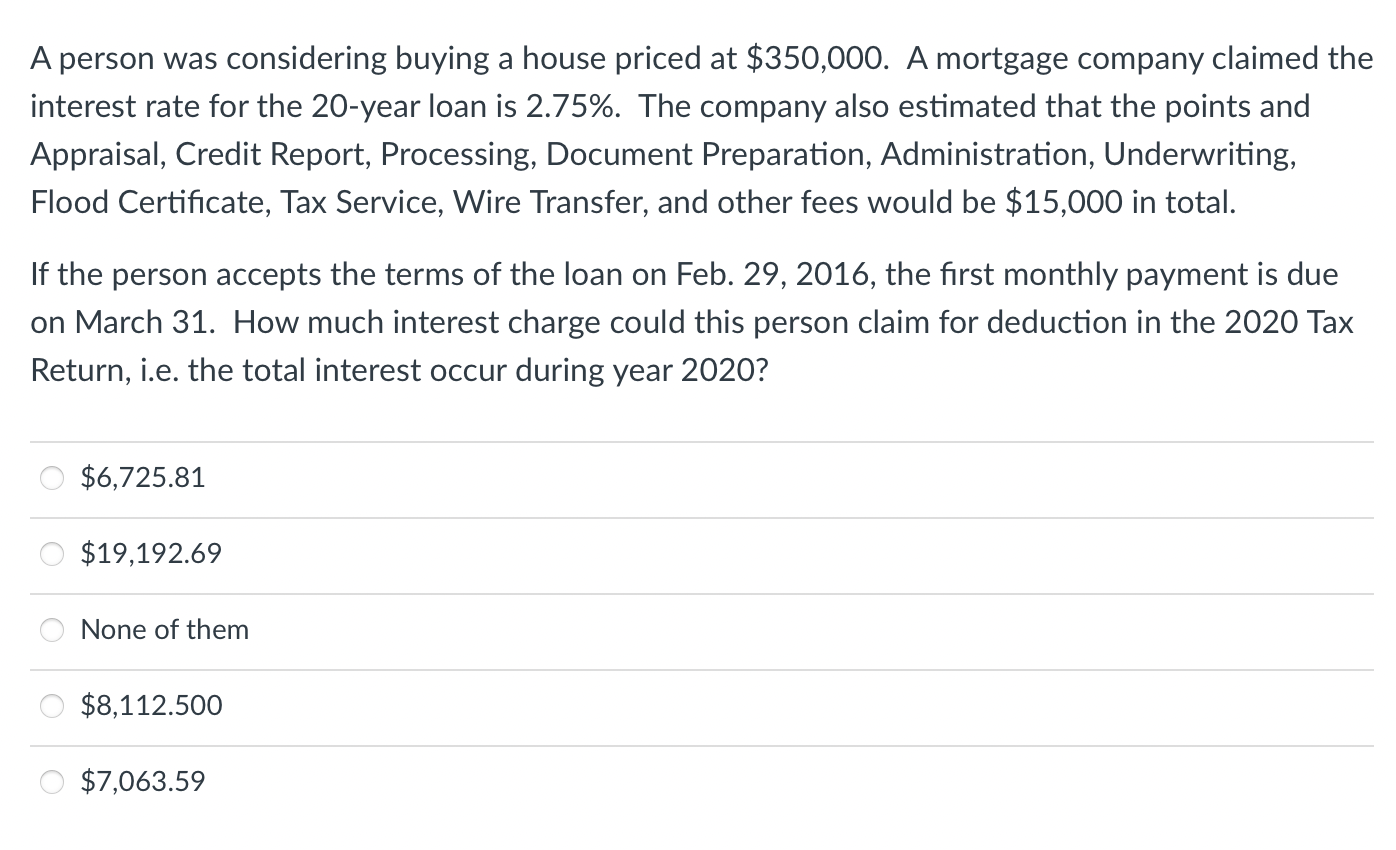

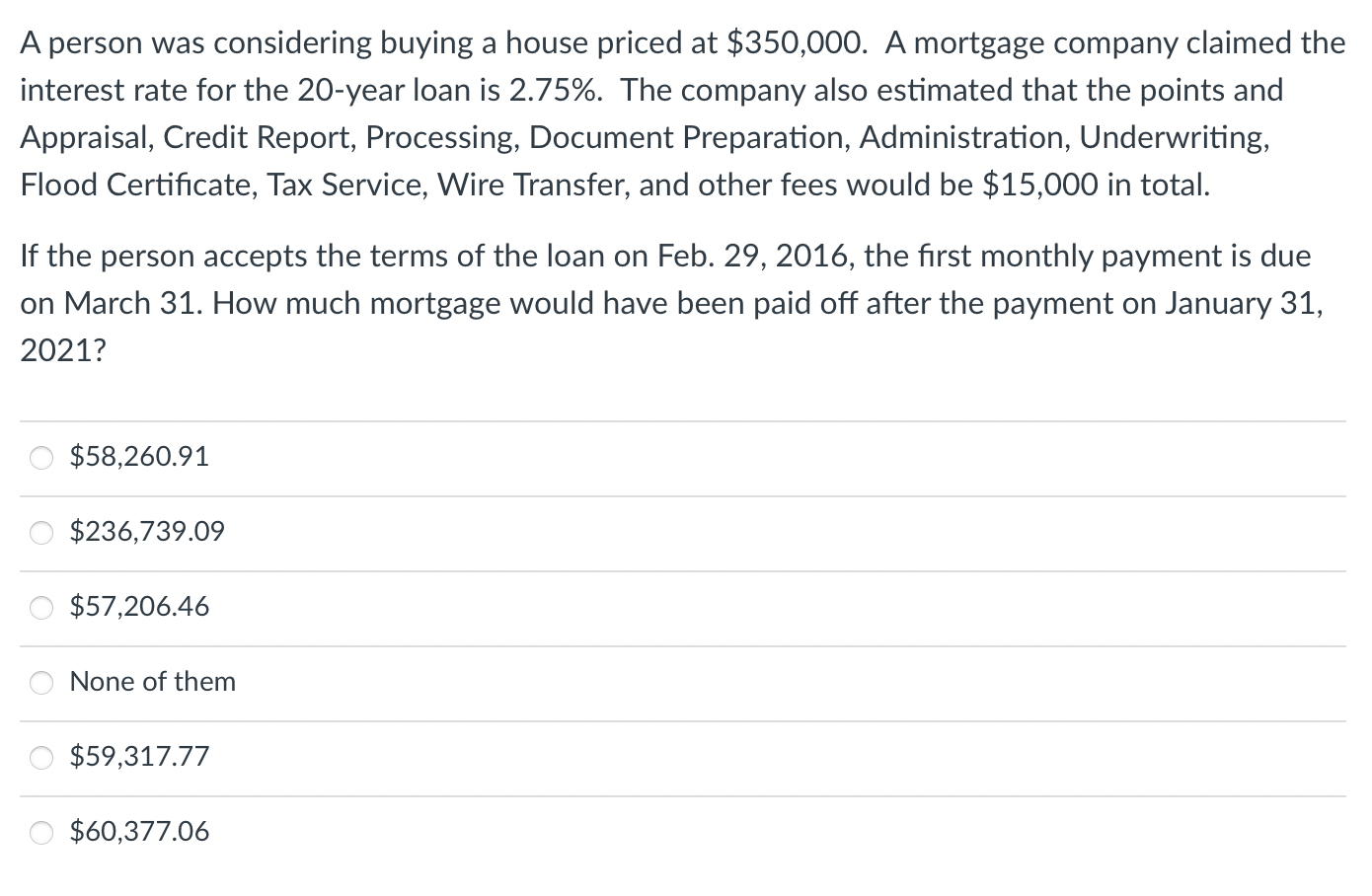

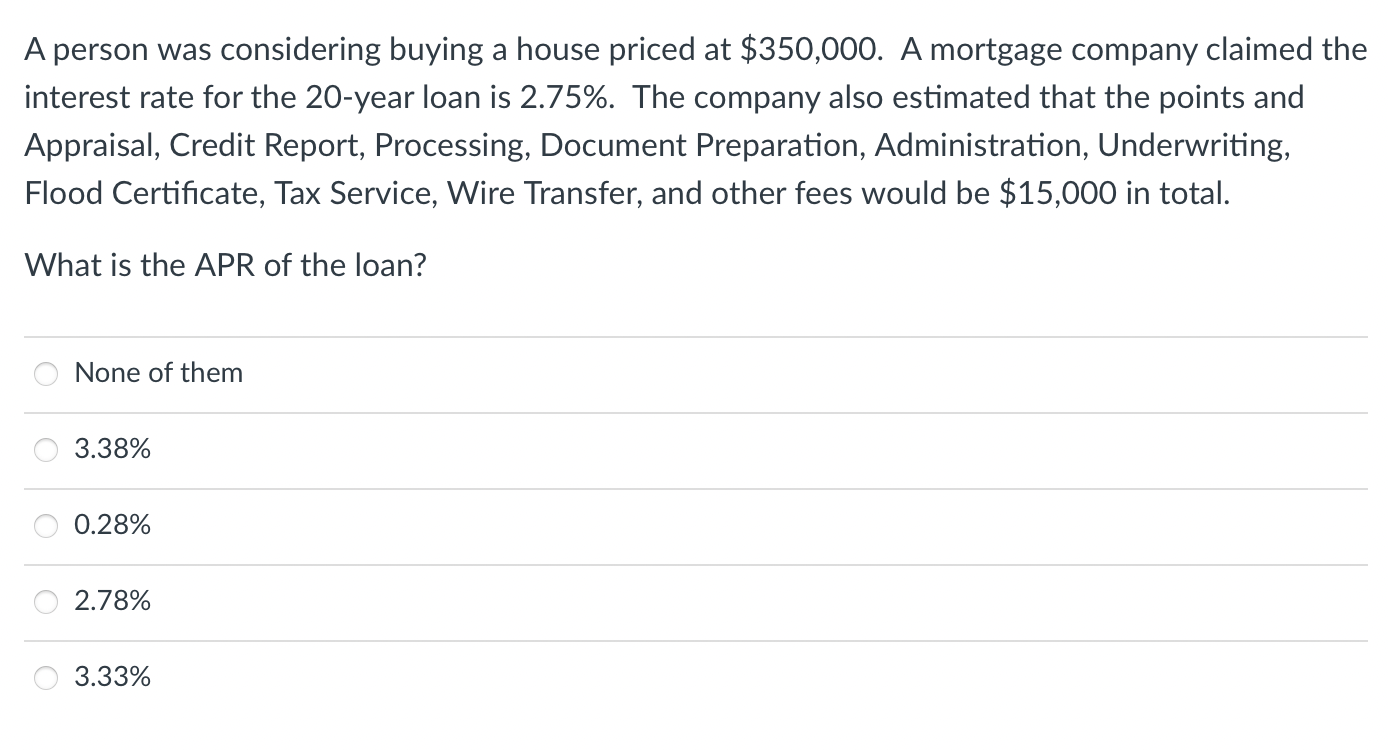

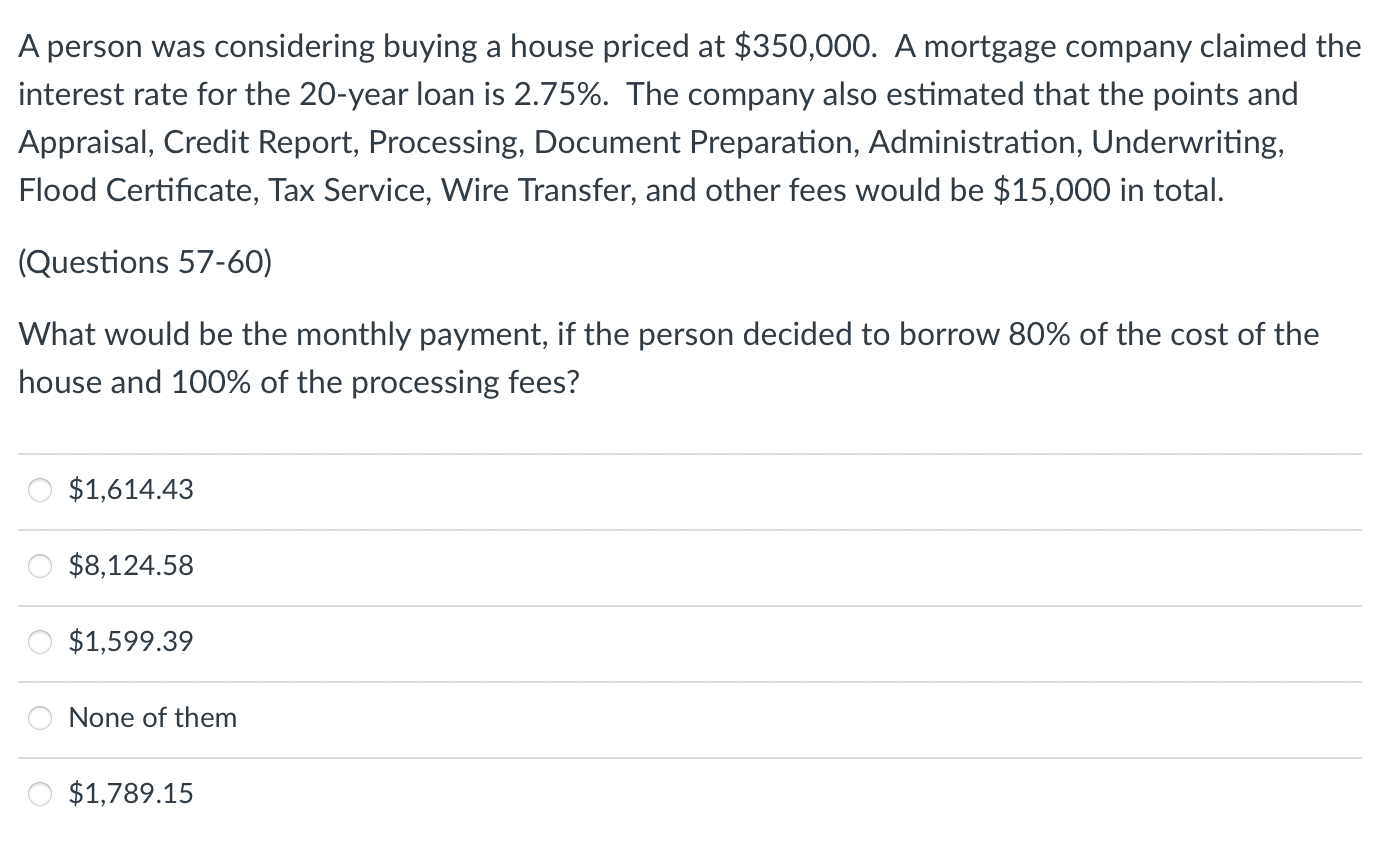

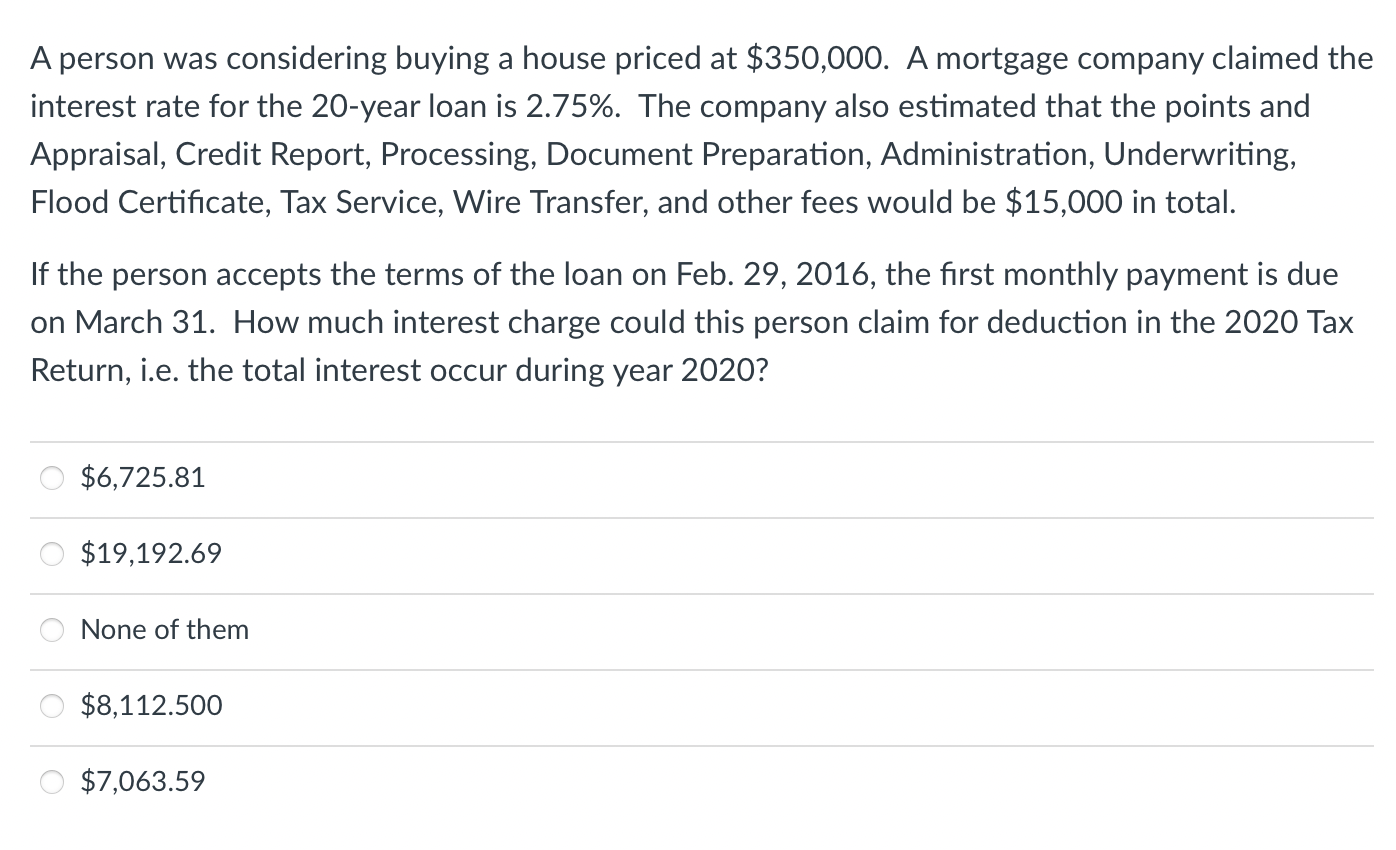

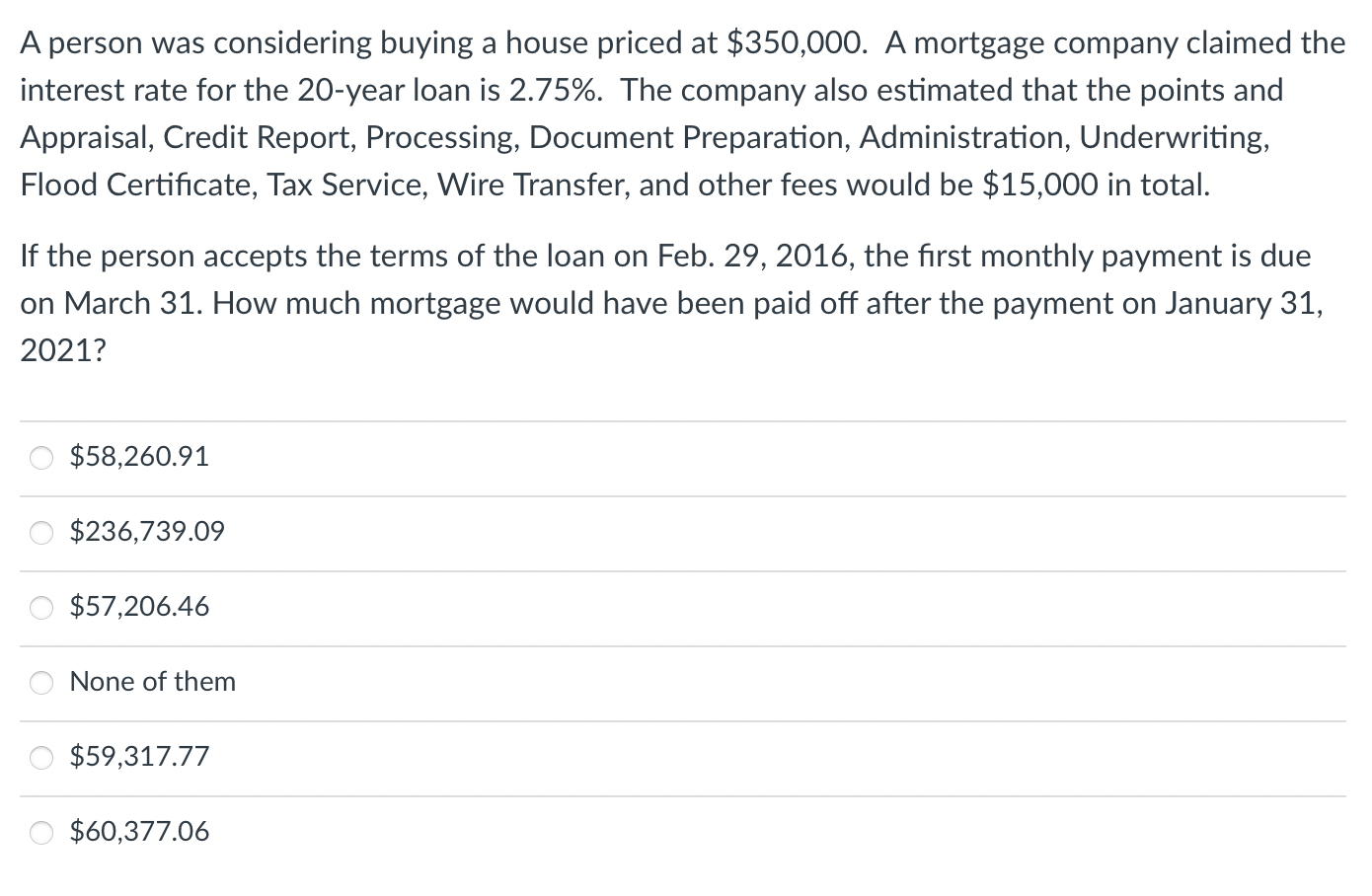

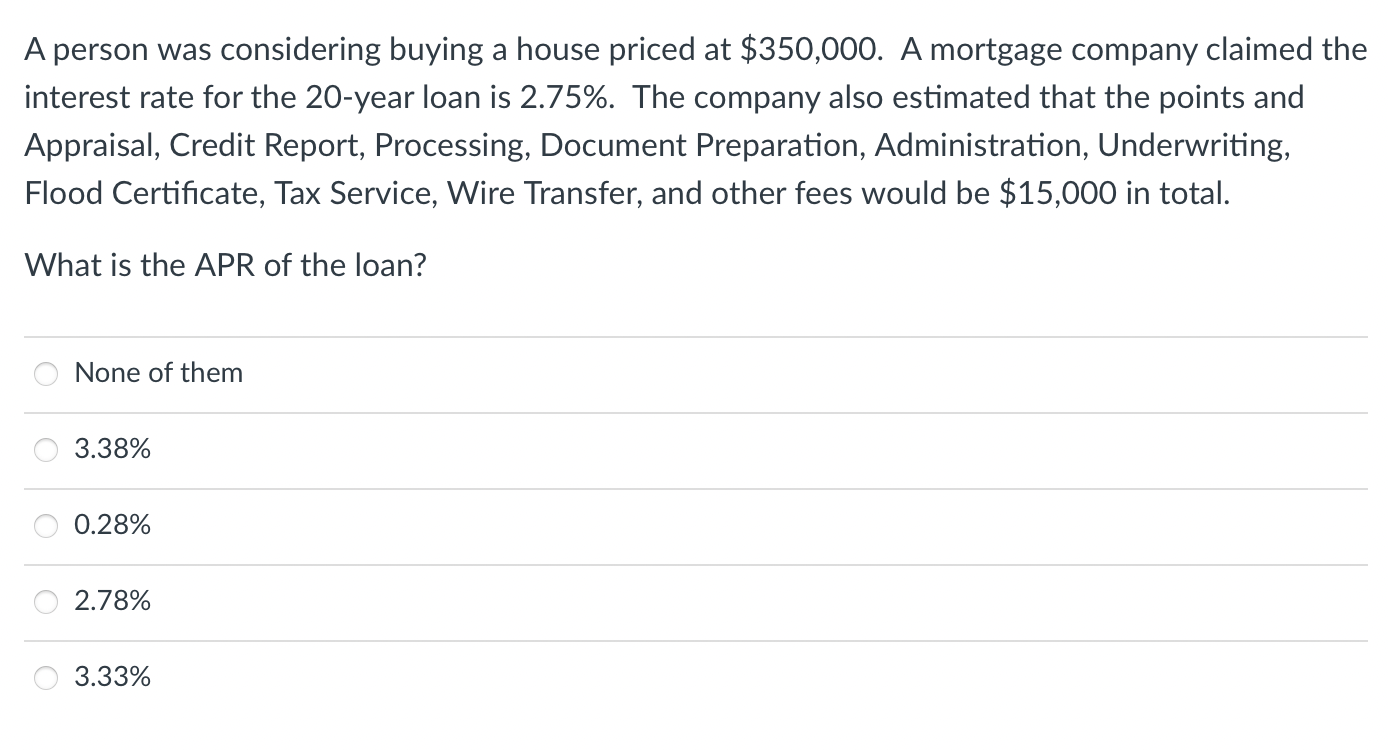

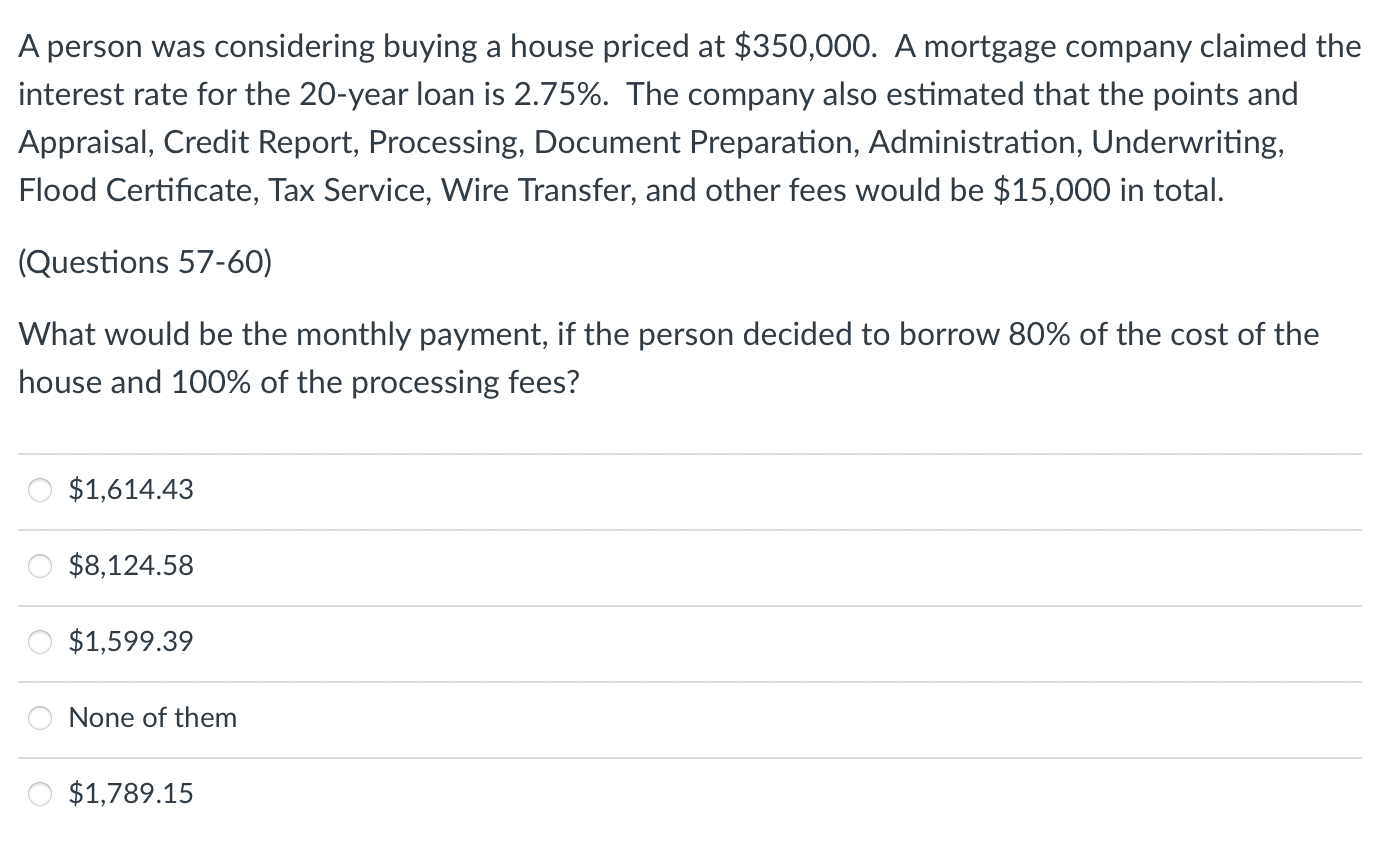

A person was considering buying a house priced at $350,000. A mortgage company claimed the interest rate for the 20-year loan is 2.75%. The company also estimated that the points and Appraisal, Credit Report, Processing, Document Preparation, Administration, Underwriting, Flood