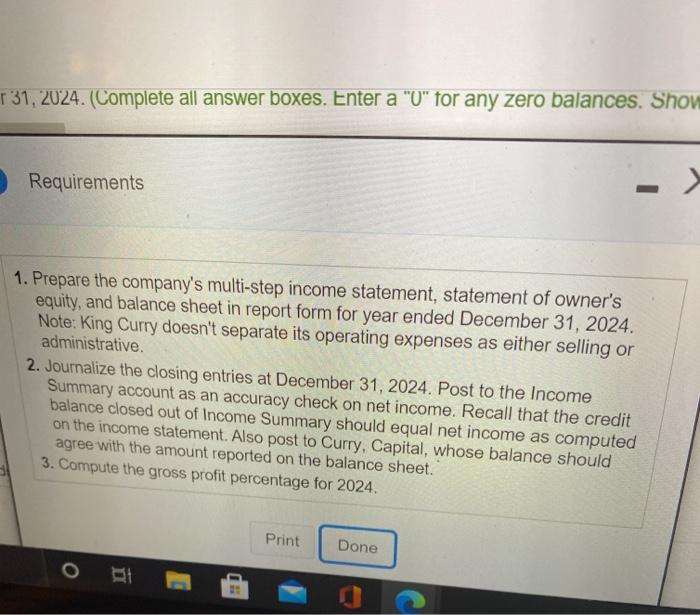

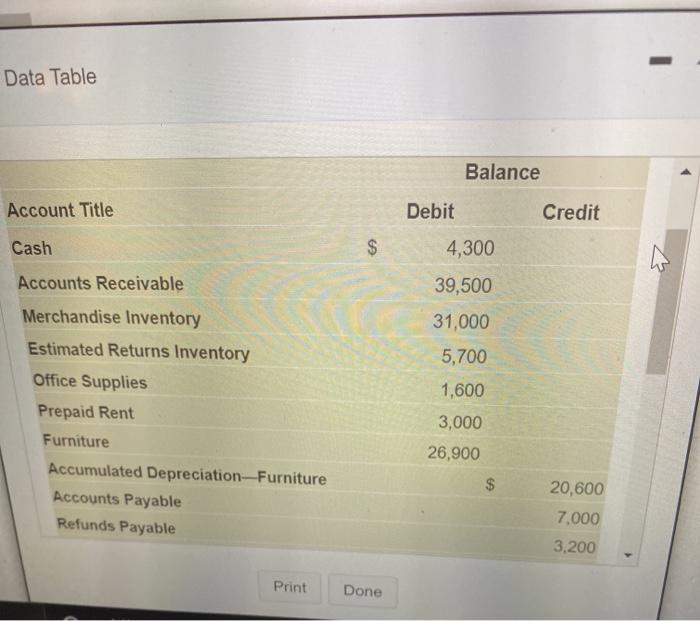

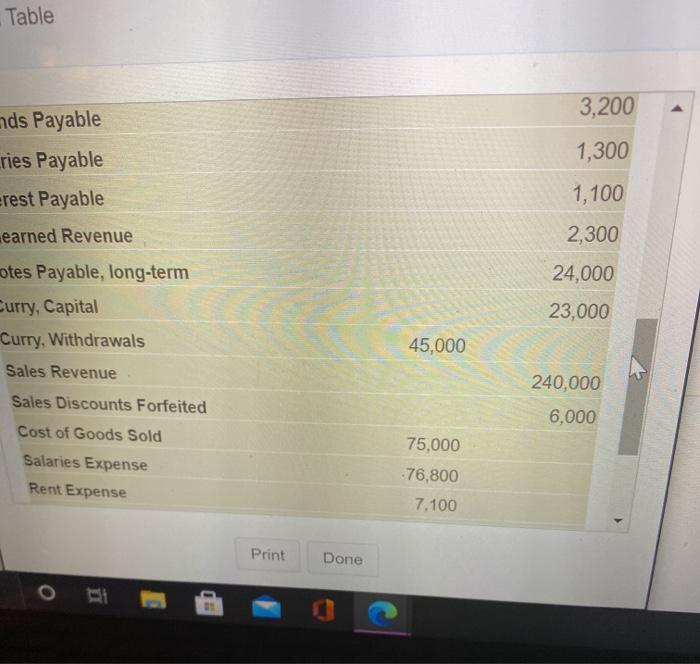

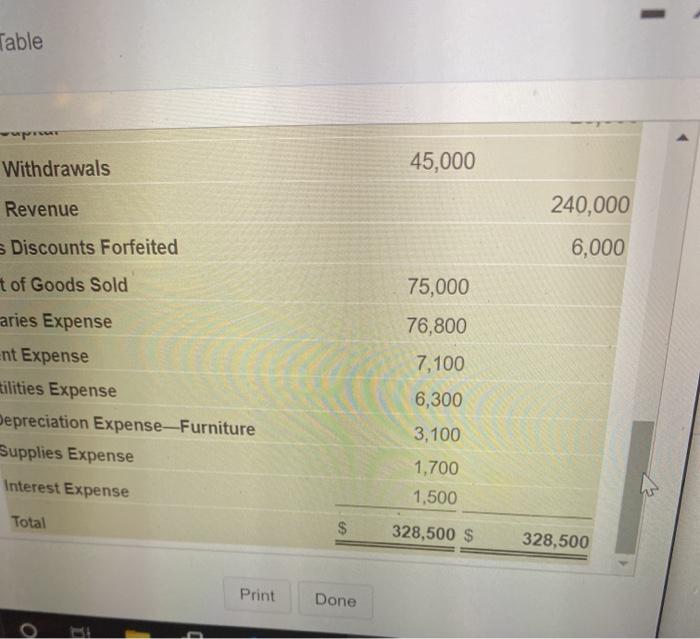

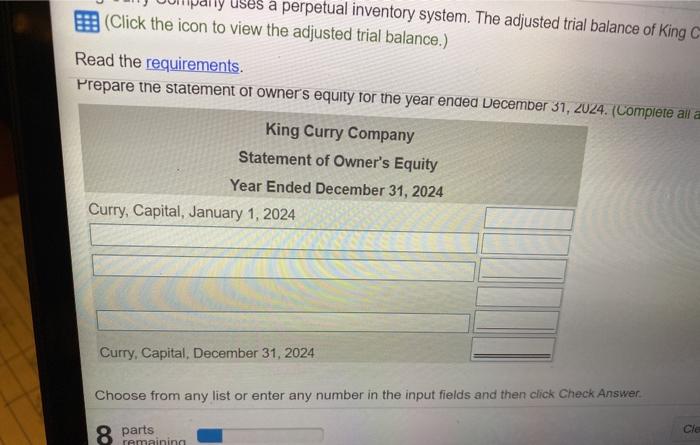

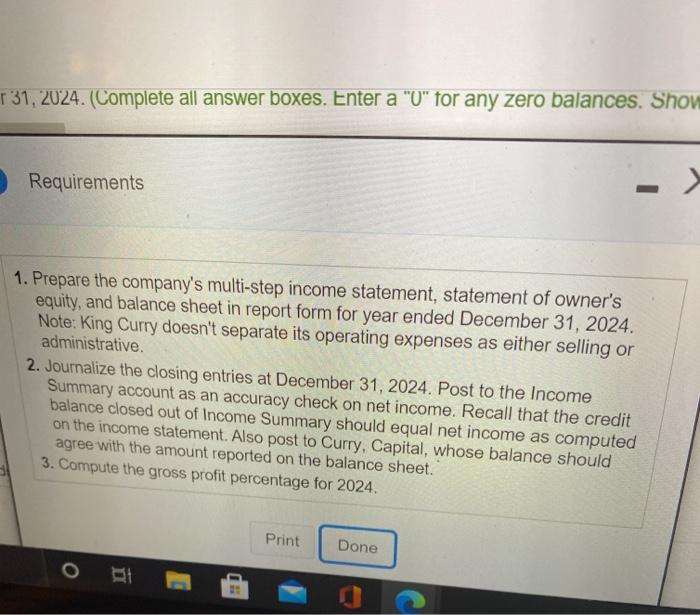

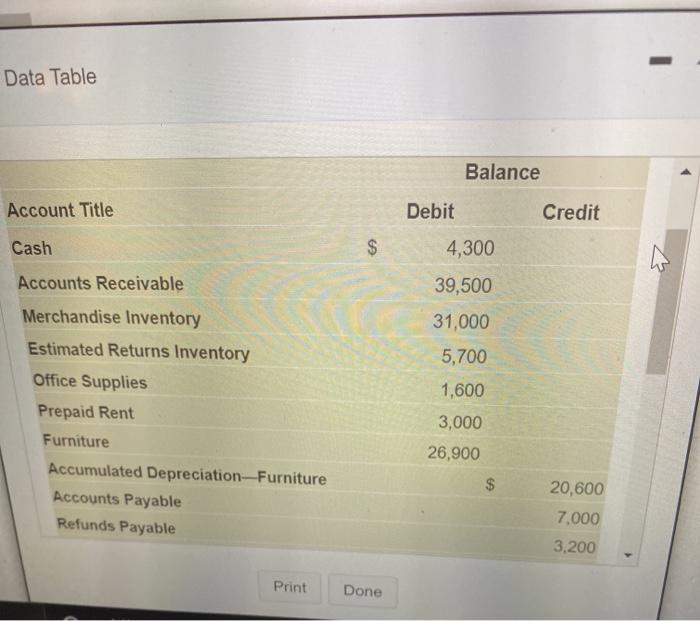

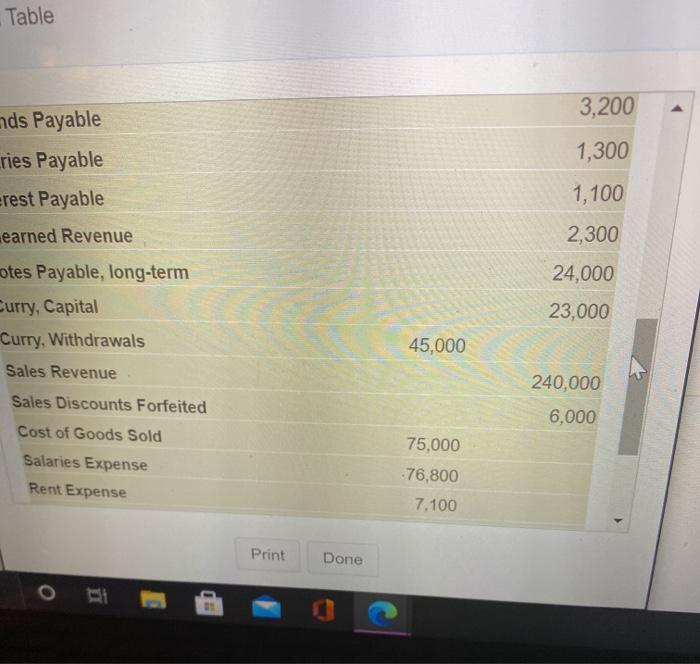

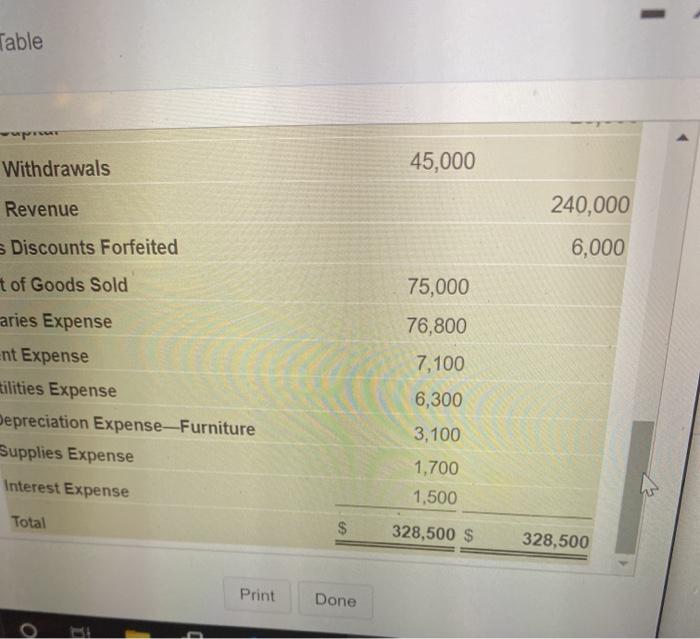

a perpetual inventory system. The adjusted trial balance of King C (Click the icon to view the adjusted trial balance.) Read the requirements. Prepare the statement of owners equity for the year ended December 31, 2024. (Complete alla King Curry Company Statement of Owner's Equity Year Ended December 31, 2024 Curry, Capital, January 1, 2024 Curry, Capital, December 31, 2024 Choose from any list or enter any number in the input fields and then click Check Answer Cle 8 parts remaining T 31, 2024. (Complete all answer boxes. Enter a "0" for any zero balances. Show Requirements 1. Prepare the company's multi-step income statement, statement of owner's equity, and balance sheet in report form for year ended December 31, 2024. Note: King Curry doesn't separate its operating expenses as either selling or administrative. 