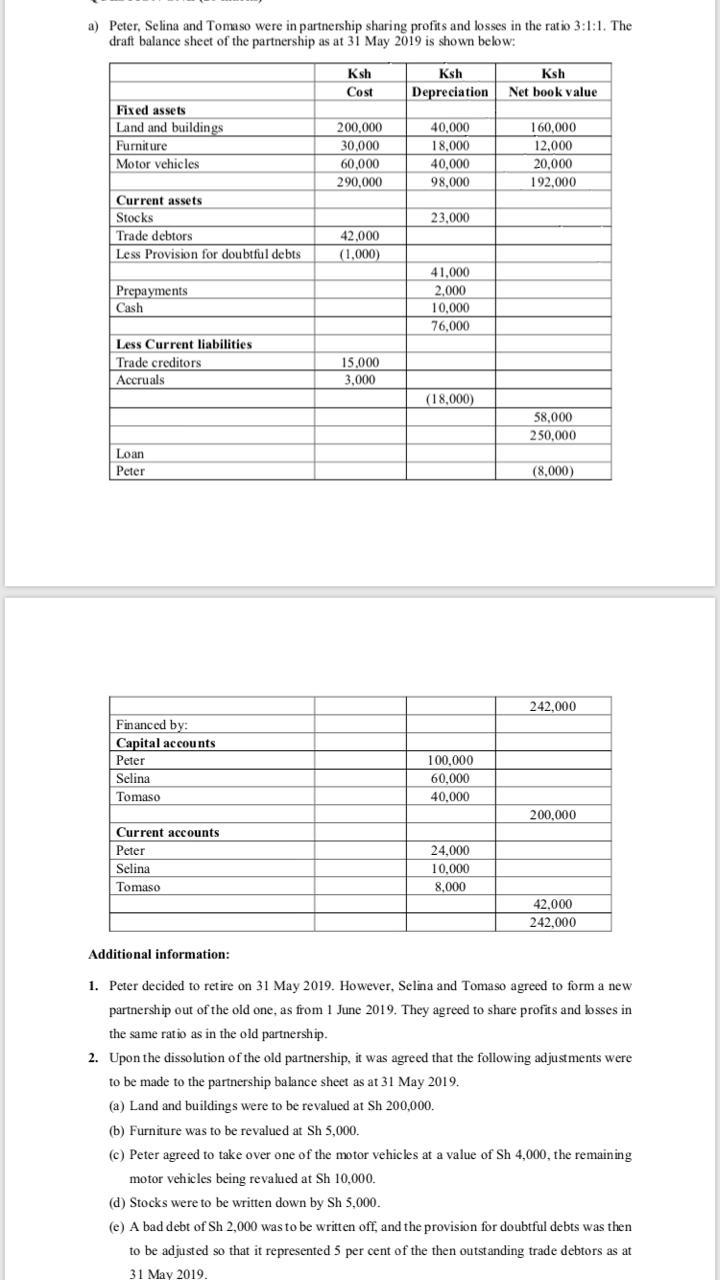

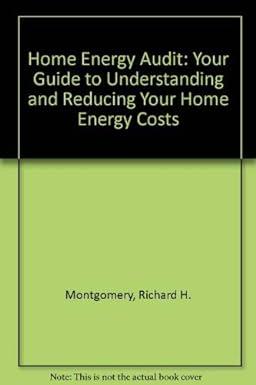

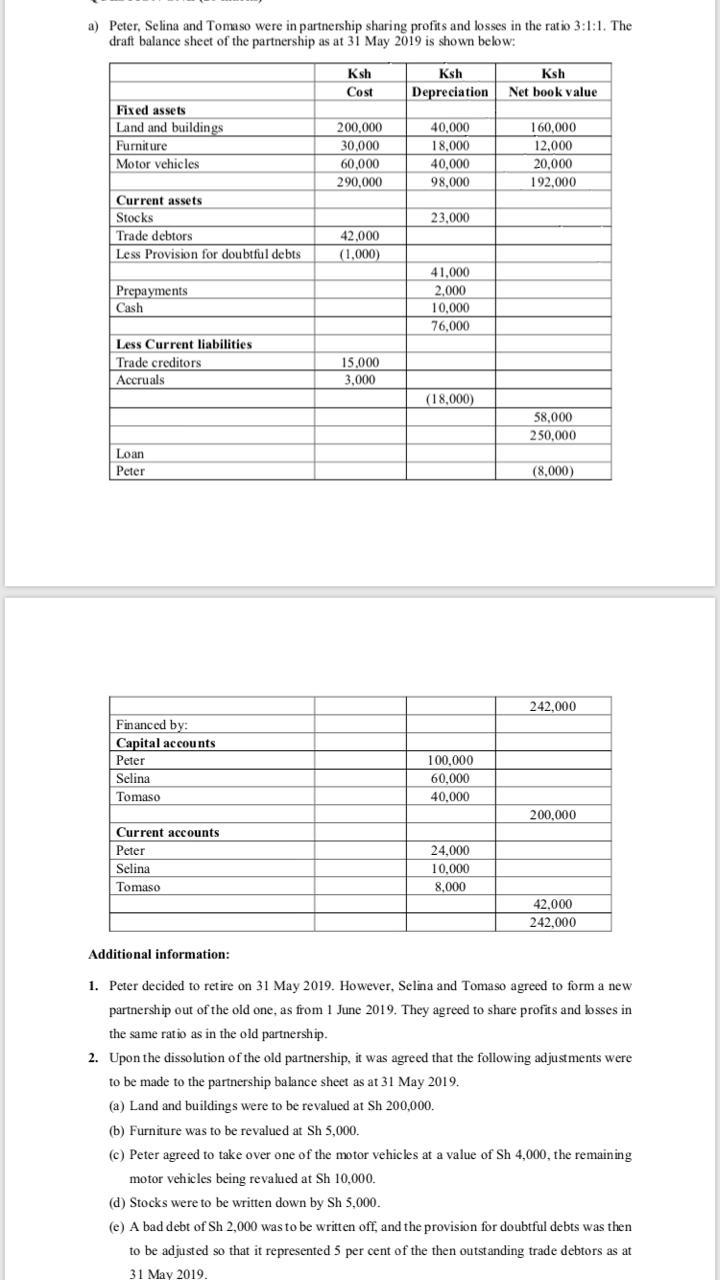

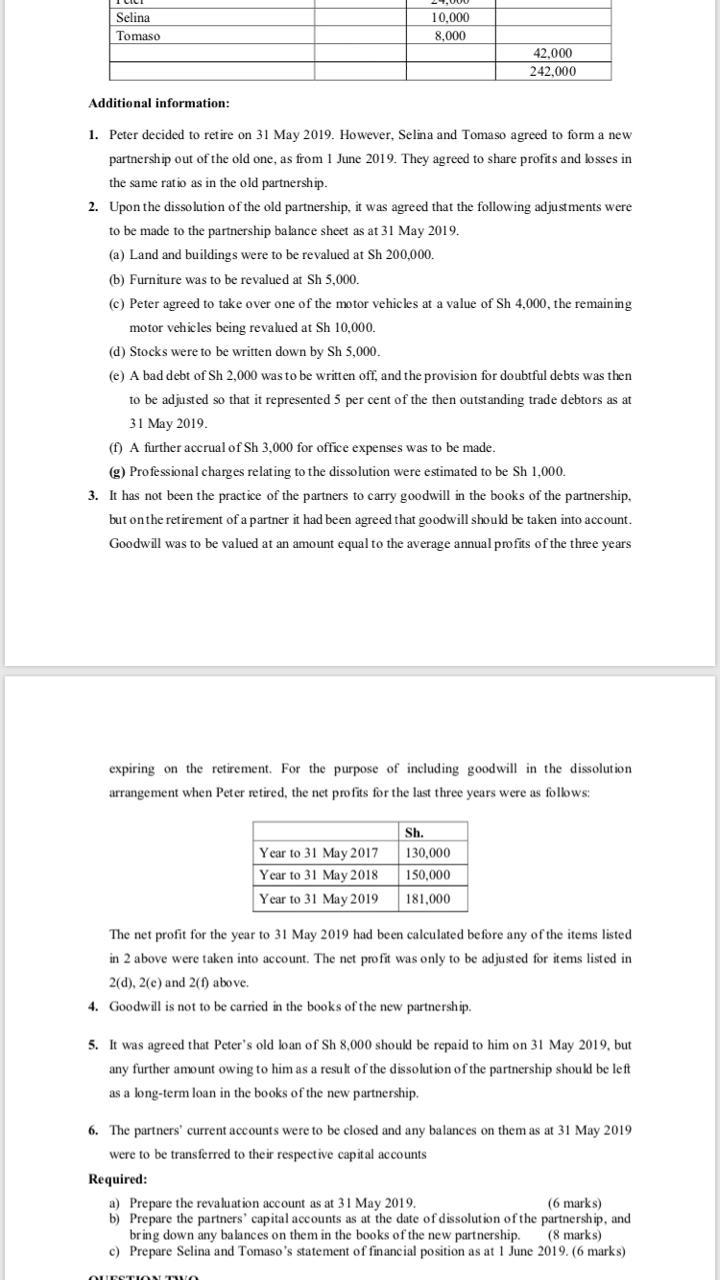

a) Peter, Selina and Tomaso were in partnership sharing profits and losses in the ratio 3:1:1. The draft balance sheet of the partnership as at 31 May 2019 is shown below: Ksh Cost Ksh Depreciation Ksh Net book value Fixed assets Land and buildings Furniture Motor vehicles 200,000 30,000 60,000 290.000 40,000 18,000 40.000 98.000 160.000 12,000 20,000 192,000 Current assets Stocks 23,000 Trade debtors Less Provision for doubtful debts 42.000 (1,000) Prepayments Cash 41,000 2.000 10,000 76,000 Less Current liabilities Trade creditors Accruals 15,000 3,000 (18,000) 58,000 250.000 Loan Peter (8,000) 242.000 Financed by: Capital accounts Peter Selina Tomaso 100.000 60,000 40,000 200.000 Current accounts Peter Selina Tomaso 24,000 10.000 8,000 42,000 242.000 Additional information: 1. Peter decided to retire on 31 May 2019. However, Selina and Tomaso agreed to form a new partnership out of the old one, as from 1 June 2019. They agreed to share profits and losses in the same ratio as in the old partnership 2. Upon the dissolution of the old partnership, it was agreed that the following adjustments were to be made to the partnership balance sheet as at 31 May 2019. (a) Land and buildings were to be revalued at Sh 200,000. (b) Furniture was to be revalued at Sh 5,000. (c) Peter agreed to take over one of the motor vehicles at a value of Sh 4,000, the remaining motor vehicles being revalued at Sh 10,000. (d) Stocks were to be written down by Sh 5,000. (e) A bad debt of Sh 2,000 was to be written off, and the provision for doubtful debts was then to be adjusted so that it represented 5 per cent of the then outstanding trade debtors as at 31 May 2019. Selina Tomaso 10,000 8,000 42,000 242.000 Additional information: 1. Peter decided to retire on 31 May 2019. However, Selina and Tomaso agreed to form a new partnership out of the old one, as from 1 June 2019. They agreed to share profits and losses in the same ratio as in the old partnership. 