Certificate, Tax Service, Wire Transfer, and other fees would be $15,000 in total. If the person accepts the terms of the loan on Feb. 29, 2016, the first monthly payment is due on March 31. How much interest charge could this person claim for deduction in the 2020 Tax Return, i.e. the total interest occur during year 2020 ? $6,725.81$19,192.69 None of them $8,112.500$7,063.59 A person was considering buying a house priced tat $350,000. A mortgage company claimed the interest rate for the 20 -year loan is 2.75%. The company also estimated that the points and Appraisal, Credit Report, Processing, Document Preparation, Administration, Underwriting, Flood Certificate, Tax Service, Wire Transfer, and other fees would be $15,000 in total. If the person accepts the terms of the loan on Feb. 29, 2016, the first monthly payment is due on March 31. How much mortgage would have been paid off after the payment on January 31, 2021? $58,260.91 $236,739.09$57,206.46 None of them $59,317.77 $60,377.06 A person was considering buying a house priced at $350,000. A mortgage company claimed the interest rate for the 20-year loan is 2.75%. The company also estimated that the points and Appraisal, Credit Report, Processing, Document Preparation, Administration, Underwriting, Flood Certificate, Tax Service, Wire Transfer, and other fees would be $15,000 in total. What is the APR of the loan? None of them 3.38% 0.28% 2.78% 3.33% A person was considering buying a house priced at $350,000. A mortgage company claimed the interest rate for the 20 -year loan is 2.75%. The company also estimated that the points and Appraisal, Credit Report, Processing, Document Preparation, Administration, Underwriting, Flood Certificate, Tax Service, Wire Transfer, and other fees would be $15,000 in total. (Questions 57-60) What would be