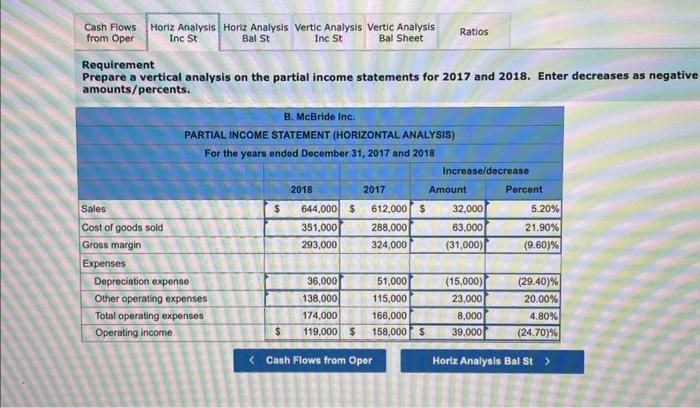

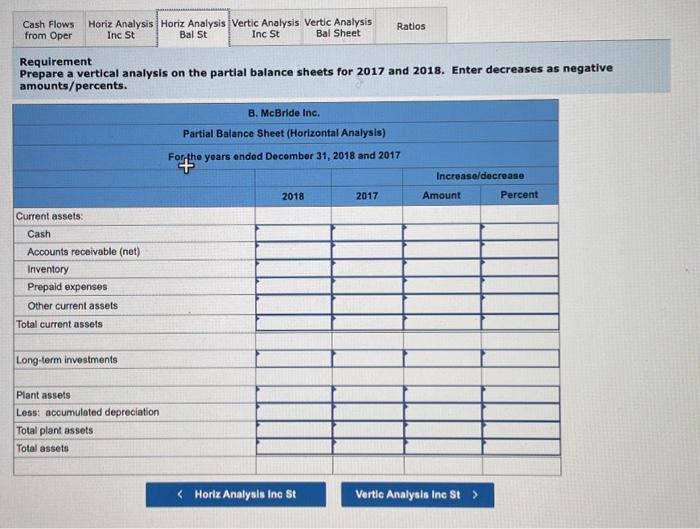

a) Please help me with the Partial balance sheet (horizontal analysis)

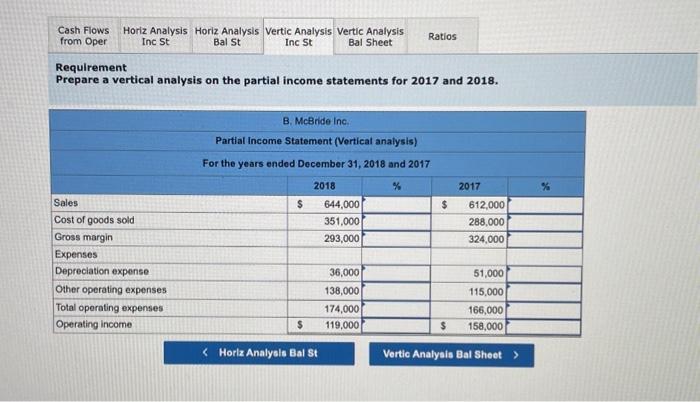

b) Please help with the partial income statement (vertical analysis)

