Question

The Jacobs Corporation produced and sold 20,000 cowbells last year. Jacobss profit report follows: This year Jacobs again expects to sell 20,000 cowbells through normal

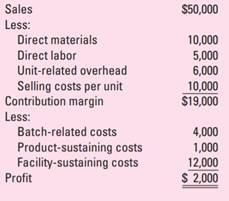

The Jacobs Corporation produced and sold 20,000 cowbells last year. Jacobs’s profit report follows:

This year Jacobs again expects to sell 20,000 cowbells through normal channels. It has also received an order for 5,000 cowbells at $1.75 each. The selling cost per unit will not be incurred on this order because no commission will be paid; however, an additional production run will be required at a cost of $1,000. Product-sustaining costs will not be incurred. The company has the capacity to produce the order.

Required:

A. What is the relevant cost of the special order?

B. Should Jacobs accept or reject the special order?

C. How could this decision be affected by Jacobs’s other customers?

D. How could this decision be affected by legal factors?

Sales Less: Direct materials Direct labor Unit-related overhead Selling costs per unit Contribution margin Less: Batch-related costs Product-sustaining costs Facility-sustaining costs Profit $50,000 10,000 5,000 6,000 10,000 $19,000 4,000 1,000 12,000 $ 2,000

Step by Step Solution

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

A Calculation of relevant cost for special order Special order mits 5...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started