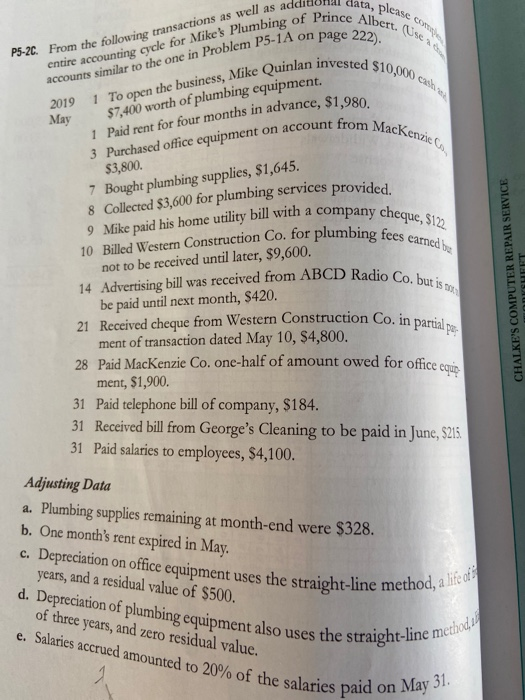

a. please ions as well as additional data P5.1A on page 222). ) P5-2C vested $10,000 From the following transactions cntire accounting cycle for Mikes Plumbing of Prince accounts similar to the one in Problem P5-1A on pa 2019 1 To open the business, Mike Quinlan inye $7,400 worth of plumbing equipment. 1 Paid rent for four months in advance, $1,980 3 Purchased office equipment on account from May from Mackenzie company cheque, $12 lumbing fees earned by $3,800 7 Bought plumbing supplies, $1,645. 8 Collected $3,600 for plumbing services provided. 9 Mike paid his home utility bill with a company che 10 Billed Western Construction Co. for plumbing not to be received until later, $9,600. 14 Advertising bill was received from ABCD Radio be paid until next month, $420. 21 Received cheque from Western Construction Coin ment of transaction dated May 10, $4,800. Radio Co. but is CHALKE'S COMPUTER REPAIR SERVICE astruction Co. in partial pe. CHALKE'S COMPUTER 28 Paid MacKenzie Co. one-half of amount owed for office coin ment, $1,900. 31 Paid telephone bill of company, $184. 31 Received bill from George's Cleaning to be paid in June, 5215 31 Paid salaries to employees, $4,100. Adjusting Data a. Plumbing supplies remaining at month-end were $328. b. One month's rent expired in May. c. Depreciation on office equipment uses the straight-line me years, and a residual value of $500. t-line method, a life of d. Depreciation of plumbing equipment also uses the strany of three years, and zero residual value. e. Salaries accrued amounted to 20% of the salaries paid the straight-line method, i salaries paid on May 31. a. please ions as well as additional data P5.1A on page 222). ) P5-2C vested $10,000 From the following transactions cntire accounting cycle for Mikes Plumbing of Prince accounts similar to the one in Problem P5-1A on pa 2019 1 To open the business, Mike Quinlan inye $7,400 worth of plumbing equipment. 1 Paid rent for four months in advance, $1,980 3 Purchased office equipment on account from May from Mackenzie company cheque, $12 lumbing fees earned by $3,800 7 Bought plumbing supplies, $1,645. 8 Collected $3,600 for plumbing services provided. 9 Mike paid his home utility bill with a company che 10 Billed Western Construction Co. for plumbing not to be received until later, $9,600. 14 Advertising bill was received from ABCD Radio be paid until next month, $420. 21 Received cheque from Western Construction Coin ment of transaction dated May 10, $4,800. Radio Co. but is CHALKE'S COMPUTER REPAIR SERVICE astruction Co. in partial pe. CHALKE'S COMPUTER 28 Paid MacKenzie Co. one-half of amount owed for office coin ment, $1,900. 31 Paid telephone bill of company, $184. 31 Received bill from George's Cleaning to be paid in June, 5215 31 Paid salaries to employees, $4,100. Adjusting Data a. Plumbing supplies remaining at month-end were $328. b. One month's rent expired in May. c. Depreciation on office equipment uses the straight-line me years, and a residual value of $500. t-line method, a life of d. Depreciation of plumbing equipment also uses the strany of three years, and zero residual value. e. Salaries accrued amounted to 20% of the salaries paid the straight-line method, i salaries paid on May 31