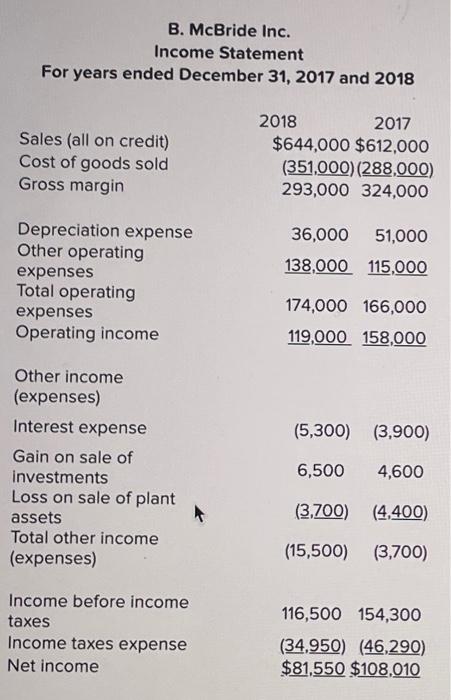

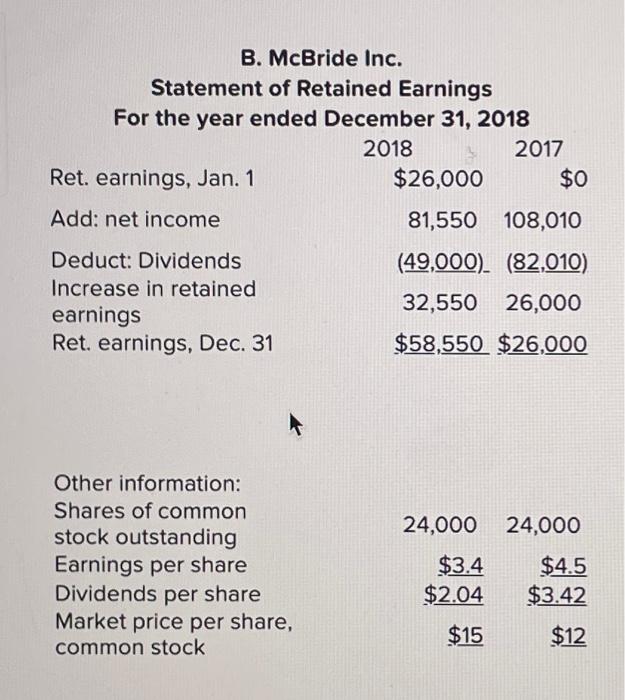

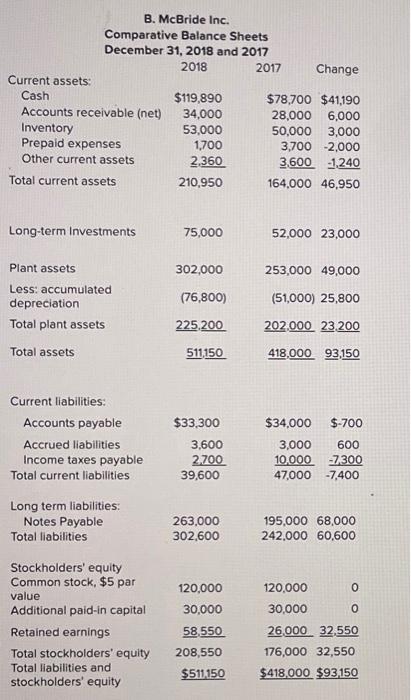

B. McBride Inc. Income Statement For years ended December 31, 2017 and 2018 Other income (expenses) Interest expense (5,300)(3,900) Gain on sale of investments 6,5004,600 Loss on sale of plant assets (3,700)(4,400) Total other income (expenses) (15,500)(3,700) Income before income taxes 116,500154,300 Income taxes expense (34,950)(46,290) Net income $81,500$108,010 B. McBride Inc. Statement of Retained Earnings For the year ended December 31,2018 B. McBride Inc. Comparative Balance Sheets December 31, 2018 and 2017 2018 Change Current assets: 2017 Change Cash Accounts receivable (net) Inventory Prepaid expenses Other current assets Total current assets Long-term Investments Plant assets Less: accumulated depreciation Total plant assets Total assets Current liabilities: Accounts payable Accrued liabilities Income taxes payable Total current liabilities Long term liabilities: Notes Payable Total liabilities Stockholders' equity Common stock, \$5 par value Additional paid-in capital Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $119,890 34,000 53,000 1,700 2,360 210,950 75,000 302,000 (76,800) 225,200 511,150 $33,300 3,600 39.6002.700 263,000 302,600 120,000 30,000 58,550 208,550 $511,150 $511,150 $418,000$993,150 52,00023,000 253,00049,000 (51,000) 25,800 202,00023,200 418,00093,150 $34,000$700 3,00047,00010,0006007,4007,300 195,00068,000 242,00060,600 120,0000 30,0000 26,00032,550 176,00032,550 $418,000$93,150 Requirement Prepare a vertical analysis on the partial income statements for 2017 and 2018 . Enter decreases as negativ amounts/percents. Requirement Prepare a vertical analysis on the partial balance sheets for 2017 and 2018 . Enter decreases as negative amounts/percents. Requirement Prepare a vertical analysis on the partial income statements for 2017 and 2018. B. McBride Inc. Income Statement For years ended December 31, 2017 and 2018 Other income (expenses) Interest expense (5,300)(3,900) Gain on sale of investments 6,5004,600 Loss on sale of plant assets (3,700)(4,400) Total other income (expenses) (15,500)(3,700) Income before income taxes 116,500154,300 Income taxes expense (34,950)(46,290) Net income $81,500$108,010 B. McBride Inc. Statement of Retained Earnings For the year ended December 31,2018 B. McBride Inc. Comparative Balance Sheets December 31, 2018 and 2017 2018 Change Current assets: 2017 Change Cash Accounts receivable (net) Inventory Prepaid expenses Other current assets Total current assets Long-term Investments Plant assets Less: accumulated depreciation Total plant assets Total assets Current liabilities: Accounts payable Accrued liabilities Income taxes payable Total current liabilities Long term liabilities: Notes Payable Total liabilities Stockholders' equity Common stock, \$5 par value Additional paid-in capital Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $119,890 34,000 53,000 1,700 2,360 210,950 75,000 302,000 (76,800) 225,200 511,150 $33,300 3,600 39.6002.700 263,000 302,600 120,000 30,000 58,550 208,550 $511,150 $511,150 $418,000$993,150 52,00023,000 253,00049,000 (51,000) 25,800 202,00023,200 418,00093,150 $34,000$700 3,00047,00010,0006007,4007,300 195,00068,000 242,00060,600 120,0000 30,0000 26,00032,550 176,00032,550 $418,000$93,150 Requirement Prepare a vertical analysis on the partial income statements for 2017 and 2018 . Enter decreases as negativ amounts/percents. Requirement Prepare a vertical analysis on the partial balance sheets for 2017 and 2018 . Enter decreases as negative amounts/percents. Requirement Prepare a vertical analysis on the partial income statements for 2017 and 2018