2. Upon the dissolution of the old partnership, it was agreed that the following adjustments were to be made to the partnership balance sheet as at 31 May 2019. (a) Land and buildings were to be revalued at Sh 200,000. (b) Furniture was to be revalued at Sh 5,000. (c) Peter agreed to take over one of the motor vehicles at a value of Sh 4.000, the remaining motor vehicles being revalued at Sh 10,000. (d) Stocks were to be written down by Sh 5,000, e) A bad debt of Sh 2,000 was to be written off, and the provision for doubtful debts was then to be adjusted so that it represented 5 per cent of the then outstanding trade debtors as at 31 May 2019. (1) A further accrual of Sh 3,000 for office expenses was to be made. (g) Professional charges relating to the dissolution were estimated to be sh 1,000. 3. It has not been the practice of the partners to carry goodwill in the books of the partnership, but on the retirement of a partner it had been agreed that goodwill should be taken into account. Goodwill was to be valued at an amount equal to the average annual profits of the three years expiring on the retirement. For the purpose of including goodwill in the dissolution arrangement when Peter retired, the net profits for the last three years were as follows: Year to 31 May 2017 Year to 31 May 2018 Year to 31 May 2019 Sh. 130,000 150,000 181,000 The net profit for the year to 31 May 2019 had been calculated before any of the items listed in 2 above were taken into account. The net profit was only to be adjusted for items listed in 2(d), 2(c) and 2 (1) above. 4. Goodwill is not to be carried in the books of the new partnership, 5. It was agreed that Peter's old loan of Sh 8,000 should be repaid to him on 31 May 2019, but any further amount owing to him as a result of the dissolution of the partnership should be left as a long-term loan in the books of the new partnership 6. The partners' current accounts were to be closed and any balances on them as at 31 May 2019 were to be transferred to their respective capital accounts Required: a) Prepare the revaluation account as at 31 May 2019. (6 marks) b) Prepare the partners' capital accounts as at the date of dissolution of the partnership, and bring down any balances on them in the books of the new partnership (8 marks) c) Prepare