2. Journalize the closing entries at December 31, 2024. Post to the Income Summary account as an accuracy check on net income. Recall that the credit balance closed out of Income Summary should equal net income as computed on the income statement. Also post to Curry, Capital, whose balance should agree with the amount reported on the balance sheet. 3. Compute the gross profit percentage for 2024. Print Done Data Table Balance Account Title Debit Credit Cash $ $ 4,300 Accounts Receivable 39,500 31,000 5,700 1,600 Merchandise Inventory Estimated Returns Inventory Office Supplies Prepaid Rent Furniture Accumulated Depreciation Furniture Accounts Payable Refunds Payable 3,000 26,900 $ 20,600 7,000 3,200 Print Done Table 3,200 nds Payable 1,300 ries Payable Erest Payable 1,100 earned Revenue 2,300 24,000 otes Payable, long-term Surry, Capital Curry, Withdrawals 23,000 45,000 Sales Revenue 240,000 Sales Discounts Forfeited 6,000 Cost of Goods Sold Salaries Expense Rent Expense 75,000 -76,800 7.100 Print Done Table Withdrawals 45,000 Revenue 240,000 Discounts Forfeited 6,000 t of Goods Sold 75,000 76,800 7,100 aries Expense Ent Expense silities Expense Depreciation Expense-Furniture Supplies Expense Interest Expense 6,300 3,100 1,700 1,500 Total 328,500 $ 328,500 Print Done a

