Question

A personal balance sheet is the financial picture of how much wealth you have accumulated as of a certain date. It specifically lists your assets

A personal balance sheet is the financial picture of how much "wealth" you have accumulated as of a certain date. It specifically lists your assets (i.e., what you own) and your liabilities (i.e., what you owe). Your current net worth is the difference between the assets and the liabilities.

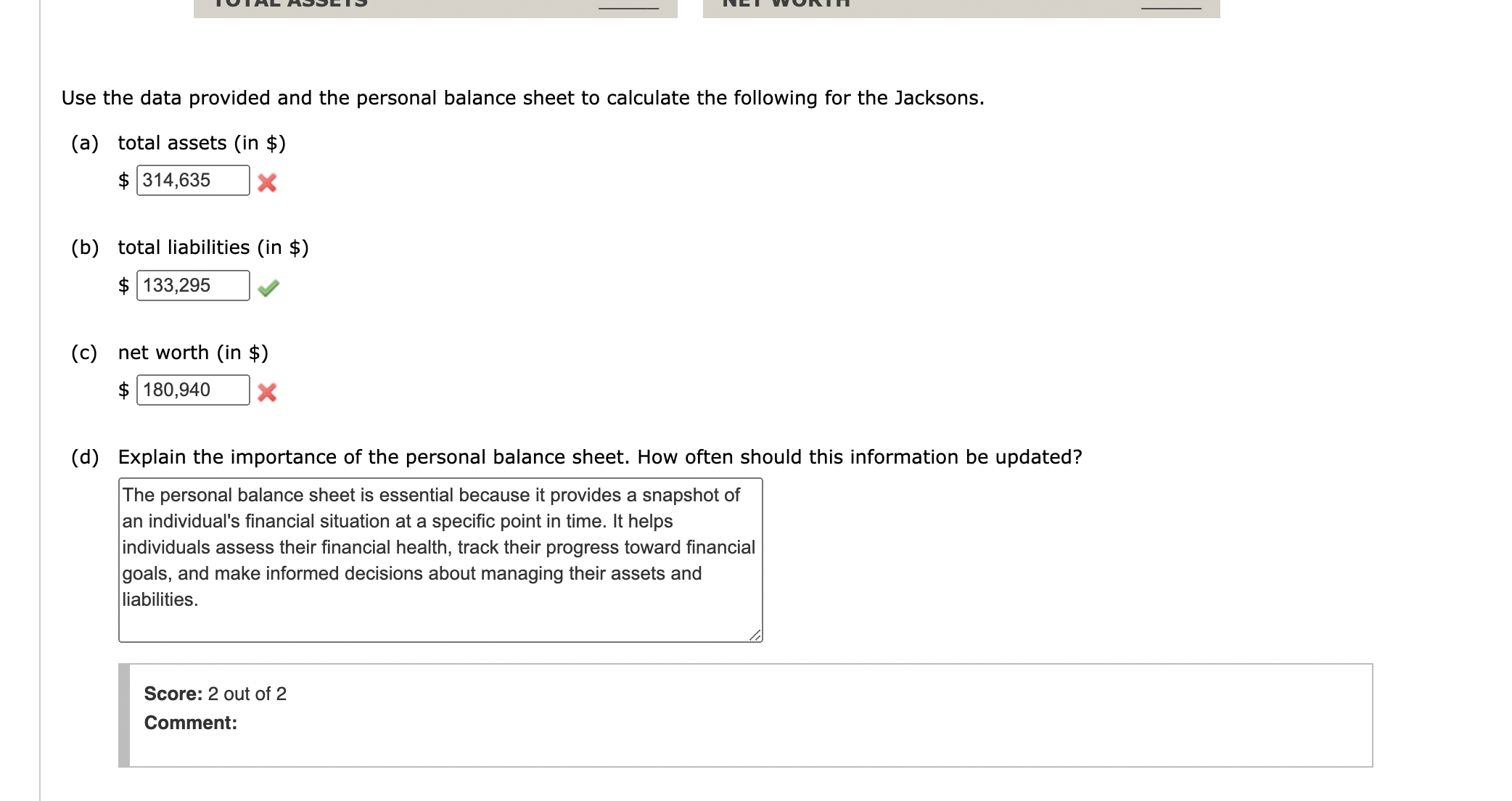

net worth = assets liabilities

Tom and Carol Jackson have asked for your help in preparing a personal balance sheet. They have listed the following assets and liabilities: current value of home, $148,000; audio/video equipment, $1,340; automobiles, $17,800; personal property, $4,350; computer, $3,700; mutual funds, $26,700; 401(k) retirement plan, $53,680; jewelry, $4,800; certificates of deposit, $19,300; stock investments, $24,280; furniture and other household goods, $8,600; balance on Walmart and Sears charge accounts, $4,868; automobile loan balance, $8,840; home mortgage balance, $106,270; Visa and MasterCard balances, $4,217; savings account balance, $3,700; Carol's night school tuition loan balance, $2,750; checking account balance, $1,385; signature loan balance, $6,350.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started