Selina and Tomaso's statement of financial position as at 1 June 2019. (6 marks) a) Peter, Selina and Tomaso were in partnership sharing profits and losses in the ratio 3:1:1. The draft balance sheet of the partnership as at 31 May 2019 is shown below: Ksh Cost Ksh Depreciation Ksh Net book value Fixed assets Land and buildings Furniture Motor vehicles 200,000 30,000 60,000 290.000 40,000 18,000 40.000 98.000 160.000 12,000 20,000 192,000 Current assets Stocks 23,000 Trade debtors Less Provision for doubtful debts 42.000 (1,000) Prepayments Cash 41,000 2.000 10,000 76,000 Less Current liabilities Trade creditors Accruals 15,000 3,000 (18,000) 58,000 250.000 Loan Peter (8,000) 242.000 Financed by: Capital accounts Peter Selina Tomaso 100.000 60,000 40,000 200.000 Current accounts Peter Selina Tomaso 24,000 10.000 8,000 42,000 242.000 Additional information: 1. Peter decided to retire on 31 May 2019. However, Selina and Tomaso agreed to form a new partnership out of the old one, as from 1 June 2019. They agreed to share profits and losses in the same ratio as in the old partnership 2. Upon the dissolution of the old partnership, it was agreed that the following adjustments were to be made to the partnership balance sheet as at 31 May 2019. (a) Land and buildings were to be revalued at Sh 200,000. (b) Furniture was to be revalued at Sh 5,000. (c) Peter agreed to take over one of the motor vehicles at a value of Sh 4,000, the remaining motor vehicles being revalued at Sh 10,000. (d) Stocks were to be written down by Sh 5,000. (e) A bad debt of Sh 2,000 was to be written off, and the provision for doubtful debts was then to be adjusted so that it represented 5 per cent of the then outstanding trade debtors as at 31 May 2019. Selina Tomaso 10,000 8,000 42,000 242.000 Additional information: 1. Peter decided to retire on 31 May 2019. However, Selina and Tomaso agreed to form a new partnership out of the old one, as from 1 June 2019. They agreed to share profits and losses in the same ratio as in the old partnership. 