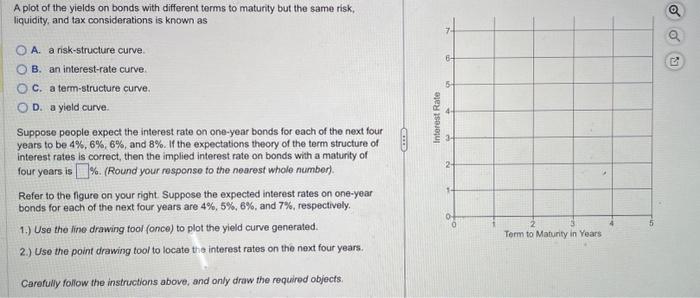

A plot of the yields on bonds with different terms to maturity but the same risk, liquidity, and tax considerations is known as A. a risk-structure curve. B. an interest-rate curve. C. a term-structure curve. D. a yield curve. Suppose people expect the interest rate on one-year bonds for each of the next four years to be 4%,6%,6%, and 8%. If the expectations theory of the term structure of interest rates is correct, then the implied interest rate on bonds with a maturity of four yoars is \%. (Round your responso to the noarest whole number). Refer to the figure on your right. Suppose the expected interest rates on one-year bonds for each of the next four years are 4%,5%,6%, and 7%, respectively. 1.) Use the line drawing tool (once) to plot the yield curve generated. 2.) Use the point drawing tool to locate the interest rates on the next four years. Carefully follow the instructions above, and only draw the required objects. What effect would reducing income tax rates have on the interest rates of municipal bonds? A. Interest rates would rise because the reduction in income tax rates would make the tax-exempt privilege for municipal bonds less valuable and reduce the demand for municipal bonds. B. Interest rates would fall because Treasury securities are now less valuable and more people will want to hold municipal bonds. C. Interest rates would fall because the reduction in income tax rates would make the tax-exempt privilege for municipal bonds less valuable and reduce the demand for municipal bonds. D. Interest rates would rise because Treasury securities are now less valuable and more people will want to hold municipal bonds. Would interest rates of Treasury secunties be affected by the tax rate change? A. Yes, because the reduction in the tax-exempt privilege in municipal bonds would raise the relative value of Treasury securites, making Treasury securities more desirable. B. Yes, because municipal bonds are less risky than Treasury securities, the demand for Treasury securities will decrease. C. Yes, because the increase in interest rates would increase the desire to hold more municipal bonds and less Treasury securities. D. No, there would be no impact on the market for Treasury securities. A plot of the yields on bonds with different terms to maturity but the same risk, liquidity, and tax considerations is known as A. a risk-structure curve. B. an interest-rate curve. C. a term-structure curve. D. a yield curve. Suppose people expect the interest rate on one-year bonds for each of the next four years to be 4%,6%,6%, and 8%. If the expectations theory of the term structure of interest rates is correct, then the implied interest rate on bonds with a maturity of four yoars is \%. (Round your responso to the noarest whole number). Refer to the figure on your right. Suppose the expected interest rates on one-year bonds for each of the next four years are 4%,5%,6%, and 7%, respectively. 1.) Use the line drawing tool (once) to plot the yield curve generated. 2.) Use the point drawing tool to locate the interest rates on the next four years. Carefully follow the instructions above, and only draw the required objects. What effect would reducing income tax rates have on the interest rates of municipal bonds? A. Interest rates would rise because the reduction in income tax rates would make the tax-exempt privilege for municipal bonds less valuable and reduce the demand for municipal bonds. B. Interest rates would fall because Treasury securities are now less valuable and more people will want to hold municipal bonds. C. Interest rates would fall because the reduction in income tax rates would make the tax-exempt privilege for municipal bonds less valuable and reduce the demand for municipal bonds. D. Interest rates would rise because Treasury securities are now less valuable and more people will want to hold municipal bonds. Would interest rates of Treasury secunties be affected by the tax rate change? A. Yes, because the reduction in the tax-exempt privilege in municipal bonds would raise the relative value of Treasury securites, making Treasury securities more desirable. B. Yes, because municipal bonds are less risky than Treasury securities, the demand for Treasury securities will decrease. C. Yes, because the increase in interest rates would increase the desire to hold more municipal bonds and less Treasury securities. D. No, there would be no impact on the market for Treasury securities