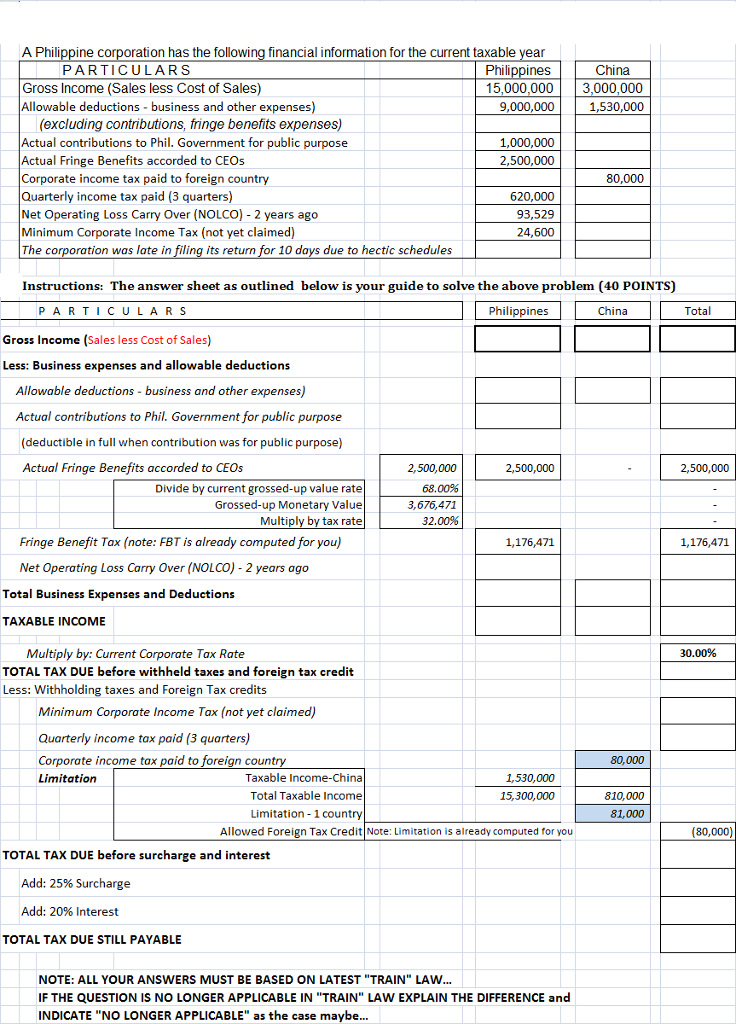

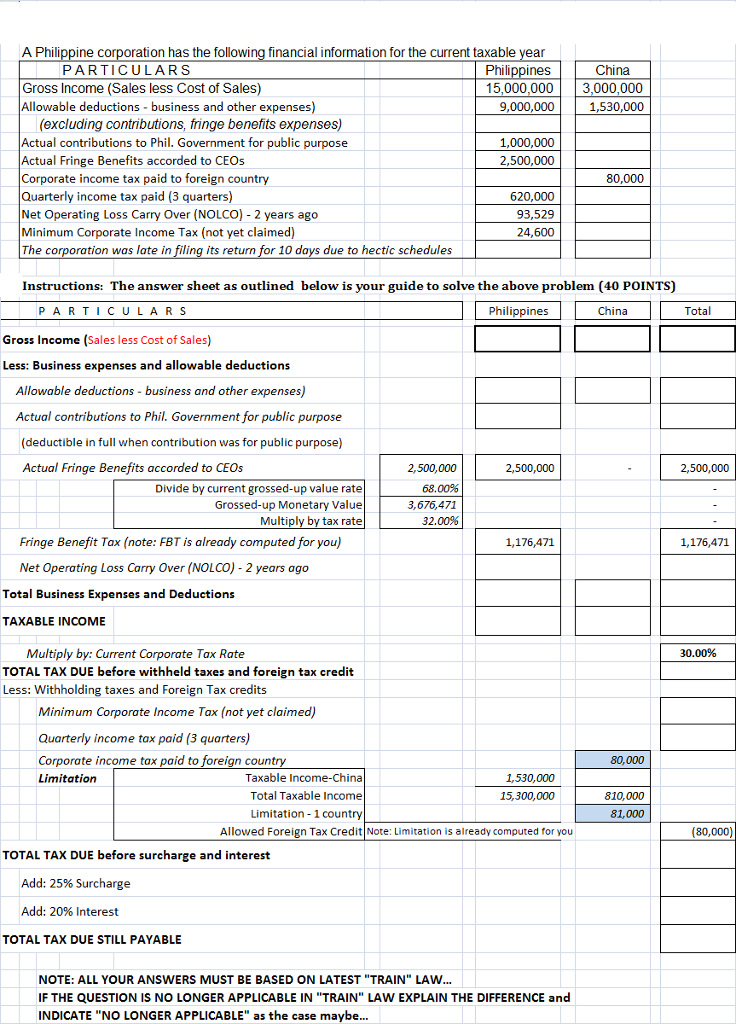

A Philippine co ration has the following financial information for the current taxable year PARTICULARS Philippines 15,000,000 3,000,000 China Gross Income (Sales less Cost of Sales) Allowable deductions-business and other expenses) 9,000,000 1,530,000 (excluding contributions, fringe benefits expenses) Actual contributions to Phil. Government for public purpose Actual Fringe Benefits accorded to CEOs Corporate income tax paid to foreign country Quarterly income tax paid (3 quarters) Net Operating Loss Carry Over (NOLCO) 2 years ago Minimum Corporate Income Tax (not yet claimed) The corporation was late in filing its return for 10 1,000,000 2,500,000 80,000 620,000 93,529 24,600 due to hectic schedules Instructions: The answer sheet as outlined below is your guide to solve the above problem (40 POINTS PARTICULA R S Philippines China Total Gross Income (Sales less Cost of Sales) Less: Business expenses and allowable deductions Allowable deductions business and other expenses) Actual contributions to Phil. Government for public purpose (deductible in full when contribution was for public purpose) Actual Fringe Benefits accorded to CEOs 2,500,000 68.00% 3,676,471 32.00% 2,500,000 2,500,000 Divide by current grossed-up value rate Grossed-up Monetary Value tax rate Multi Fringe Benefit Tax (note: FBT is already computed for you) 1,176,471 1,176,471 Net Operating Loss Carry Over (NOLCO) - 2 years ago Total Business Expenses and Deductions TAXABLE INCOME Multiply by: Current Corporate Tax Rate TOTAL TAX DUE before withheld taxes and foreign tax credit Less: Withholding taxes and Foreign Tax credits 30.00% Minimum Corporate Income Tax (not yet claimed) Quarterly income tax paid (3 quarters) Corporate income tax paid to foreign coun Limitation 80,000 Taxable Income-China Total Taxable Income Limitation 1country 1,530,000 15,300,000 810,000 81,000 Allowed Foreign Tax Credit Note: Limitation is already computed for you (80,000) TOTAL TAX DUE before surcharge and interest Add: 25% Surcharge Add: 20% Interest TOTAL TAX DUE STILL PAYABLE NOTE: ALL YOUR ANSWERS MUST BE BASED ON LATEST "TRAIN" LAW IF THE QUESTION IS NO LONGER APPLICABLE IN "TRAIN" LAW EXPLAIN THE DIFFERENCE and INDICATE "NO LONGER APPLICABLE" as the case maybe