2. Upon the dissolution of the old partnership, it was agreed that the following adjustments were to be made to the partnership balance sheet as at 31 May 2019. (a) Land and buildings were to be revalued at Sh 200,000. (b) Furniture was to be revalued at Sh 5,000. (c) Peter agreed to take over one of the motor vehicles at a value of Sh 4.000, the remaining motor vehicles being revalued at Sh 10,000. (d) Stocks were to be written down by Sh 5,000, e) A bad debt of Sh 2,000 was to be written off, and the provision for doubtful debts was then to be adjusted so that it represented 5 per cent of the then outstanding trade debtors as at 31 May 2019. (1) A further accrual of Sh 3,000 for office expenses was to be made. (g) Professional charges relating to the dissolution were estimated to be sh 1,000. 3. It has not been the practice of the partners to carry goodwill in the books of the partnership, but on the retirement of a partner it had been agreed that goodwill should be taken into account. Goodwill was to be valued at an amount equal to the average annual profits of the three years expiring on the retirement. For the purpose of including goodwill in the dissolution arrangement when Peter retired, the net profits for the last three years were as follows: Year to 31 May 2017 Year to 31 May 2018 Year to 31 May 2019 Sh. 130,000 150,000 181,000 The net profit for the year to 31 May 2019 had been calculated before any of the items listed in 2 above were taken into account. The net profit was only to be adjusted for items listed in 2(d), 2(c) and 2 (1) above. 4. Goodwill is not to be carried in the books of the new partnership, 5. It was agreed that Peter's old loan of Sh 8,000 should be repaid to him on 31 May 2019, but any further amount owing to him as a result of the dissolution of the partnership should be left as a long-term loan in the books of the new partnership 6. The partners' current accounts were to be closed and any balances on them as at 31 May 2019 were to be transferred to their respective capital accounts Required: a) Prepare the revaluation account as at 31 May 2019. (6 marks) b) Prepare the partners' capital accounts as at the date of dissolution of the partnership, and bring down any balances on them in the books of the new partnership (8 marks) c) Prepare Selina and Tomaso's statement of financial position as at 1 June 2019. (6 marks)