Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A person has $800000 in a retirement account, X. The retirement account, X, earns an annual effective rate of interest of i= 6.9%. The

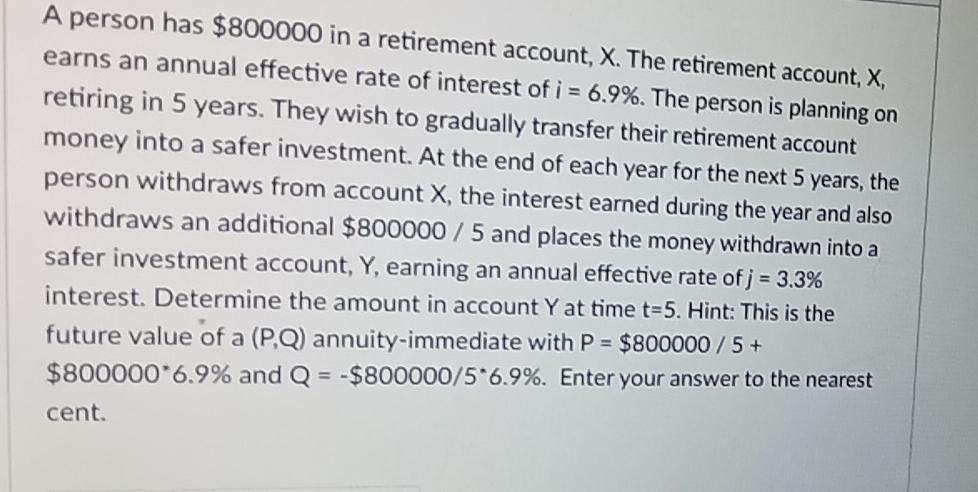

A person has $800000 in a retirement account, X. The retirement account, X, earns an annual effective rate of interest of i= 6.9%. The person is planning on retiring in 5 years. They wish to gradually transfer their retirement account money into a safer investment. At the end of each year for the next 5 years, the person withdraws from account X, the interest earned during the year and also withdraws an additional $800000 / 5 and places the money withdrawn into a safer investment account, Y, earning an annual effective rate of j = 3.3% interest. Determine the amount in account Y at time t-5. Hint: This is the future value of a (PQ) annuity-immediate with P = $800000 / 5 + $800000*6.9% and Q = - $800000/5*6.9%. Enter your answer to the nearest cent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

End Year Interest at 69Prinbal Principal depositec in Y Total deposit in Y Principal Balance in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started