the monthly payment, if the person decided to borrow 80% of the cost of the house and 100% of the processing fees? $1,614.43 $8,124.58 $1,599.39 None of them $1,789.15 A person was considering buying a house priced at $350,000. A mortgage company claimed the interest rate for the 20-year loan is 2.75%. The company also estimated that the points and Appraisal, Credit Report, Processing, Document Preparation, Administration, Underwriting, Flood Certificate, Tax Service, Wire Transfer, and other fees would be $15,000 in total. If the person accepts the terms of the loan on Feb. 29, 2016, the first monthly payment is due on March 31. How much interest charge could this person claim for deduction in the 2020 Tax Return, i.e. the total interest occur during year 2020 ? $6,725.81$19,192.69 None of them $8,112.500$7,063.59 A person was considering buying a house priced tat $350,000. A mortgage company claimed the interest rate for the 20 -year loan is 2.75%. The company also estimated that the points and Appraisal, Credit Report, Processing, Document Preparation, Administration, Underwriting, Flood Certificate, Tax Service, Wire Transfer, and other fees would be $15,000 in total. If the person accepts the terms of the loan on Feb. 29, 2016, the first monthly payment is due on March 31. How much mortgage would have been paid off after the payment on January 31, 2021? $58,260.91 $236,739.09$57,206.46 None of them $59,317.77 $60,377.06 A person was considering buying a house priced at $350,000. A mortgage company claimed the interest rate for the 20-year loan is 2.75%. The company also estimated that the points and Appraisal, Credit Report, Processing, Document Preparation, Administration, Underwriting, Flood Certificate, Tax Service, Wire Transfer, and other fees would be $15,000 in total. What is the APR of the loan? None of them 3.38% 0.28% 2.78% 3.33% A person was considering buying a house priced at $350,000. A mortgage company claimed the interest rate for the 20 -year loan is 2.75%. The company also estimated that the points and Appraisal, Credit Report, Processing, Document Preparation, Administration, Underwriting, Flood Certificate, Tax Service, Wire Transfer, and other fees would be $15,000 in total. (Questions 57-60) What would be the monthly payment, if the person decided to borrow 80% of the cost of the house and 100% of the processing fees? $1,614.43 $8,124.58 $1,599.39 None of them $1,789.15