a perpetual inventory system. The adjusted trial balance of King C (Click the icon to view the adjusted trial balance.) Read the requirements. Prepare the statement of owners equity for the year ended December 31, 2024. (Complete alla King Curry Company Statement of Owner's Equity Year Ended December 31, 2024 Curry, Capital, January 1, 2024 Curry, Capital, December 31, 2024 Choose from any list or enter any number in the input fields and then click Check Answer Cle 8 parts remaining T 31, 2024. (Complete all answer boxes. Enter a "0" for any zero balances. Show Requirements 1. Prepare the company's multi-step income statement, statement of owner's equity, and balance sheet in report form for year ended December 31, 2024. Note: King Curry doesn't separate its operating expenses as either selling or administrative. 2. Journalize the closing entries at December 31, 2024. Post to the Income Summary account as an accuracy check on net income. Recall that the credit balance closed out of Income Summary should equal net income as computed on the income statement. Also post to Curry, Capital, whose balance should agree with the amount reported on the balance sheet. 3. Compute the gross profit percentage for 2024. Print Done Data Table Balance Account Title Debit Credit Cash $ $ 4,300 Accounts Receivable 39,500 31,000 5,700 1,600 Merchandise Inventory Estimated Returns Inventory Office Supplies Prepaid Rent Furniture Accumulated Depreciation Furniture Accounts Payable Refunds Payable 3,000 26,900 $ 20,600 7,000 3,200 Print Done Table 3,200 nds Payable 1,300 ries Payable Erest Payable 1,100 earned Revenue 2,300 24,000 otes Payable, long-term Surry, Capital Curry, Withdrawals 23,000 45,000 Sales Revenue 240,000 Sales Discounts Forfeited 6,000 Cost of Goods Sold Salaries Expense Rent Expense 75,000 -76,800 7.100 Print Done Table Withdrawals 45,000 Revenue 240,000 Discounts Forfeited 6,000 t of Goods Sold 75,000 76,800 7,100 aries Expense Ent Expense silities Expense Depreciation Expense-Furniture Supplies Expense Interest Expense 6,300 3,100 1,700 1,500 Total 328,500 $ 328,500 Print Done a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started